1,387 Finance results

- February 4, 2026

Brookfield Asset Management promotes Connor Teskey to CEO, posts record results

Global alternative asset manager Brookfield Asset Management named company executive Connor Teskey as its CEO as the investment giant reported record fourth-quarter earnings and said it sees rising deal activity this year. - February 4, 2026

Blackstone secures $3 billion refinancing package for Cosmopolitan Las Vegas

A Blackstone real estate investment trust and investment firm Stonepeak Partners have secured a $3.05 billion refinancing of loans backing The Cosmopolitan Las Vegas through a commercial mortgage-backed securities transaction. - January 30, 2026

Newmark expands hospitality practice; Paragon names investment chief; Skanska promotes building executive

Newmark said it promoted Jeff Mayer to senior managing director and national practice leader for hospitality, gaming and leisure, as the company looks to expand its valuation and advisory services geared to those property categories. - January 26, 2026

Lone Star refinances hotel portfolio loan ahead of 2026 maturity

Lone Star Real Estate Fund VI has secured $500 million in fresh financing for a six-property hotel portfolio set to mature in November. - January 23, 2026

Closing of Oakland's only boutique hotel adds to Bay Area city's hospitality woes

Oakland's only boutique hotel is closing its doors after only a few years in business. - January 23, 2026

Pro Football Hall of Fame campus secures $135 million financing deal

The Hall of Fame Village project in Canton, Ohio, has secured a $135 million financing package to complete an indoor waterpark and build a new hotel adjacent to the Pro Football Hall of Fame. - January 23, 2026

CPP Investments deploys US$162 million to Japan for hospitality deals

Canada Pension Plan Investment Board, the country’s largest pension fund manager, has made a major move into Japan’s hotel sector with a million-dollar commitment to invest in a hospitality strategy run by SC Capital Partners. - January 23, 2026

Covivio acquires Meininger Porto hotel

French hotel real estate investment trust Covivio, via its Covivio Hotels division, has acquired a forthcoming 228-room (834 bed) Meininger-branded hotel in Porto from Eiffage Immobilier Portugal. - January 21, 2026

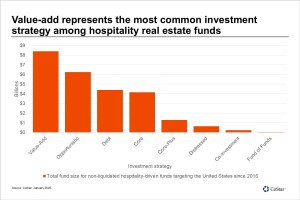

Hospitality real estate funds slow deployment amid tariff uncertainty and weak travel demand

Hospitality real estate fund managers are grappling with uninspiring capital deployment from 2025. Ongoing tariff uncertainty and softness in transient demand contributed to the inactivity of these fund managers, who gravitated toward opportunistic investments. - January 20, 2026

CBRE expands LA North team; Stream targets healthcare business; Inland names investment CEO

CBRE said it expanded its executive ranks in the Los Angeles North region with the hiring of Josh Caruana as market leader to oversee its Glendale, Woodland Hills and Oxnard offices. It also hired Patrick McGrath as executive managing director for the South Bay region. Caruana joined the firm from Marcus & Millichap, where he worked in leadership roles in Southern California and Indianapolis. McGrath previously served as chief information officer and president for the West region of Savills North America. - January 14, 2026

Concord Hospitality secures $167 million WoodSpring Suites loan

Concord Hospitality and Whitman Peterson completed a $167.67 million recapitalization financing from CIM Group on a 15-property portfolio of WoodSpring Suites extended-stay hotels. - January 14, 2026

Ashford extends nearly $724 million loan as it weighs options

Troubled hotel owner Ashford Hospitality Trust has extended a mortgage loan backing some of its most valuable U.S. hotels as it suspends shareholder dividends in an effort to preserve liquidity. - January 13, 2026

Criterion secures £294 million facility from Maslow for hotels

Specialist real estate finance provider Maslow Capital has provided a £294 million facility to Criterion Capital to back its acquisition of the 732-bed St Giles Hotel and Criterion’s pre-existing freehold interest, alongside the refinancing of Haymarket House with a bespoke construction facility to deliver a 508-bed Zedwell hotel. - January 13, 2026

Aprirose refinances Reading hotel with new lender

Aprirose has refinanced its Hilton Reading hotel, ushering in a new relationship with Mizrahi Tefahot Bank. - January 12, 2026

Cushman names Houston chief; Avison Young appoints Phoenix leader; Ferguson hires hospitality director

Travis Overall joined Cushman & Wakefield as managing principal of its Houston operations, leading the advisory business where Cushman has more than 250 employees, including 60 brokers. The firm said Overall will also be involved in Cushman’s 34 million-square-foot Houston property management portfolio and will head talent recruiting efforts. - January 9, 2026

Downtown Dallas skyscraper that underwent city’s largest conversion heads to foreclosure

The National, a 52-story skyscraper turned mixed-use hub that was vacant for a decade before it was redeveloped in downtown Dallas, is headed into foreclosure and expected to revert to its lender.