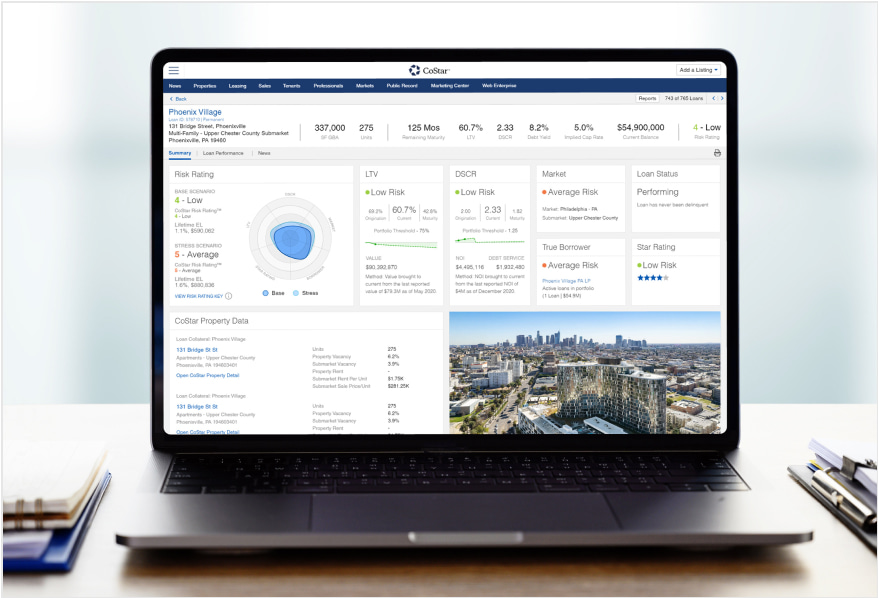

Gain an advantage at every stage of the lending cycle

CoStar's CRE solution for lenders supports loan screening, portfolio surveillance, risk management, and regulatory reporting.

WATCH VIDEO

The Power of

CoStar for Lenders

Your loan portfolio, mapped to CoStar’s industry-leading property data, market analytics, and our proven credit default model will enable you to confidently manage risk, make more informed lending decisions, and will strengthen your credibility with regulators.

Connect Your Portfolio to Live Data and Advanced Analytics

The integration of property data, market forecast, and advanced modeling provides a trustworthy assessment of Expected Loss driven by the on-going monitoring of LTV, DSCR, market, tenant, and properties.

Empower Your Portfolio Risk Management Team in a Volatile Environment

Easily conduct comprehensive impact analysis of concentration risk, refinance risk, loan risk rating, and CECL utilizing both top-down stress test and custom scenarios and bottom-up loan idiosyncrasies.

Instill Confidence and Ensure Efficiency in Regulatory Process

Report to regulators in a timely fashion with more credibility and resilience to scrutiny by leveraging a proven credit model integrated with fresh, granular, and defensible data.