Enabling You to Make Better Lending Decisions

Watch the video to learn the benefits of connecting your portfolio to dynamic, accurate data and analytics.

CoStar for Lenders Drives Better Outcomes In:

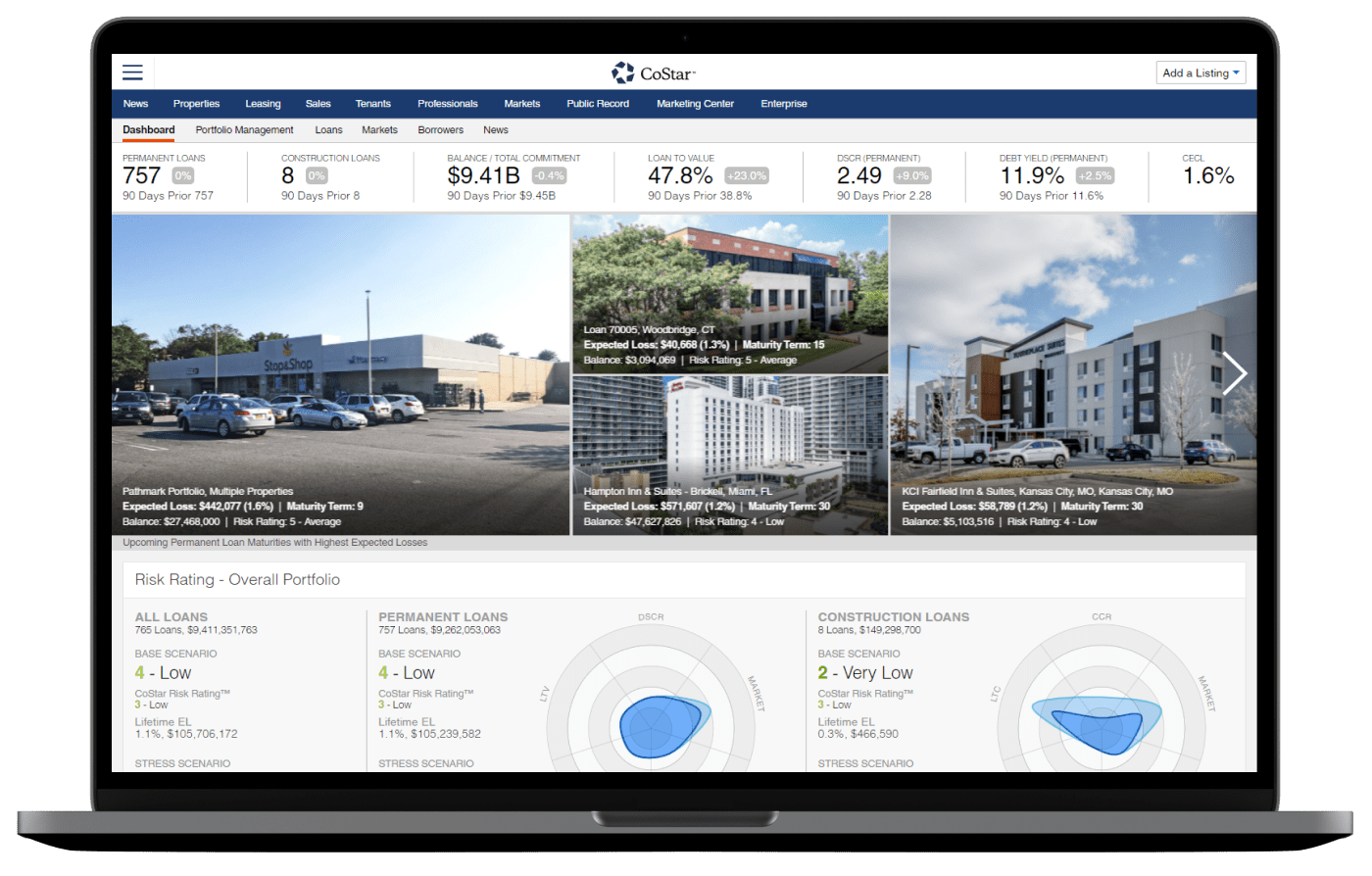

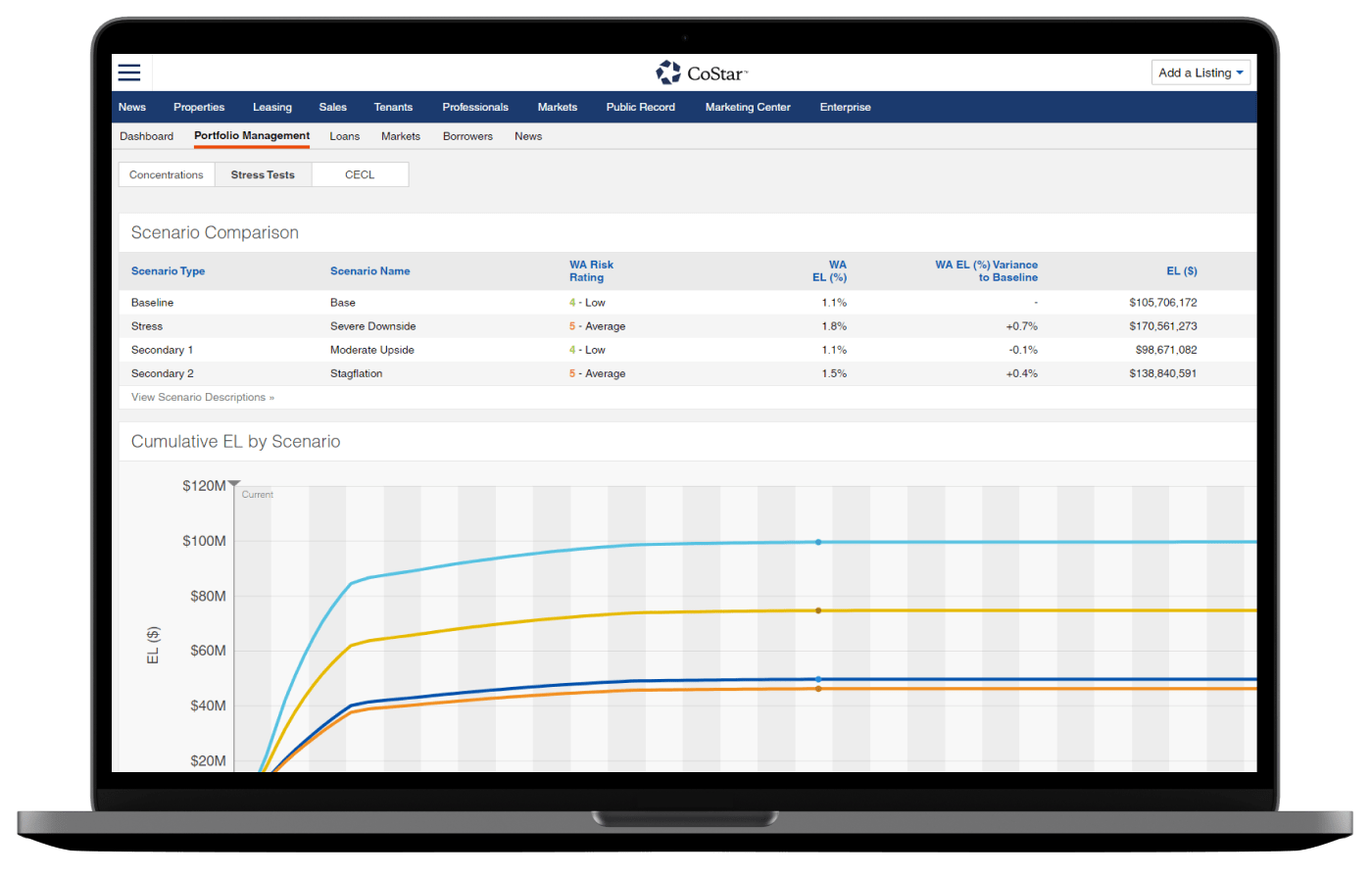

Portfolio Surveillance

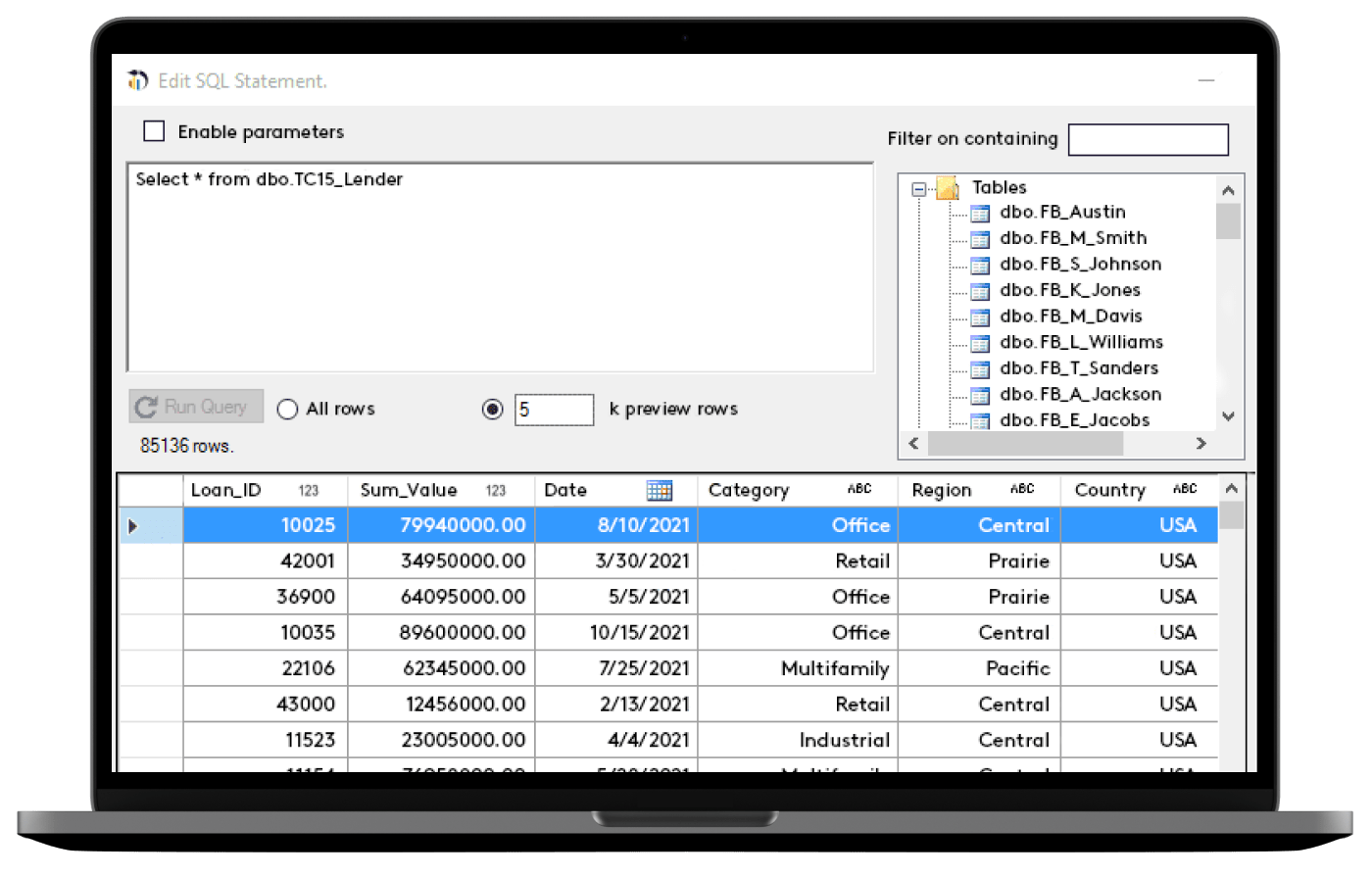

See EL, CECL, LTV and DSCR for your entire portfolio and click into property-level data – all updated continuously.

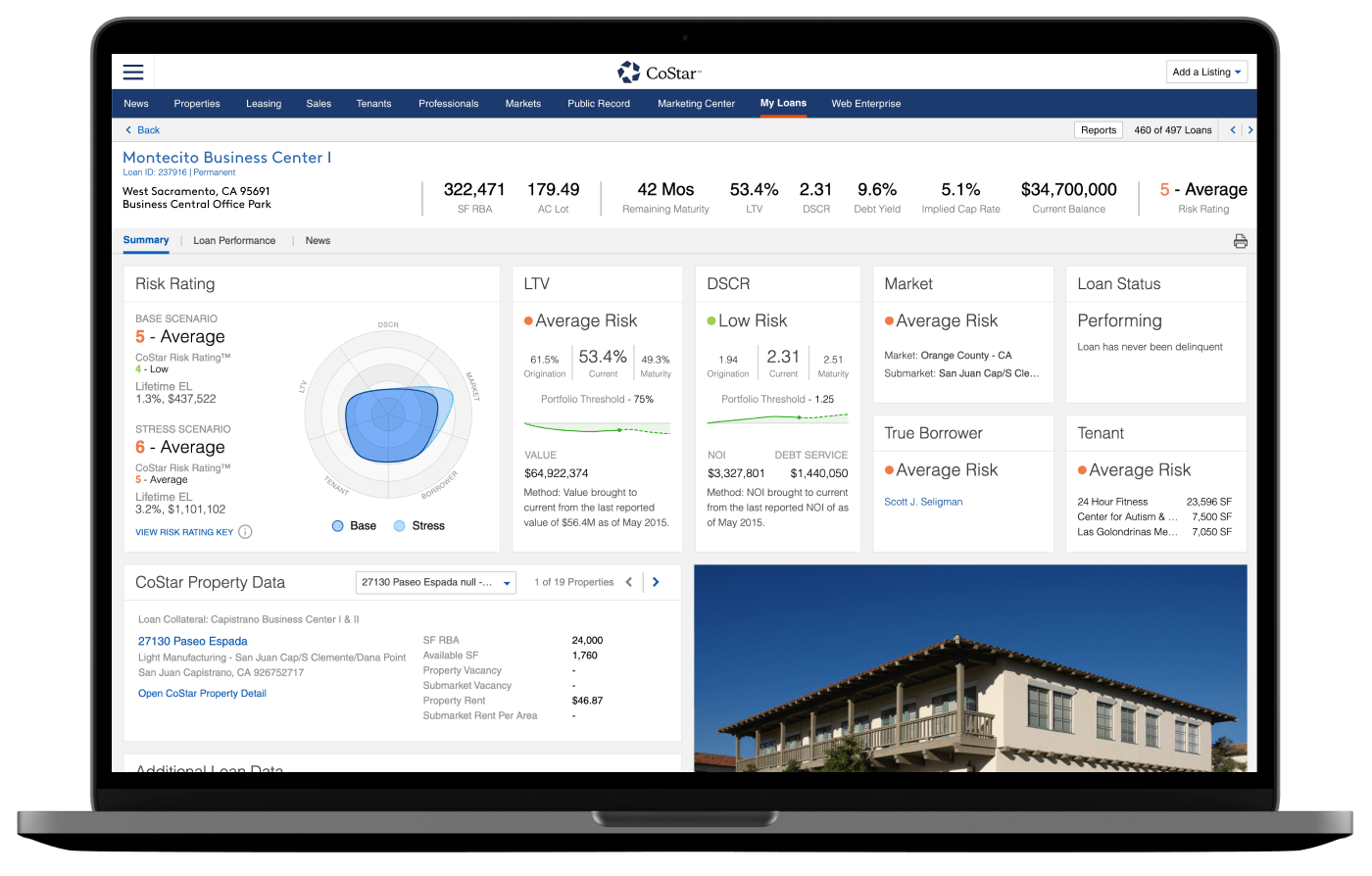

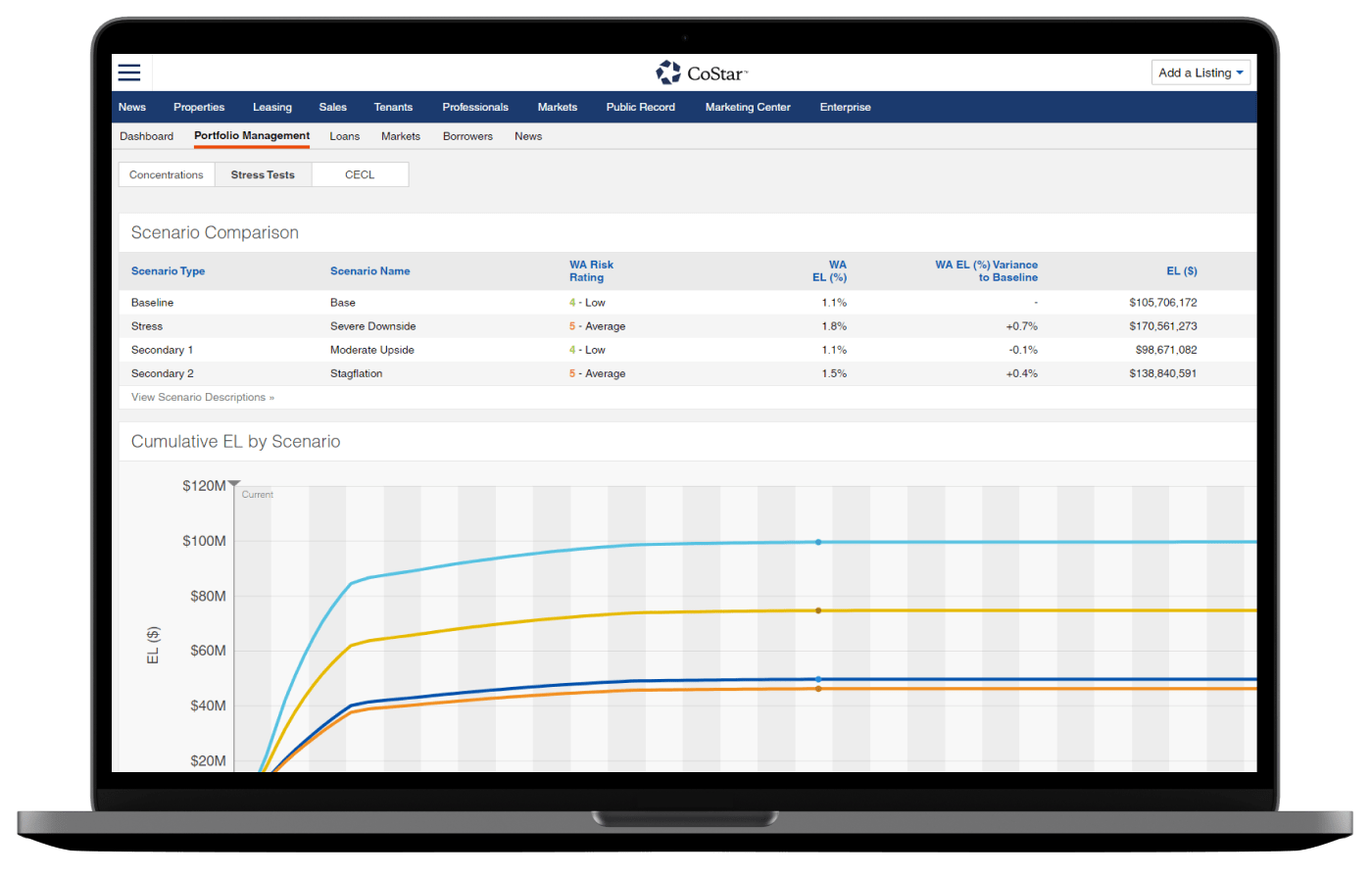

Risk Management

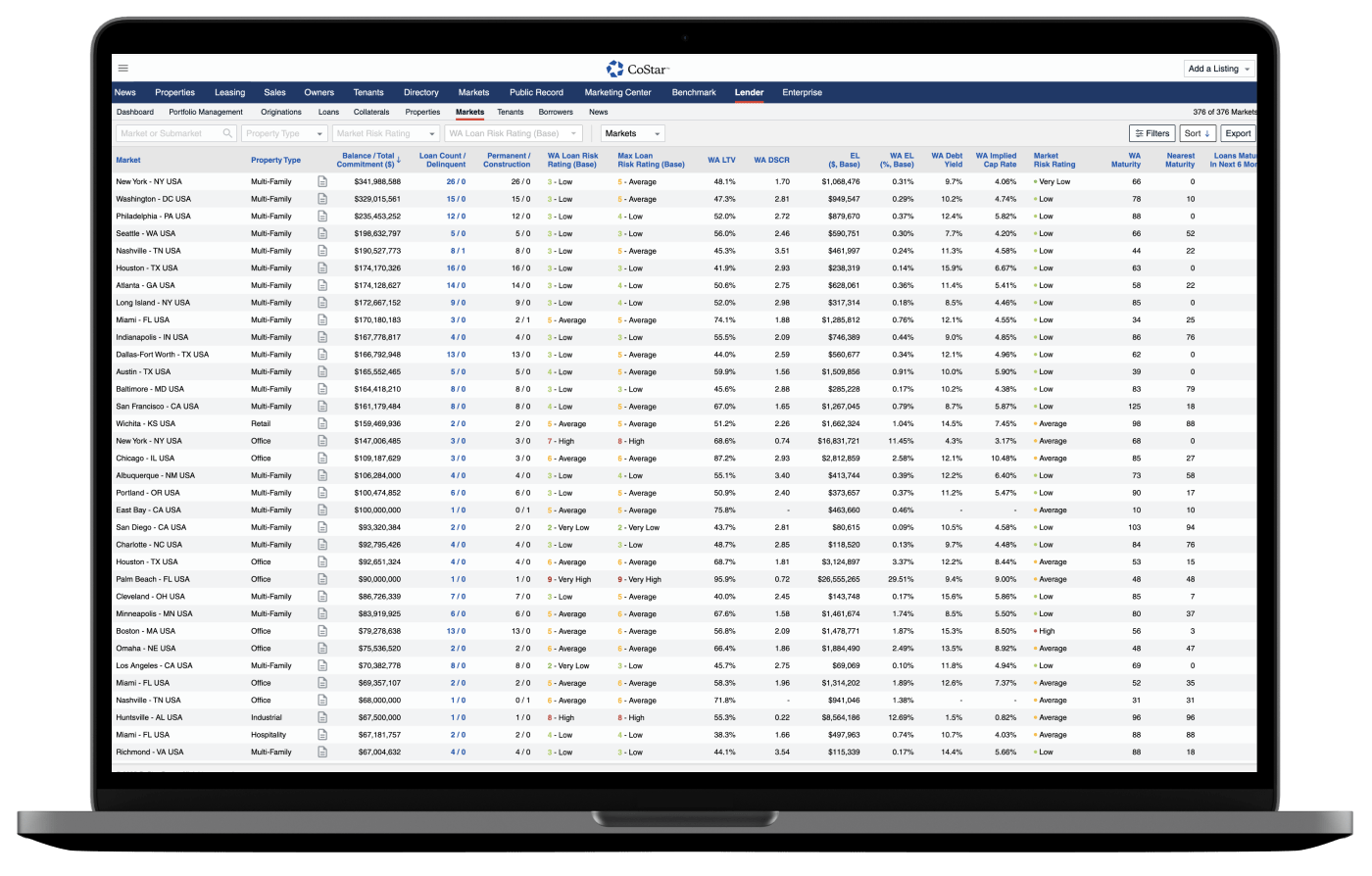

Stress test your portfolio across different economic scenarios and view concentration risk by tenant, market, submarket, property type, borrower and more.

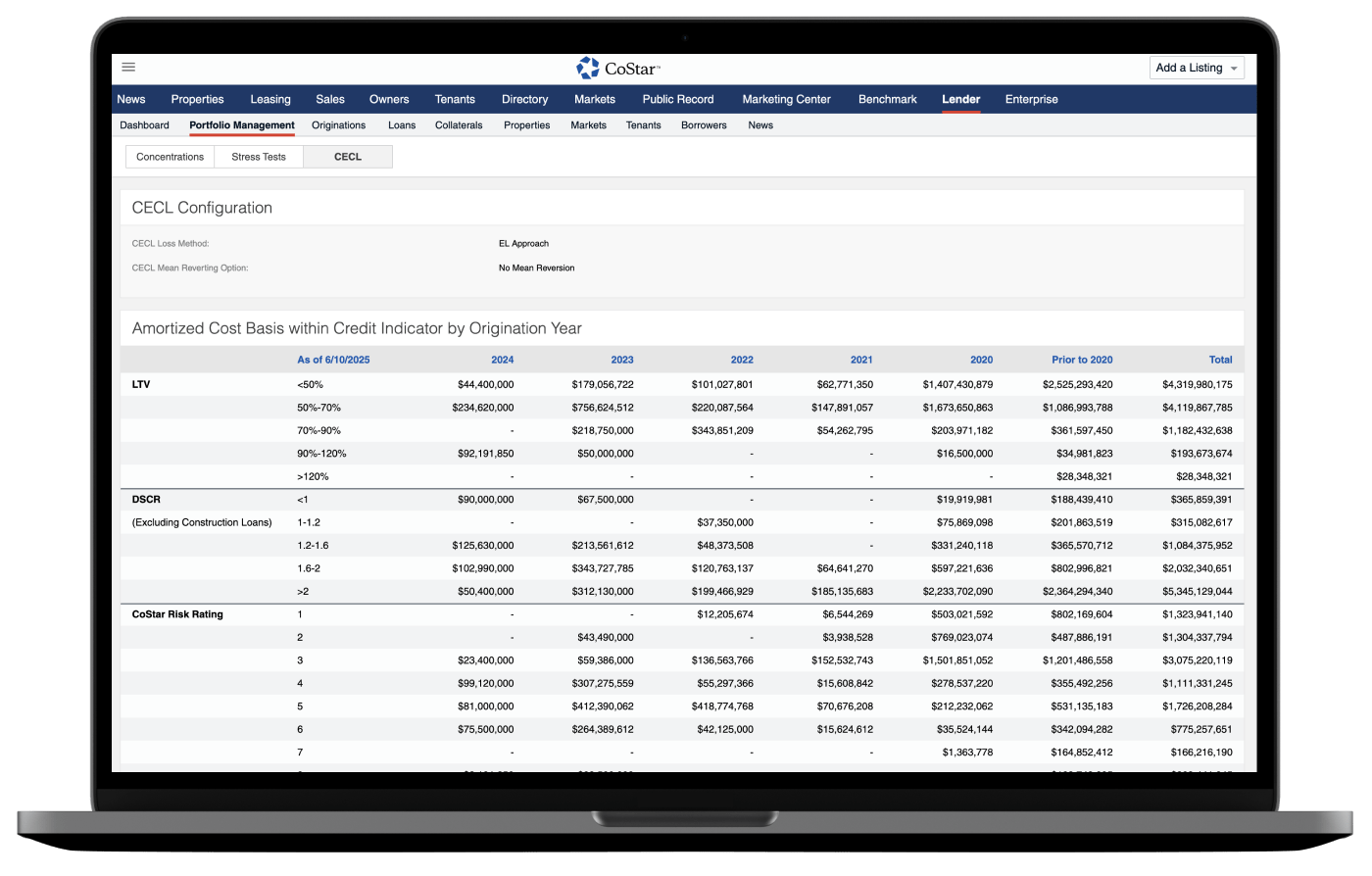

Regulatory Reporting

Leverage a proven credit default model for comprehensive regulatory analysis on concentration risk, CECL, CCAR/DFAST, and custom stress testing.

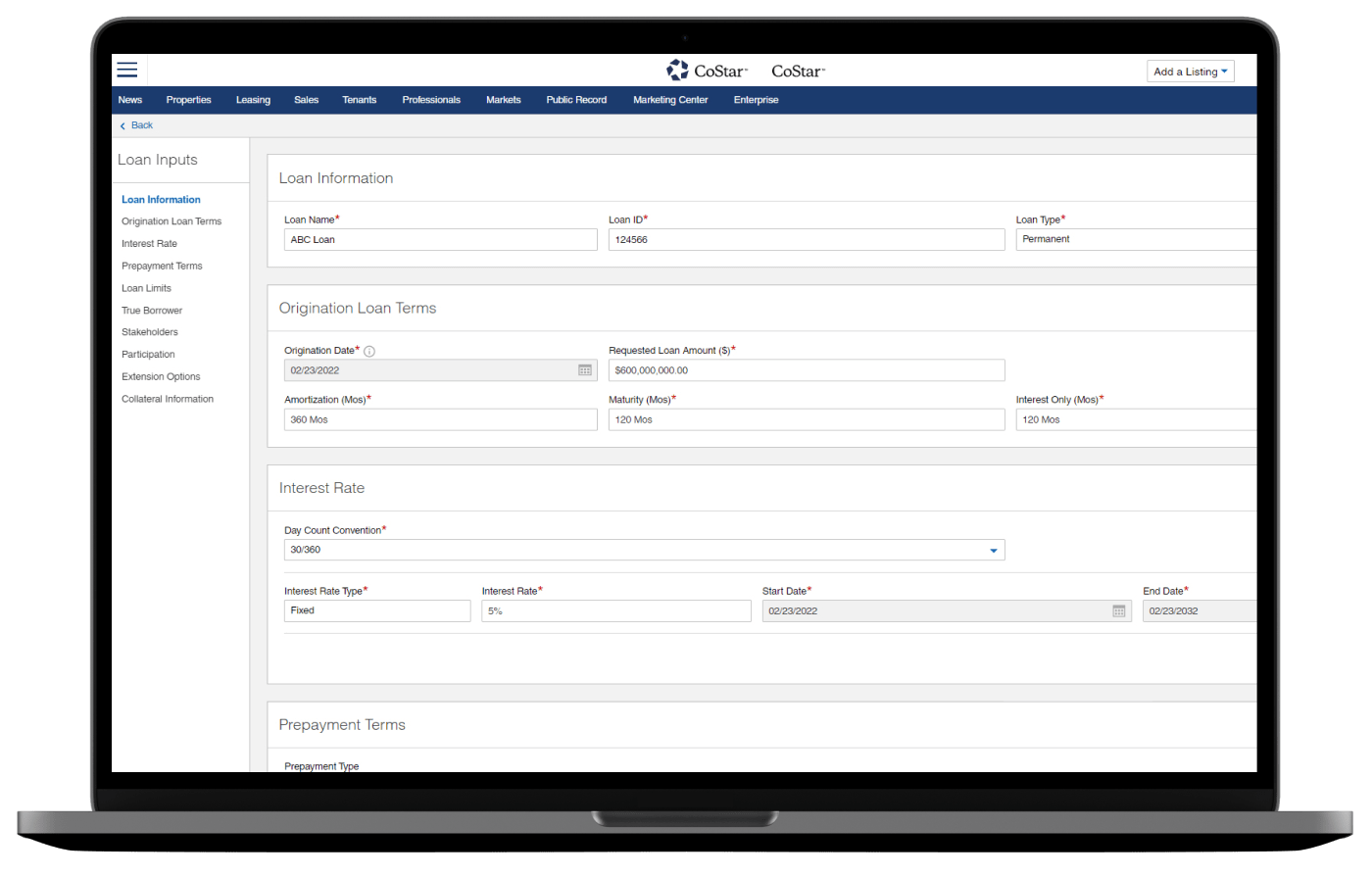

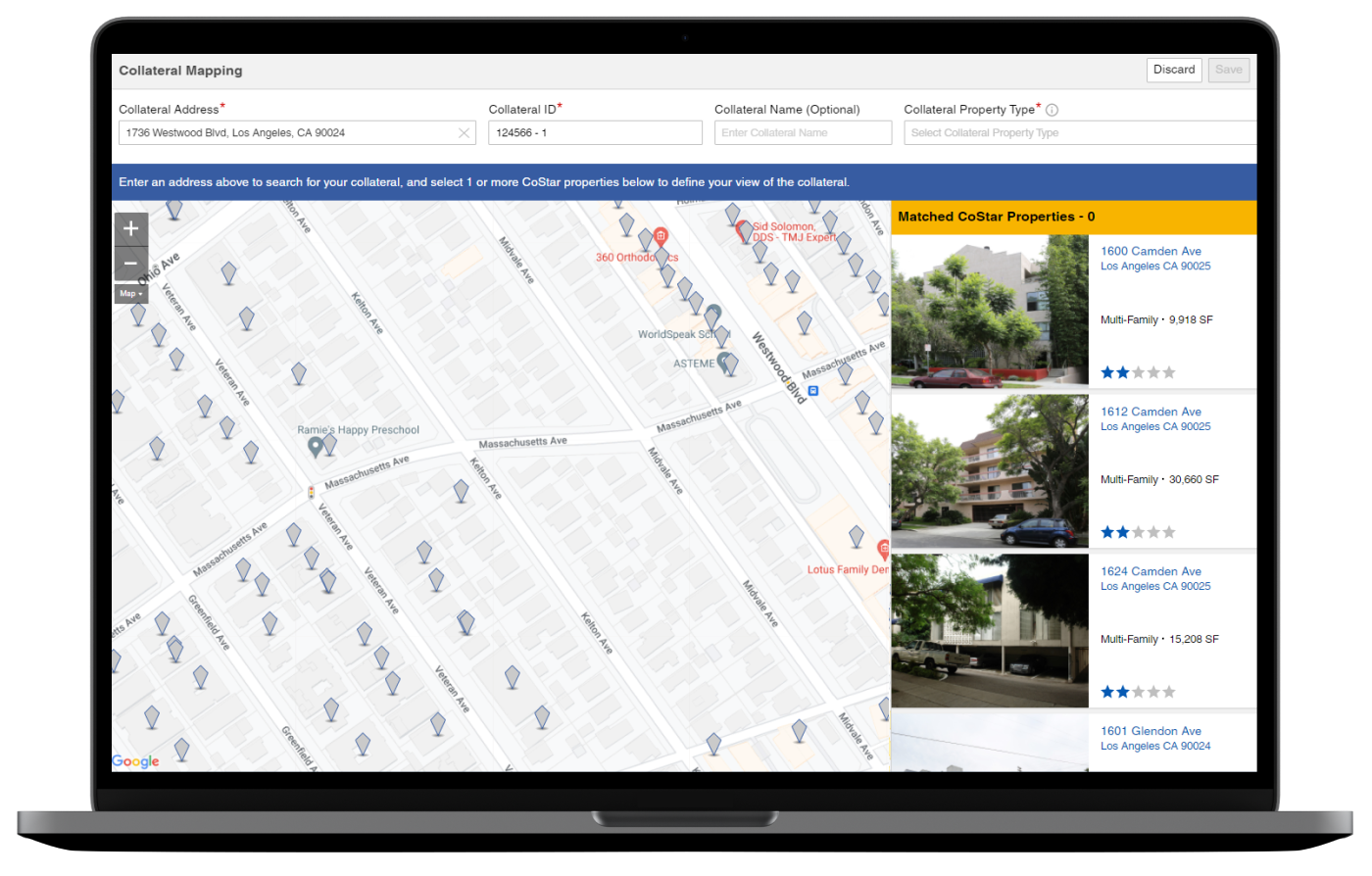

Loan Screening, Origination & Underwriting

Select any of CoStar’s 6.8M properties, enter loan information and receive a scorecard complete with property data, market analytics, and risk ratings.

Your loan portfolio mapped to CoStar’s industry-leading property information, market analytics, and the COMPASS credit default model means you’ll reach sound lending decisions more quickly.

Get connected to CoStar’s industry-leading property information, market analytics and credit default modeling.

CoStar’s investment in research and risk methodology is unparalleled. For over 35 years, lenders and the entire commercial real estate industry have relied on CoStar to make timely, data-driven decisions, manage risk, and earn new business.

20 years

Time-tested COMPASS credit default model trusted by regulators

$5B

Invested in research and technology

3.9B yearly updates

CoStar is dynamically updated with third-party data, including rent observations from Apartments.com and CMBS loan and financial data

1,600+

Researchers gathering details on properties, transactions and tenants

620+

Software developers building new products

55+

Analysts and economists analyzing markets and creating forecasts

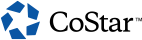

Your Loan Portfolio

Scrubbed and uploaded to CoStar’s secured database

↓

Combined with the Power of CoStar

7.3

Million

Commercial

Properties

20

Million

Sale and Lease

Comparables

8.3

Million

Tenant

Profiles

17

Thousand

Submarkets

with Forecasts

20

Years

COMPASS Credit

Default Model

↓

An Easy-to-Use Solution to Answer your Complex Questions

Empower Your Team with Industry Trusted Data and Analytics

Gain Operational Efficiency

Reduce the cost of regulatory compliance and allow valuable personnel to focus on analytics.

Manage Risk with Confidence

Monitor current LTV, DSCR, and CECL for your entire portfolio at a single click. Drill into loans to see risk ratings and access extensive property-level data, all in one place.

Win More Deals

Make better and faster loan origination and portfolio decisions by having around- the-clock access to CoStar data and analytics.

Data Integrity & Security

Advanced technology to clean your data in a fully hosted web solution built to meet all industry-standard security requirements, along with all relevant audit reports.

Senior Management

Set Your Lending Strategy

Portfolio and Risk Management

Manage Risk with Confidence

Underwriter

Underwrite Deals Faster

Originator

An Easier, Quicker Way to Originate Loans

As a long-term client of CoStar and its products, we chose Compass as the ideal tool in helping us understand and manage our credit risk book as well as meet our reserving requirements. Our decision was based on best-in-class commercial real estate data combined with a robust and tenured model. Our adoption of CECL reserving methodology was seamless and the CoStar team was very responsive and supportive of our specific needs, including a custom calibration of our loss history.

Throughout the real estate cycle, the models’ capabilities provided the necessary controls to reflect senior management’s view of the evolving market environment. This has provided confidence in quantifying the firm’s credit risk and that reserves for losses are adequate and compliant with GAAP requirements.

C. Dave Maisel, Senior Managing Director, Enterprise Risk & Governance, Multifamily Capital Markets

Why CoStar for Lenders is the Smart Choice:

Integrated and Intuitive

Your portfolio is connected to CoStar’s powerful data and analytics so you can see all relevant information in one place.

Enterprise-Level Security

CoStar has a 38-year record of working with the commercial real estate industry, and CoStar for Lenders meets all standard industry security requirements.

Regulatory Compliance

Calculate CECL/ALLL reserves, run stress tests (including CCAR/DFAST) and create regulatory reports.

Proven Reliability

Developed by CoStar Risk Analytics’ team of PhDs and industry veterans, the COMPASS credit default model is the most mature in the industry.

Quality Data

Access property-level data including vacancy, rents, sale comps, peers and tenants for any multifamily, office, industrial, hospitality or retail property.

Deeper Insights

Analyze concentration risk by tenant, industry, property type, market, submarket, borrower, and more.

Learn what CoStar can do for your business.

See how it works.