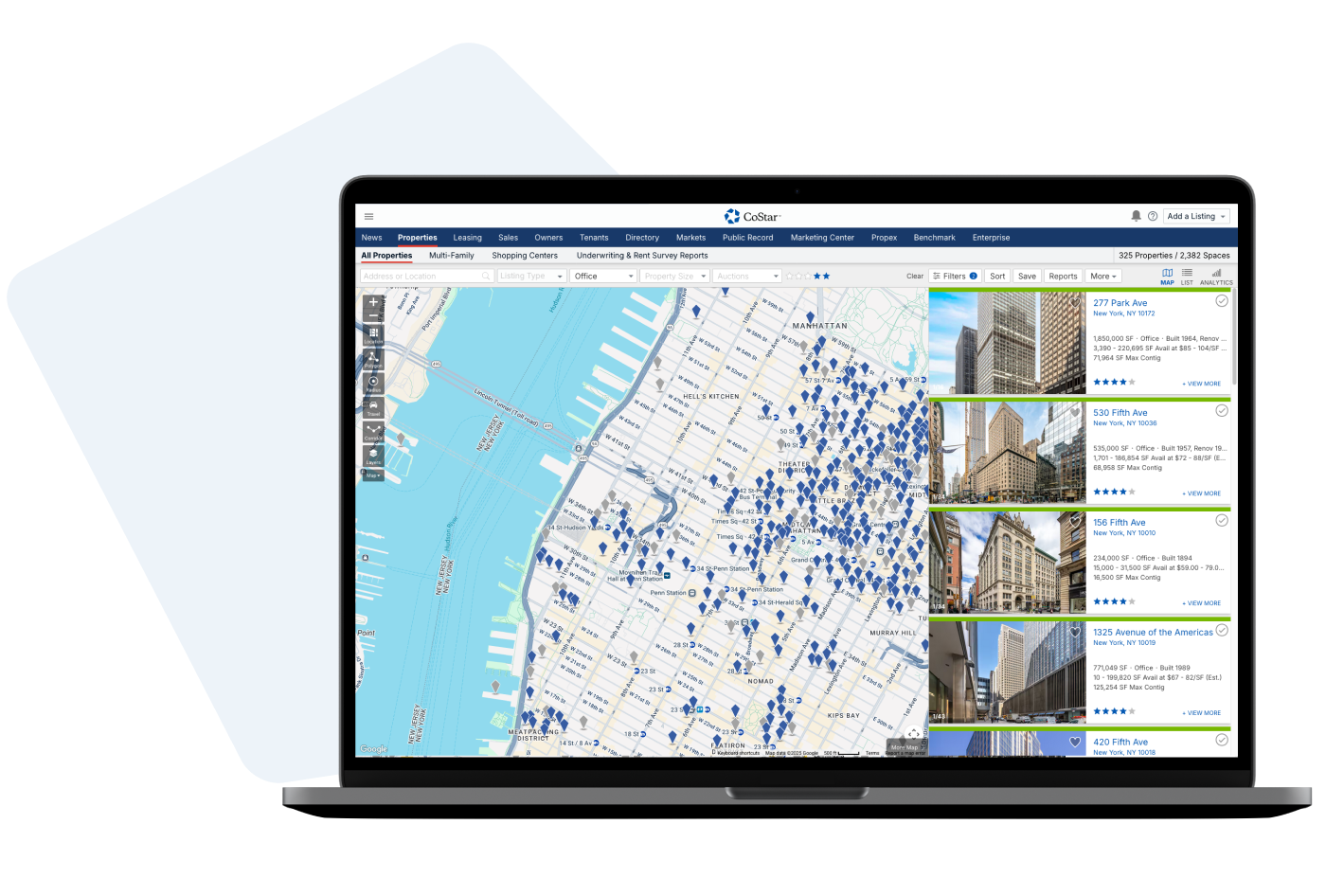

The Power of CoStar

For more than 38 years, CoStar has provided an industry-leading commercial real estate information, analytics and news platform that delivers unparalleled insights to commercial real estate professionals and other industries – helping them make informed decisions more quickly.

Commercial property data for a wide range of applications

Whether you’re buying, selling, or leasing a property, representing tenants, valuing assets, originating loans or managing diverse portfolios, CoStar has got you covered.

What sets CoStar apart?

With the largest research team in commercial real estate, we take a census-level approach to assemble comprehensive, accurate data that gives you a full picture of the market – brought to life in valuable, relevant ways by our powerful technology and useful features.

The Largest Inventory

Access a comprehensive inventory of over 7 million commercial properties.

Valuable Market Insights

Get in-depth information on the commercial real estate market, historical trends, comps and KPIs to fully understand market conditions.

Timely News & Analytics

Identify new opportunities and stay connected to the market with CoStar news, alerts, analytics tools and commentary.

8.5M+

Properties Tracked

21.8M+

Lease & Sale Comps

8.2M+

Commercial Tenants Tracked

240,000+ CoStar subscribers keep logging in for all these reasons and more:

- Identify new prospective clients and partners

- Appraise property values and potential leasing income

- Understand the underlying financial performance of assets

- Find off-market investment opportunities

- Assess market and submarket KPI trends and forecasts

- Pre-empt tenant moves, lease expirations and renewals

- Analyze the details of recent lease and sale transactions

- Stay up-to-date on the latest industry news