NASHVILLE, Tennessee — Over the past few years, U.S. hoteliers have waited for demand to recover across all segments, but two of the biggest pain points are fewer international inbound visitors and slowing group demand.

Unfortunately, both segments have yet to fully recover to pre-pandemic levels, and it's possible they won't anytime soon, said Chris Klauda, director of analytics at STR, during a Hotel Data Conference session titled "Dissect Demographics, Data and Demand."

But what's the "why" behind the slowing hotel performance trends in both international inbound demand to the U.S. and demand for large group stays, events and conferences? For added context, Raleigh Gresham, managing director at The MODIV Group, shared consumer survey data categorized into four buckets of travel demographics: luxury travelers, business travelers, younger travelers labeled as "up-and-comers" and event planners.

International travel preferences

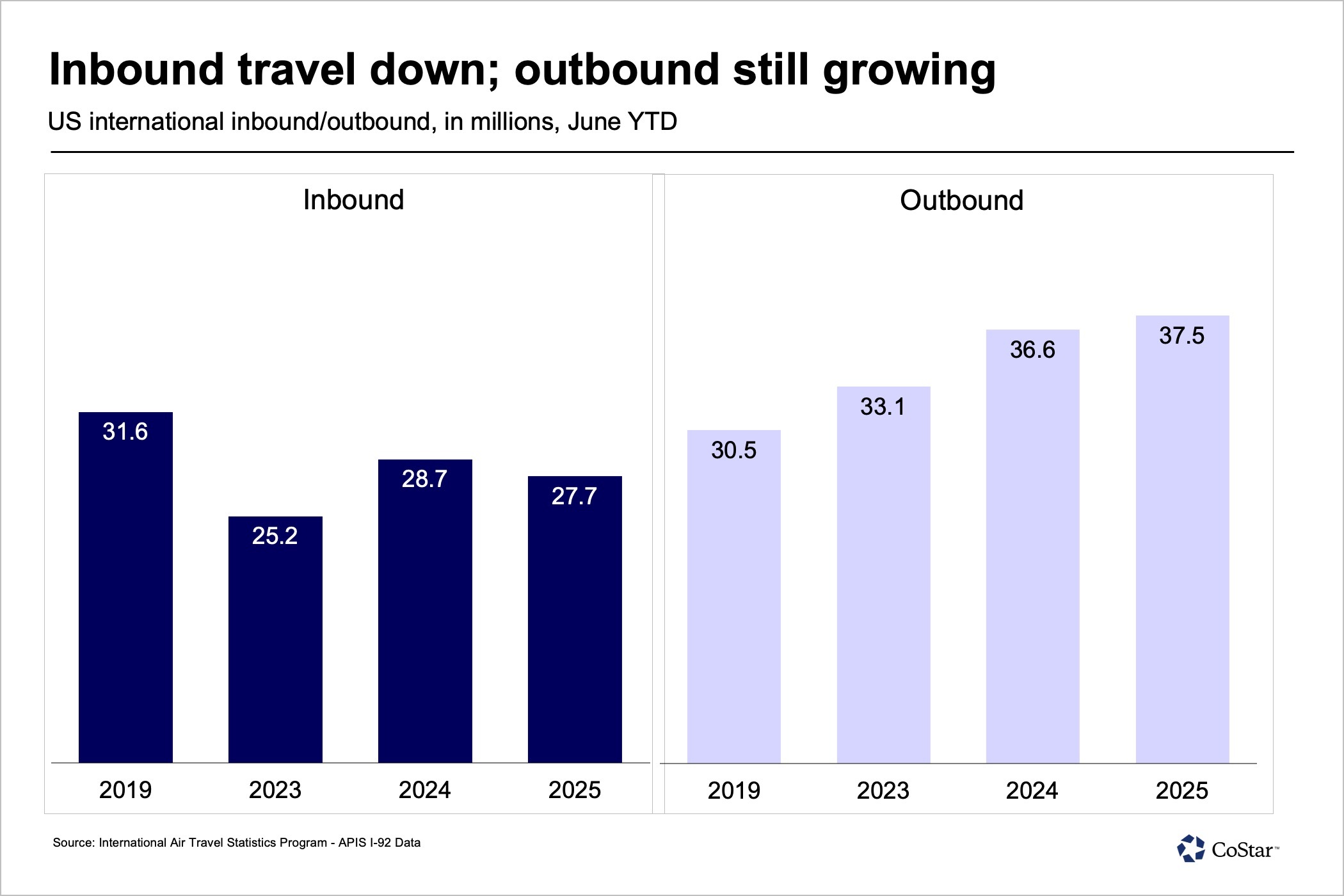

Before the pandemic, the number of inbound international visitors to the U.S. outpaced the number of Americans leaving the U.S. for international trips. But while U.S. outbound international demand continues to climb, international inbound demand to the U.S. hasn't recovered to 2019 levels and through June was even lagging 2024.

Could an aversion to the headlines coming out of the U.S. be keeping international visitors away? Political noise doesn't seem to be the biggest driver in those travel decisions, according to The MODIV Group's consumer surveys, Gresham said.

Instead, while "headline awareness" is abundant across travel demographics, people are not choosing to book leisure trips, events or business travel in the U.S. because they're looking for destinations and experiences that are a bit more unique in other parts of the globe.

"The takeaway here is the preferences and priorities, not just politics, in a lot of cases that are driving opportunities," Gresham said.

A silver lining, however, is that U.S. outbound international demand appears to be slowing, which could be a result of Americans reevaluating their travel budgets as everyday costs continue to rise, Klauda said.

"In June, outbound travel was flat. So Americans maybe are finally feeling the economic pinch and they're not traveling. But up to that point, we've seen a steady increase in outbound travel," Klauda said.

Slowing group demand and more intentional business travel

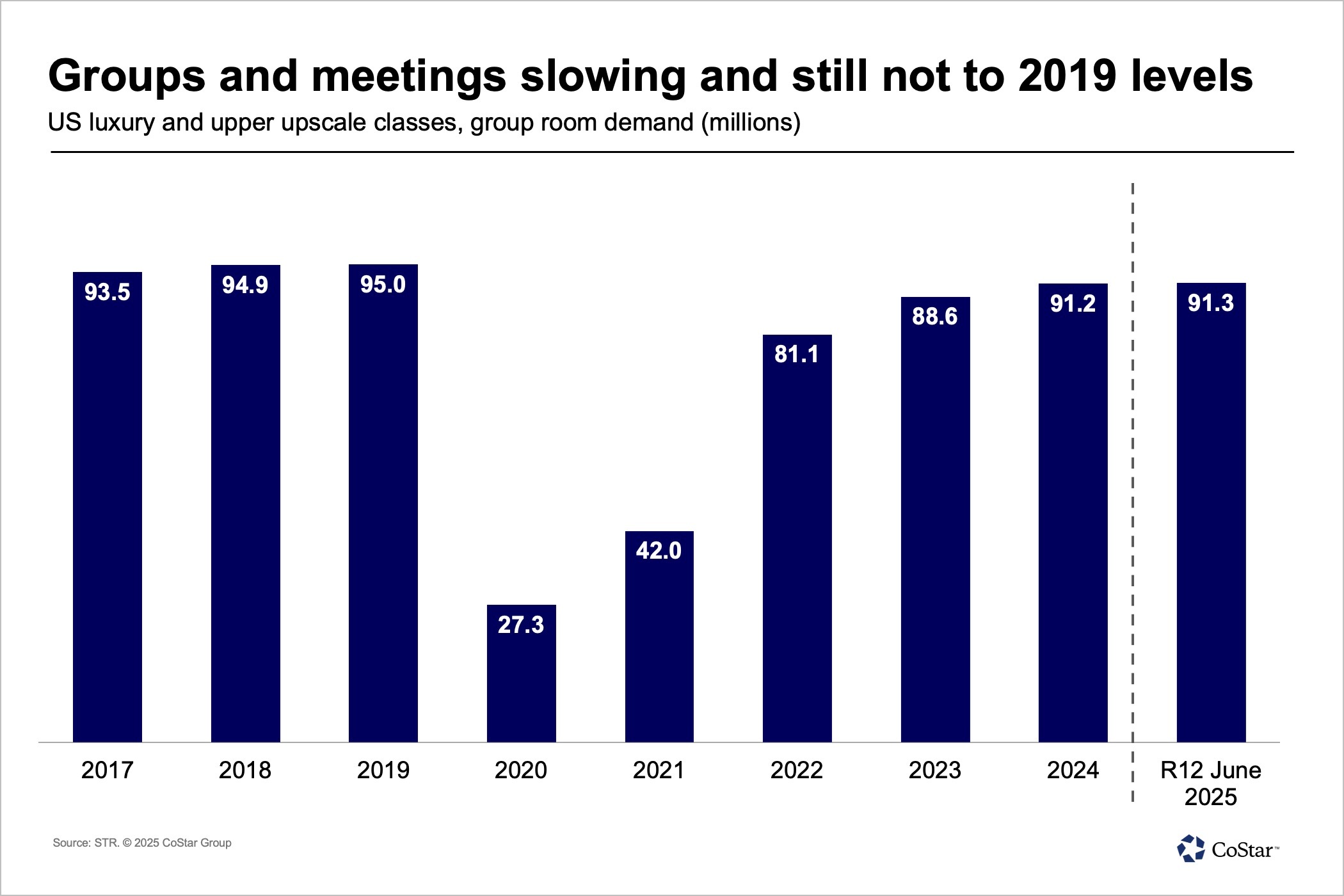

Similarly, group demand at U.S. hotels has had a tough road to recovery since the pandemic. After group room nights fell off in 2020 and 2021, group demand rebounded in 2022 through 2024 but hasn't reached the same heights as 2019.

"We've seen some really strong [group] recovery in 2024 but it's starting to slow," Klauda said.

Even so far in 2025, U.S. hotel group demand appears to be plateauing as the federal government pulls back on travel spending and other industries host smaller events or regional meetings, Klauda said.

"Group demand was flat year over year [in 2025], and really was lifted by January, February, March, you can see that the strong increases," Klauda said. "Then once April came around, I saw the demand soften. I wasn't worried because the Easter shift and the Passover shift sometimes work through March and April and flip, which is what they did. ... Once you got to May, we were still down, and we thought, 'Oh, maybe it's just a delayed school break,' but it was down in June and I can tell you it's down in July. So group is soft, and we want to know why."

Meanwhile, in MODIV's consumer surveys, respondents didn't highlight travel costs as the biggest factor for choosing one conference or business trip over another. Instead, professionals across MODIV's four hotel guest demographics are prioritizing trip purpose and exclusivity in their work travel.

"There is a shift in some cases to those small, intentional gatherings; that pattern is starting to become particularly impactful in the corporate space," Gresham said. "And then close to 60% are saying that they feel that regional or hybrid formats have replaced at least one large-scale event."