Over 65% of the U.S. population is expected to be vaccinated with at least one COVID-19 shot by the beginning of this summer, which is promising news for the hotel industry.

“This is truly a game changer, especially for the leisure markets,” Adam Sacks, president of Tourism Economics, said during a panel titled “North America Macroeconomic Overview” at the online Hotel Data Conference: Global Edition.

Even with some bumps and pauses along the way, the ramp-up in distributing the vaccine should lead to fewer deaths and hospitalizations, he said.

Traveler confidence was not where it needed to be for a “fully fledged recovery,” Sacks said, citing data showing only 55% of travelers in the U.S. said they felt safe traveling outside their community.

That number continues to rise, as well as the number of jobs gained back, which is another important indicator of the recovery, he said.

Sacks said more than half of the jobs lost last spring have been regained, but those gains have plateaued.

“With an unemployment rate of 6.2%, it’s still a challenging environment,” he said.

Reasons for Optimism

There’s still reason to be optimistic about “the state of the U.S. economy and how it’s going to support a rebound in travel,” Sacks said.

Larger companies are starting to show optimism. Interest rates are also still low, which has lowered mortgage rates near historic lows, and that is fueling a boom in housing and construction markets.

“It of course also lowers the cost of debt for households, increasing disposable income for things like travel,” he said.

While more than half of travelers said they didn’t feel comfortable traveling outside their communities, 87% of traveling households said they have travel plans in the next six months.

“I think that bodes very well for the leisure travel recovery in the summer,” Sacks said.

Data Bright Spots

Everyone has seen the charts showing dramatic declines across the three key performance indicators over the past year, but STR has found some bright spots in the data, said Ali Hoyt, senior director of consulting and analytics, during the “North America Deep Dive Analysis” at the online Hotel Data Conference: Global Edition. STR is CoStar Group’s hospitality analytics firm.

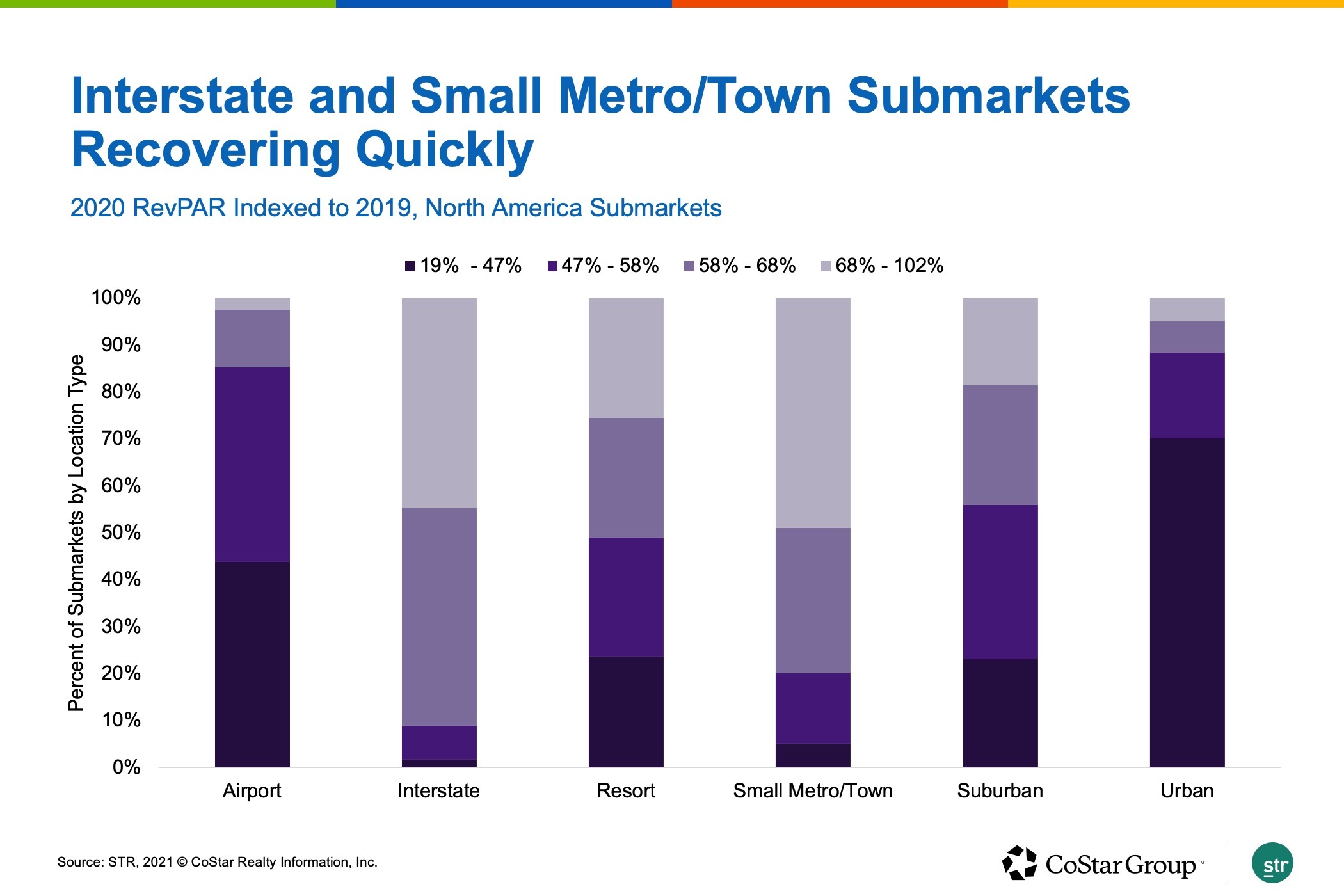

In one analysis, STR indexed revenue per available room for all North American submarkets, then categorized those by top-performing and bottom-performing submarkets by location type.

Seventy percent of urban submarkets across North America performed at under 50% of their 2019 performance in 2020.

The bright spot in the data is in interstate and small metro town location types, “where nearly half of each of those location types are just about 70% or greater to their 2019 RevPAR performance,” Hoyt said.

Best-Performing US Submarkets

Not all properties within those submarkets performed at the same rate, so STR looked at all U.S. hotels that reported performance consistently over the past 24 months to see if they have increased or decreased occupancy or rate.

Hoyt said 2.2% of those properties increased both occupancy and rate in 2020.

“That’s a much smaller percentage than it was in 2019, but still a reason to be positive about those results,” she said.

Nearly 20% of hotels increased occupancy or rate during the year.

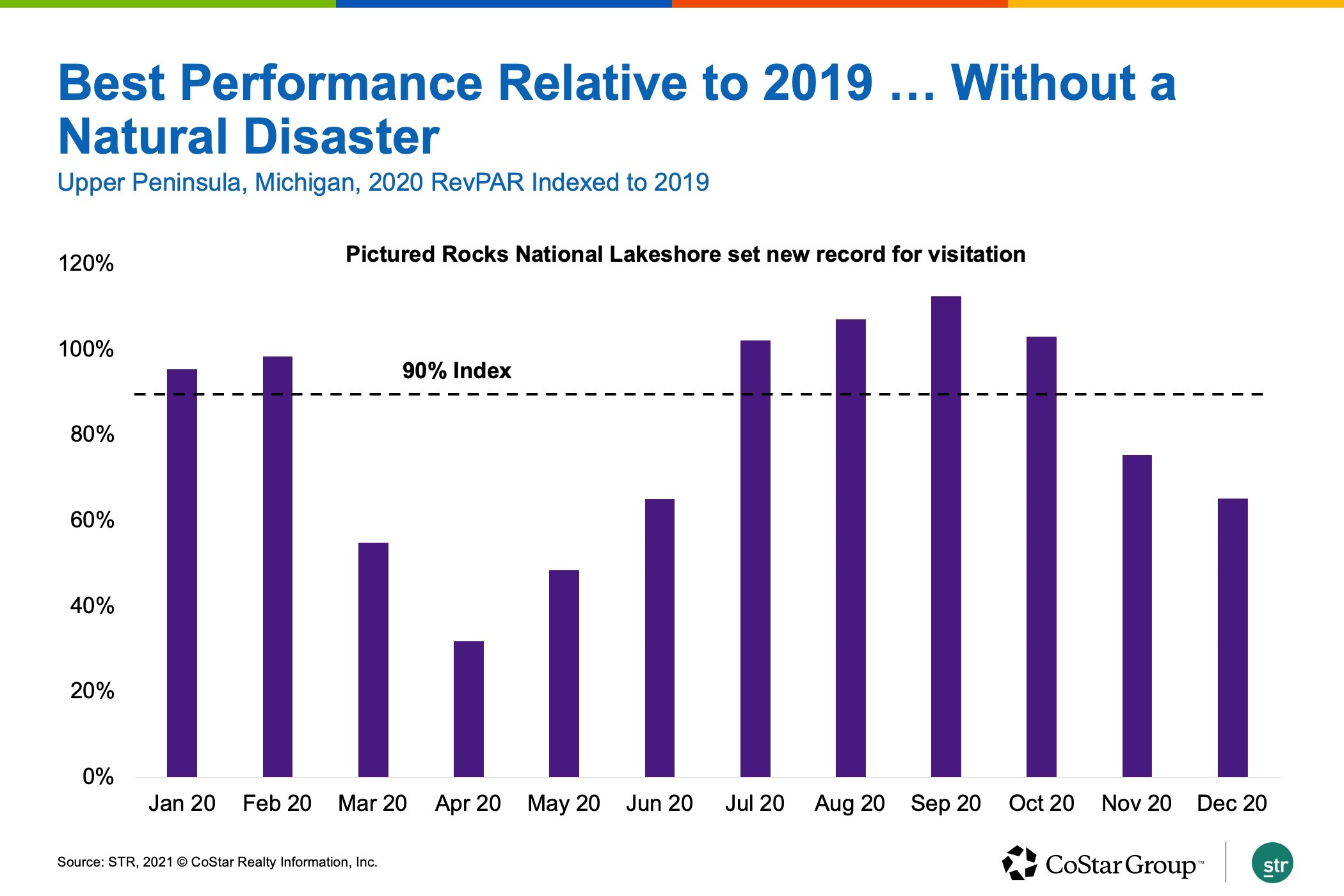

When looking at the best-performing submarkets, categorized as submarkets that achieved 102% of their 2019 performance in 2020, Hoyt said the Louisiana South submarket was “the best-performing submarket in 2020 relative to 2019.”

This isn’t 100% positive news, as Hurricane Laura came to the shores of Louisiana at the end of August, which contributed to an uptick in hotel demand due to recovery efforts and displaced residents, she said.

The second best-performing submarket was the Upper Peninsula submarket in Michigan, which performed at 90% of its 2019 RevPAR performance, Hoyt said.

“When we started to look at Michigan and the surrounding area, what stood out to us [was] that Pictured Rocks National Lakeshore set a new record for visitation last year, and that was 1.2 million visitors, which was a 40% increase over the prior year,” she said.

A trend has been seen in outdoor destinations performing well, and this is proof of that, she said.

North America Overview

Demand growth has been a struggle across the U.S., Canada, Mexico and the Caribbean, Vail Ross, senior vice president of global business and marketing, said during the “North America Hotel Performance Overview.”

“An underlying theme, specifically for the U.S. and Canada, is around the fact that we have had, in Canada, [border closures]," she said.

The lack of international travel and the lack of group travel has impacted those demand trends.

Mexico has remained open and demand is starting to come back. However, demand is down almost 57% for the region, Ross said.

Demand uncertainty has led to declines in average daily rate across North America with the exception of the Caribbean, she said.

“While demand is stagnant and declining, the rates that have been able to be realized are actually quite strong. On a 12-month-moving-average for the area, ADR is only down 0.3%,” she said.