NASHVILLE, Tennessee — U.S. hoteliers have been focused on the idea of recovering performance to the glory days of pre-pandemic.

But has U.S. hotel performance in the years since the height of the COVID-19 pandemic looked anything like the prior downturn and recovery of the Great Recession?

STR Senior Director of Analytics Isaac Collazo sought to answer that question by comparing U.S. hotel occupancy and other key metrics six years after the Great Recession and in the years around the pandemic. The data set involved 54,000 U.S. hotels open from 2008 to 2014 and then 57,000 U.S. hotels open from 2019 to to 2025.

Right off the bat, Collazo said it's clear the post-pandemic hotel recovery has reached its end.

"The pandemic recovery is over; this is the beginning of the new cycle," Collazo said during a session titled "Occupancy: Stabilizing or still catching up?" at the Hotel Data Conference.

In fact, the record-breaking highs in occupancy the U.S. hotel industry achieved in the pre-pandemic years might not be attainable again, Collazo said.

"We may never see the occupancy levels we saw in 2017, '18 and '19. And you recall specifically in August of 2018 occupancy hit on a 12-month moving average at 66.1%. That may be something we never see again," Collazo said. "And I say 'maybe' because you never say 'never, ever.' But again, that might have been the anomaly."

U.S. hotel occupancy has stayed below the pre-pandemic peak and continues to fall. For the 12 months ending in June of each year, occupancy was 62.9% in 2023, 62.6% in 2024 and 62.2% in 2025. Conversely, U.S. hotel occupancy recovered and reached a new peak for the 12-month moving average six years after the Great Recession.

The reality is the U.S. hotel industry hit its occupancy recovery peak much faster after the pandemic downturn than after the Great Recession, Collazo said.

"We actually peaked, or kind of hit a plateau, much sooner than what we think today, because right now, things have gotten soft. ... You can see the recovery line in Great Recession continually going up well here, but for the pandemic, it basically starts flattening out about 50 months after we're out from the peak," he said.

One of the key differences between the recoveries after the Great Recession and the pandemic involved hotel revenue strategy in each period. Hotel demand and occupancy were slower to recover post-recession but were more stable, while post-pandemic hotel rates soared as consumers booked "revenge travel" trips and were less price-sensitive.

"In the Great Recession, we were trying to build demand, and we slowly built demand, so as occupancy was coming back, you build demand and then you can get pricing power. At the end of the pandemic, it was the opposite. We didn't have the demand quite yet, but we pushed rates," Collazo said.

But now, U.S. inflation has kept prices for everyday goods high and eroded consumer appetite for travel. With demand falling, more hotels are behind their peak occupancy level today six years after the pandemic than they were six years after the Great Recession. And any average daily rate growth isn't keeping up with the rate of inflation.

"We didn't anticipate the inflationary piece. So when inflation starts rearing its head, it starts putting more pressure on on everything: cost of food, wages, etc.," Collazo said. "So now we're getting that pressure. We can't keep raising [hotel] rates. The demand has not returned. But at the same time, cost of living is so high, it's now starting to push down the demand piece."

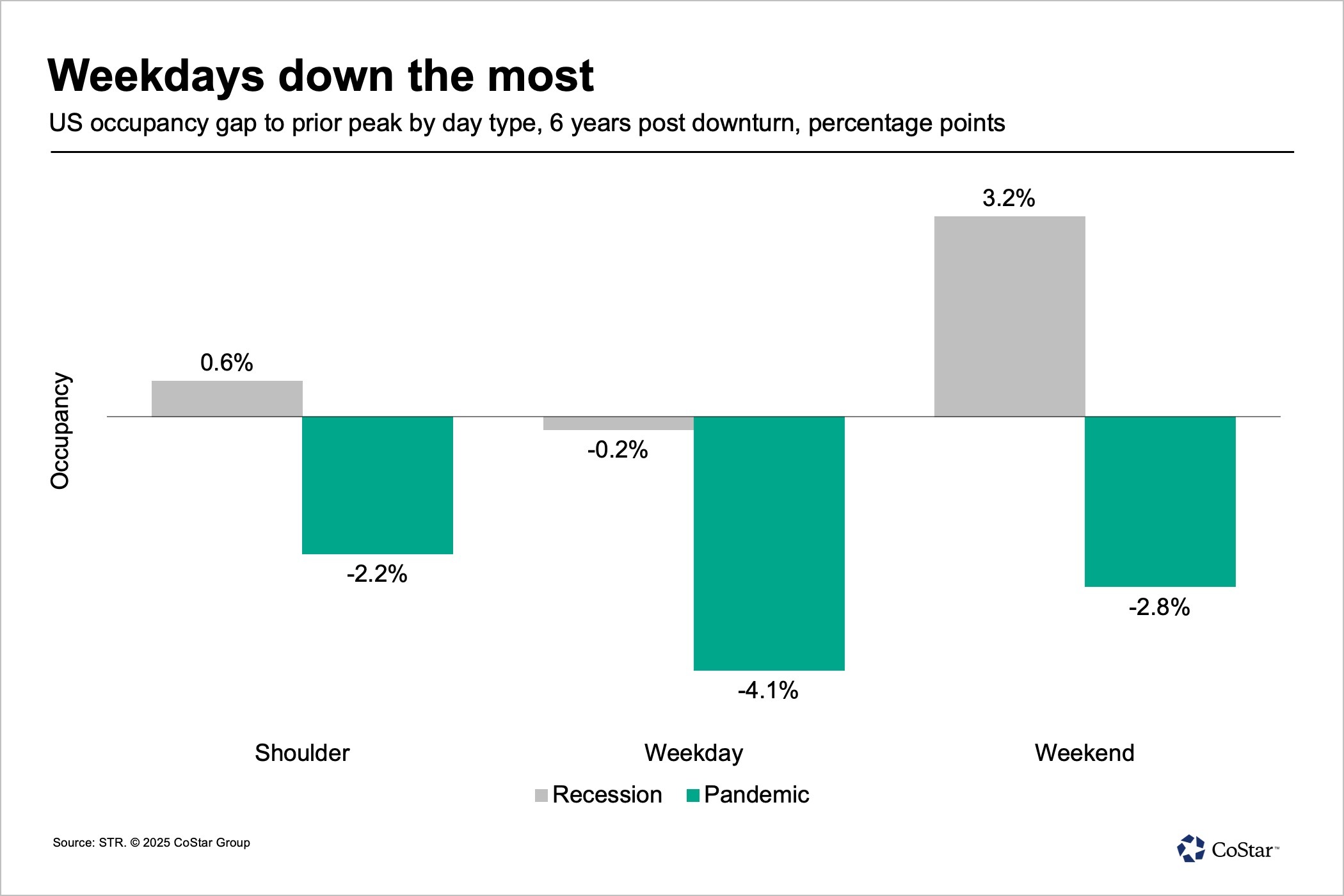

While Collazo examined other factors for possible culprits behind lower occupancy levels post-pandemic, such as regionality or hotel supply differences, the loss of weekday occupancy in U.S. hotels surfaced as a major contributor. Hotel performance on weekdays Monday to Wednesday is typically reliant on business travel and groups, and six years post-pandemic U.S. weekday occupancy is down 4.1%.

"What I think is still missing, even though it's returning, is that base business, which in this case would be weekday business transient [demand]. ... Everything's still down at this point versus where we were after the Great Recession, but it's still a big weak spot," Collazo said.