6 February 2026

Fringe benefits: Demand for office space in London’s Western Fringe is on the rise

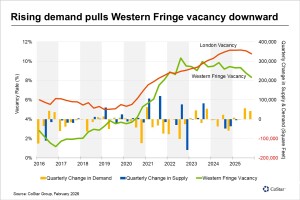

Office vacancies in London’s Western Fringe, where employees rub shoulders with the wealthy residents of Kensington, Chelsea and Notting Hill, are falling amid rising demand for space beyond the West End heartlands and ongoing weak development.