The U.S. hotel industry reported another significant decrease with revenue per available room for the week of July 13-19 down 3.3% year over year. That was only a slight improvement from the previous week, when RevPAR was down 3.7%.

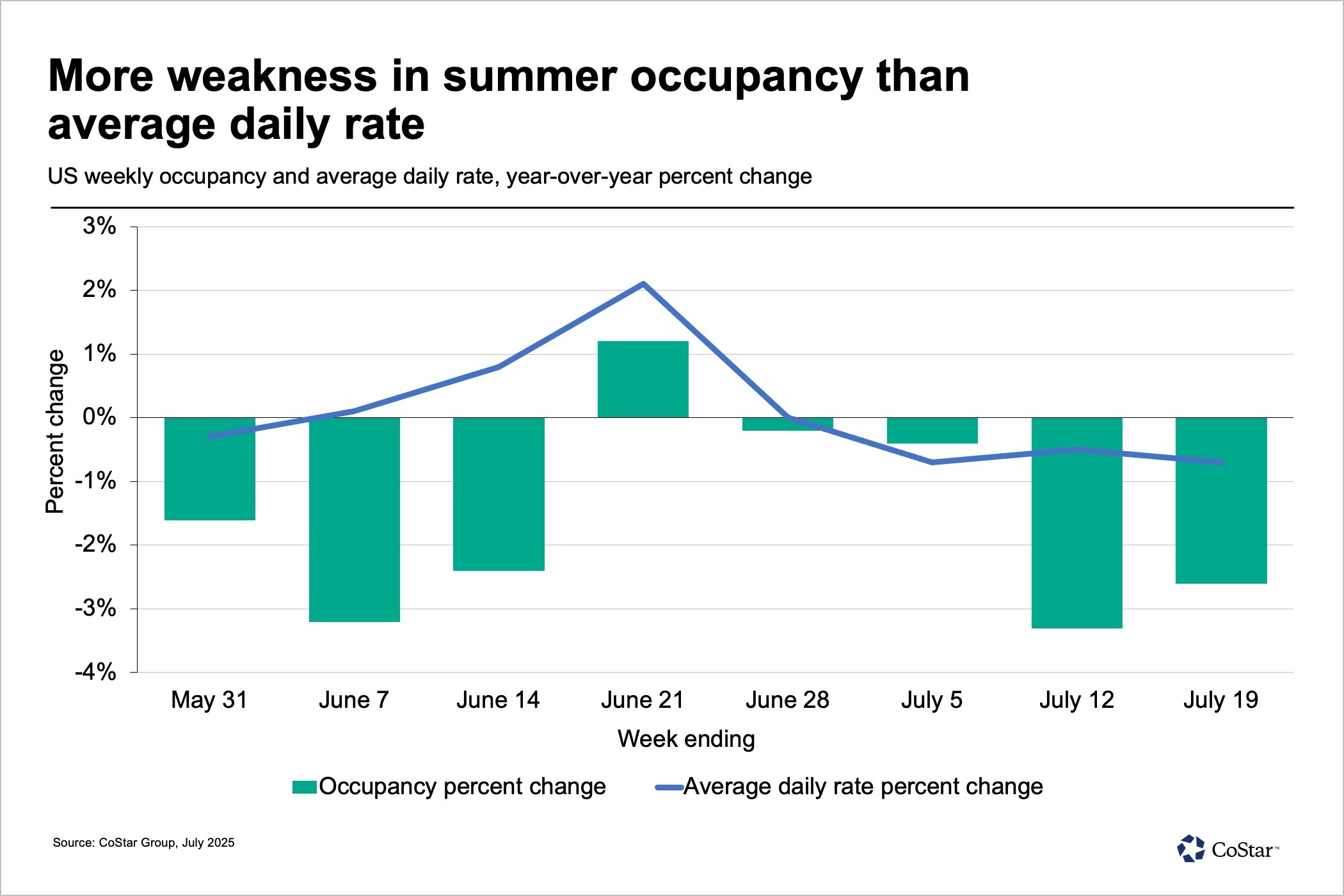

Hotel room demand declined 1.8% and was the largest contributor to the RevPAR decrease, but average daily rate also slipped 0.7%. With annual room supply up just 0.8%, weekly occupancy reached 71.6% and was 1.9 percentage points lower than last year.

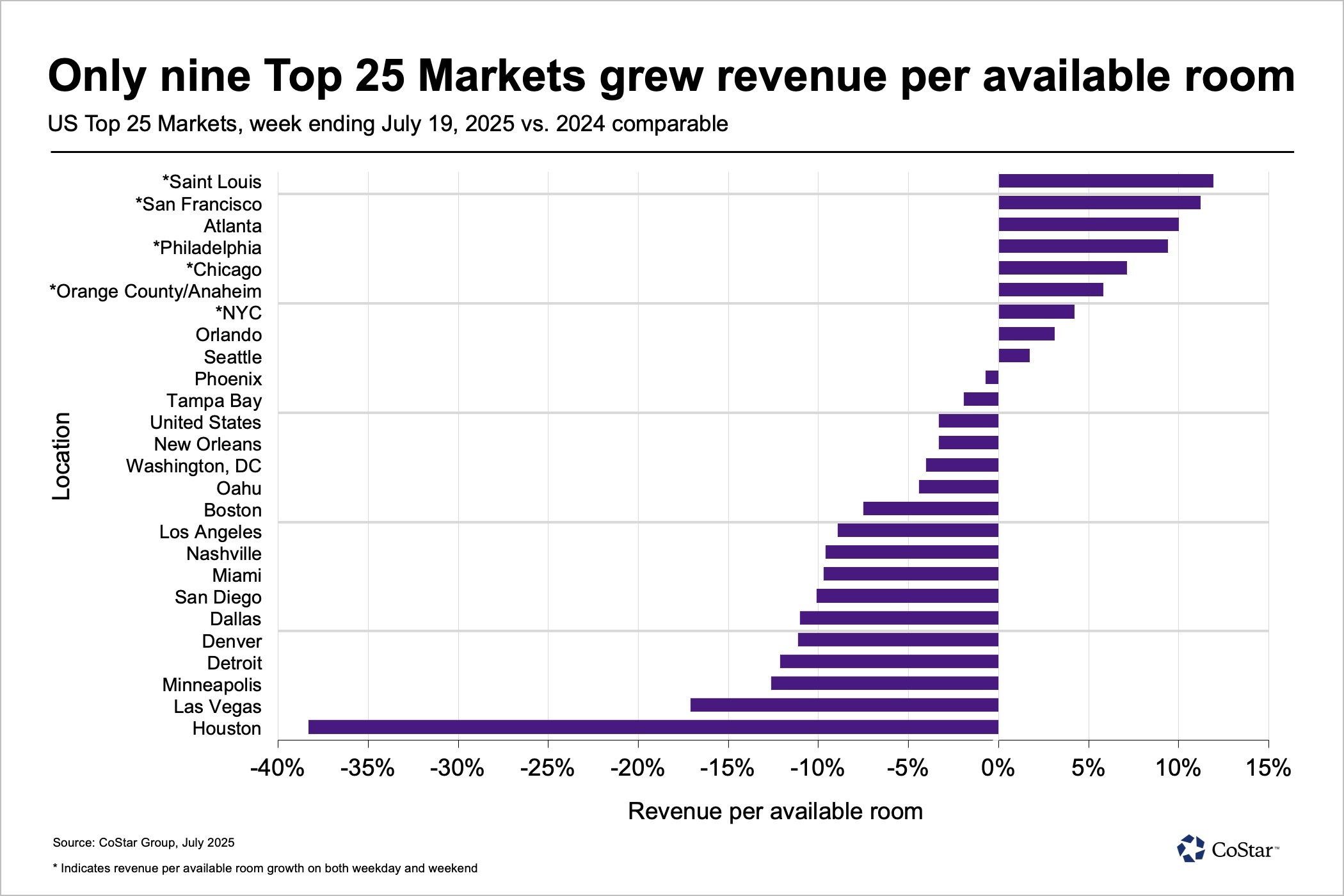

The largest RevPAR declines occurred in metro markets, both the top 25 U.S. hotel markets (-4.3%) and metro markets outside the top 25 (-4.7%). Three markets had a significant negative impact on the performance of the top 25 markets:

- Las Vegas RevPAR fell 17.1% on declining demand. As noted in previous weeks, we attribute Vegas’ performance to declining international arrivals, calendar shifts in groups and meetings and economic impacts on middle- to lower-income households.

- Houston hotels – which posted a 38.3% RevPAR drop – saw tough comps because of the displacement demand from Hurricane Beryl last year and the “Derecho” storm earlier in that year.

- Los Angeles, in particular the Los Angeles central business district, saw both demand and ADR drop amid heightened tensions in the market. Los Angeles hotel RevPAR decreased 8.9% and the central business district’s hotels reported a 17.8% RevPAR decline.

Excluding these three markets, U.S. hotel RevPAR would still have been down but only by 1.9%. Total U.S. ADR without Houston, Las Vegas and Los Angeles was still weak (-0.2%) and well below the rate of inflation. In the top 25 markets, RevPAR was somewhat flat (-0.6%) when excluding those markets and ADR rose 1%.

Metro markets – markets aligned with cities versus large rural areas – outside the top 25 saw the largest RevPAR decline (-4.7%) with the largest ADR decrease (-2.8%). The more dispersed non-metro/rural markets also saw decreases (-1.1%) due almost entirely to a 1-percentage-point occupancy decline.

Since Memorial Day weekend, summer U.S. hotel demand is down 1.6 million room nights (-0.7%) year over year and ADR is flat (+0.1%). Among the chain scales, only luxury has seen RevPAR grow, but demand has been up in all scales except economy and independent hotels. However, due to supply gains, summer hotel occupancy is down in all chain scales.

The weekend was ‘less bad’ than the weekdays

Weekend hotel RevPAR fell 2.5%, mostly because of the top 25 markets. Outside of the top 25, RevPAR dipped 0.9%. Weekdays Monday to Wednesday and shoulder days Sunday and Thursday saw RevPAR drop by more than 3%, mostly on falling occupancy with flat-to-down ADR, driven by the top 25 markets.

Excluding Houston, Las Vegas and Los Angeles, the remaining top 25 U.S. hotel markets saw flat weekday RevPAR (+0.1%) on rising ADR. However, weekday RevPAR outside the top 25 markets declined 3.5%.

Luxury chains were the bright spot again

Luxury hotels continued their positive trajectory with RevPAR increasing 1.5%, driven by a 2.2% ADR gain. The segment’s negative occupancy comparison in recent weeks is best understood within the context of its rapidly increasing room supply, which has grown by a substantial 5.3% year over year. A healthy yet lower rate of luxury room demand (+4.0%) also factors into the decreased occupancy. In other words, less than stellar occupancy growth within this segment is not a current concern.

The pendulum appears to have swung in an opposite direction for mid- to lower-end chains and most acutely for economy hotels. Economy hotels weathered the pandemic with relative strength while luxury saw sharp declines. On the flip side, this most recent week had economy chains’ RevPAR dropping 7%. Declines are evenly spread between occupancy (-4.0%) and ADR (-3.2%). General conditions among economy hotels might be even less favorable than topline indicators given that the total supply to this scale has retracted by 0.9% year over year, which would typically be a catalyst for the core indicators.

Looking ahead

U.S. hotels over these past weeks demonstrated softer-than-expected performance. We are seeing a mix of both positive/negative signals. As we have recently seen with Houston, interpretations of national- and market-level performance against the prior year will become a fair bit more nuanced now through the end of year. This is especially true in September (Hurricane Helene) and October (Hurricane Milton) as we recognize that year-over-year indicators will run into tough comparisons as those disasters affected multiple markets. We also recognize the occurrence of sociopolitical headwinds that have recently reduced demand to select markets for the short term.

Along those lines, we cannot find any reason to disagree with American Airlines CEO Robert B. Isom’s recent statement that “July will be the low point and that performance will improve sequentially each month in the quarter …and demand strengthens.”

Highest occupancy of the year with summer in full swing across most of the globe

Excluding the U.S., global hotel RevPAR has increased for the past three weeks with a 0.5% increase in the most recent week, lifted entirely by ADR. ADR has been the primary driver of RevPAR over most weeks this year. Occupancy fell 1.3 percentage points below last year, but at 72.2%, it was the highest level recorded this year. Occupancy has decreased for the past five weeks. The top countries for the past four weeks include:

- Japan maintained its top hotel RevPAR position as it has all year. Occupancy has slowed over the past three weeks, but ADR continues to rise. Osaka, host of EXPO 2025, led Japan in RevPAR in the most recent week and has posted the greatest gains of any market in the country almost every week since the start of the mega event in mid-April. All markets in Japan experienced RevPAR gains.

- Canada posted the second-highest RevPAR gain for the second consecutive week. Ten of Canada’s 22 markets posted double-digit RevPAR growth – lifted equally by both increases in ADR and occupancy – reflecting a true increase in travel.

- RevPAR in Spain advanced over 5% for the third consecutive week with the greatest lift coming from the Canary Islands in the south and the Balearic Islands in the northeast. Barcelona and Madrid, Spain’s largest urban markets, have seen negative RevPAR comps over the past two weeks.

- Hotels in the U.K. experienced another strong week with RevPAR rising in markets across the country. Four of the five largest markets grew RevPAR, led by Manchester’s 25.8% RevPAR jump. Northern Ireland was the top-performing market across the country hosting the 153rd Open Championship golf tournament.

France and Germany experienced declines this week and over the past four weeks due to sporting event calendar shifts from last year. China’s RevPAR declined 6.7%. Among the four top-tier cities, Beijing and Guangzhou saw double-digit declines while declines in Shanghai and Shenzhen were more modest (less than 3%).

Isaac Collazo is senior director of analytics at STR. Chris Klauda is director of market insights at STR. M. Brian Riley is a senior analyst at STR.

This article represents an interpretation of data collected by CoStar's hospitality analytics firm, STR. Please feel free to contact an editor with any questions or concerns. For more analysis of STR data, visit the data insights blog on STR.com.