Canada’s aim of becoming a global leader in electric vehicle parts production has proven unexpectedly difficult as progress on factories near Toronto and Montreal has stalled, leaving the projects' futures in doubt during a trade dispute with the United States, the primary market for Canada’s auto industry.

A $100 billion electric vehicle production initiative has been cast into doubt after manufacturers delayed or canceled factory construction plans on projects announced between 2021 and 2024 that involve $46 billion in private investments and more than $52 billion in commitments from federal and provincial governments.

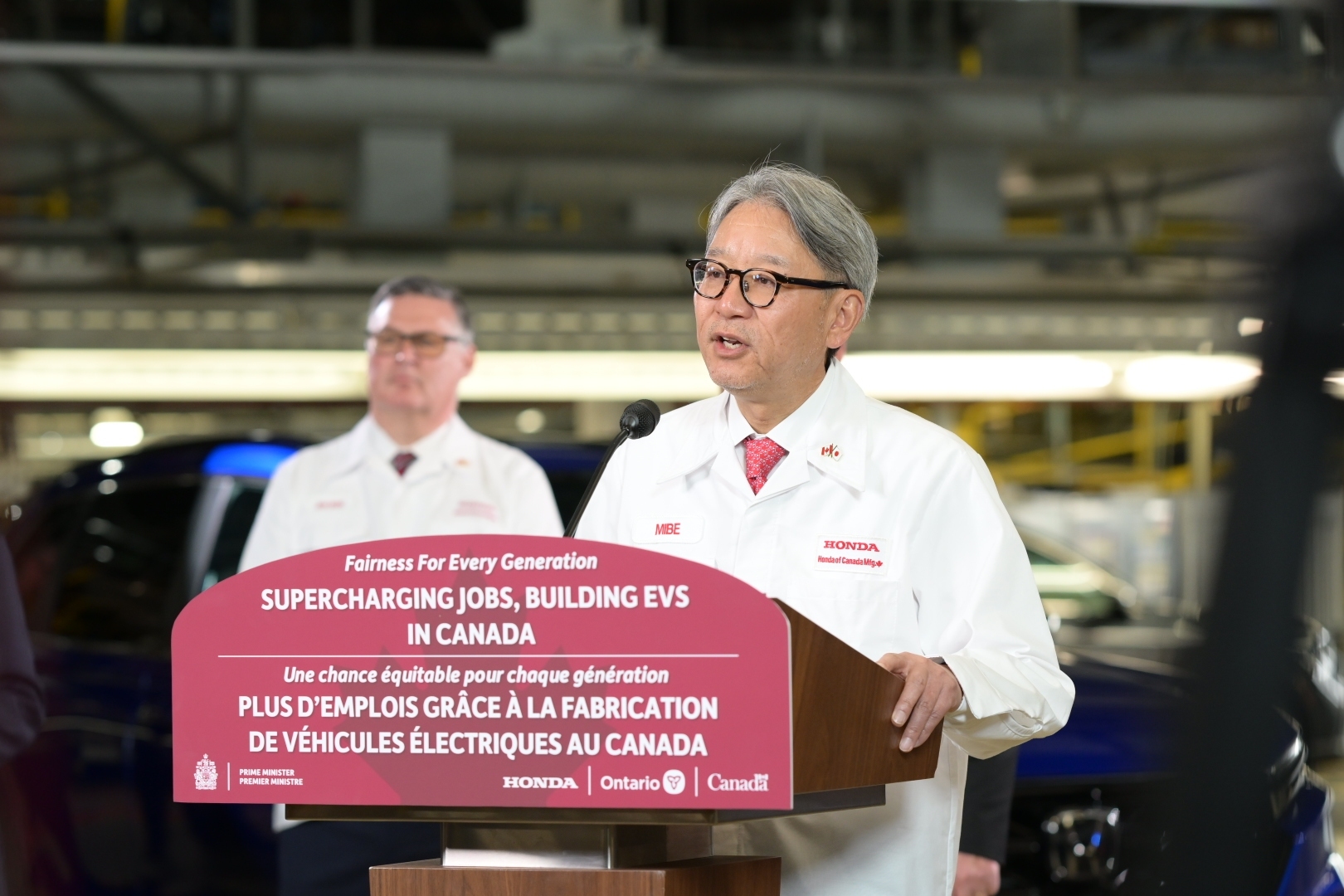

Honda halted its $15 billion electric vehicle project in Alliston, Ontario, in May. The global auto maker based in Japan initiated a two-year freeze on the project, which was announced in April 2024 to be built on a plot of land near its existing plant. Once operational in 2028, the plant was expected to produce up to 240,000 electric vehicles per year.

The project was set to include an electric vehicle assembly plant and battery plant in partnership with South Korean steelmaker Posco Future M. Co. It also included a separator plant in a joint venture with the Japanese multinational chemical company Asahi Kasei. The delay will not affect the existing Honda manufacturing plant, which has been operational since 1986 and is a major employer in Alliston, located about 90 minutes north of Toronto.

Canada’s automobile production is mainly aimed at supplying the American market, which has become increasingly challenging after the U.S. placed 25% tariffs on imports of Canadian steel and aluminum and threatened to enact tariffs on auto parts and other exports.

Over 90% of cars exported from Canada go to the United States. Though the domestic Canadian market for electric vehicles grew to 16.5% of all car sales last year, sales of EVs in Canada have tumbled 45% since a federal $5,000 subsidy per car was discontinued in January. A Quebec program that gave an additional $7,000 to EV vehicle buyers was also shelved.

Information void in Quebec

Meanwhile, the future of the Northvolt Six lithium-ion battery manufacturing plant project south of Montreal in McMasterville, Quebec, was cast into doubt after Sweden-based Northvolt filed for Chapter 11 bankruptcy in the U.S. last fall and in Sweden in March of this year. The project aimed to create 3,000 jobs in manufacturing vehicle batteries to power 1 million vehicles annually.

Northvolt is an EV battery maker founded by former Tesla employees. Its Canadian subsidiary did not declare bankruptcy, but the proceedings in Sweden could affect it.

McMasterville Mayor Martin Dulac said that no construction is taking place at the Northvolt site and that he has not received any information concerning the project's future. The Canadian federal and provincial governments are offering up to $4.6 billion in subsidies for the plant, while the provincial government of Quebec purchased the 18 million-square-foot site from real estate investor Luc Poirier in November 2023 for $240 million. The deal is believed to be the largest real estate transaction in Quebec's history.

The General Motors-Posco consortium announced last year that it would delay its cathode ion plant in Bécancour, Quebec.

Also, Lion Electric, a Quebec-based company known for producing electric school buses from its plants in St-Jérôme and Joliet, Illinois, filed for Chapter 11 bankruptcy in the United States after racking up almost $250 million U.S. dollars in debt. A group led by Vincent Chiara, a financier and head of Montreal-based real estate developer Mach Group, recently purchased Lion Electric with the goal of getting it back on track.

Other EV-related initiatives that failed to gain traction include one from Toronto-based lithium-ion battery recycling startup Li-Cycle, a company backed by Swiss-based metals producer Glencore. Li-Cycle recently sought creditor protection in Canada and the United States after reporting $10.5 million in debt. Li-Cycle had an operation in Rochester, New York, as well as other facilities in Arizona, Alabama and New York State.

One earlier project has made better progress. The NextStar Energy EV battery manufacturing plant, owned by Stellantis and LG Energy Solution in Windsor, Ontario, is expected to be completed later this year. Work started on the 4.23 million-square-foot project in August 2022.

Construction at Volkswagen’s PowerCo battery plant project in St. Thomas, Ontario, a facility slated to eventually create 1 million electric vehicle batteries per year, is scheduled to begin in 2027.