NEW YORK — For most of the year, the hospitality industry has been bracing for impact from new policies from the Trump administration. But after being in a holding pattern for the past few months, hotel leaders and economists at the NYU International Hospitality Investment Forum are pointing to the data to see what's actually happening.

According to CoStar data presented at the conference, revenue per available room is up 1.6% this year so far overall, with most of the major U.S. markets seeing growth. Room demand is trending downward but not in a highly concerning way, and the decline of international guests hasn't yet made a huge impact on the industry.

During the first day of the conference, panelists seemed to be more cautiously hopeful for the rest of the year, recognizing that dealmakers are wrapping their heads around transacting in spite of the uncertainty.

Data point of the day

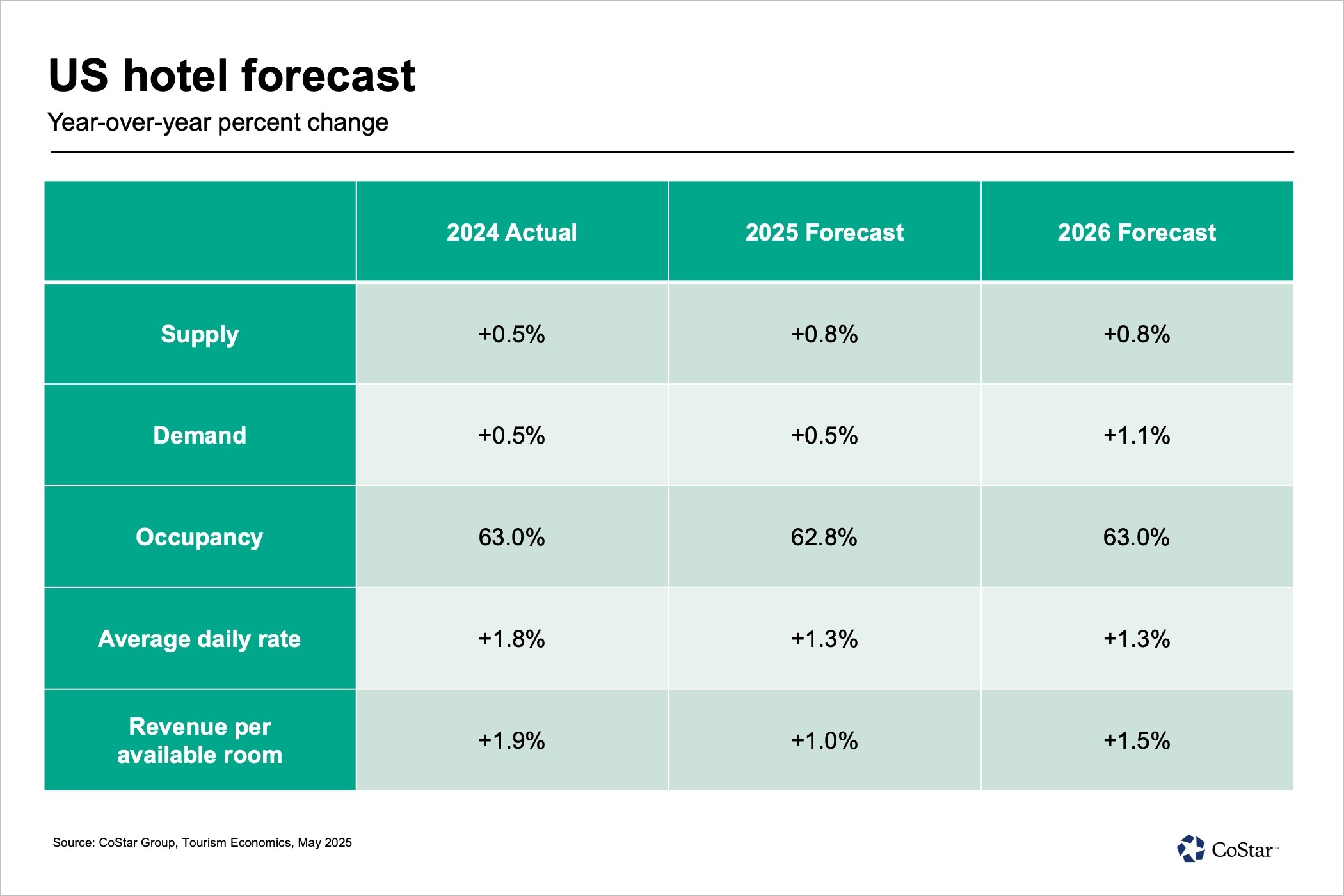

STR and Tourism Economics revised their U.S. hotel forecast, and STR President Amanda Hite presented the new data at day one of the NYU International Hospitality Investment Forum.

Photos of the day

Quotes of the day

"The formula blew up. Everything from fiscal policy to regulatory policy to monetary policy came into light this year and a lot of changes that drive investment today, like capital cost and the strength of the dollar, have been thrown into the ether. But in the long term, I think we're headed for lower rates, a weaker dollar — which is better for the economy — and we're going to be in a much better place."

—Michael Bluhm, managing director and global head of real estate, gaming and lodging at Jefferies, speaking about how political chaos and tariff uncertainty in the first half of 2025 affected the hotel transactions climate.

"I think there is increased discipline, and so the bar is a little higher right now to transact. ... The second half of the year is going to start showing more assets clearly and that we are in a functioning market. If we can get past some of this uncertainty, which is really causing the seller universe, notwithstanding the fact that the demands and pressures to sell to say, 'hey, not right now,' we can get past some of that and start to get into a period where it's a little clearer in terms of some of these mandates that are playing out right now at the regulatory and fiscal level. I think it's in sight. I don't think we're years away."

— Jeffrey Dauray, co-chief investment officer and executive vice president at RLJ Lodging Trust.

"I remain extremely bullish for our industry. ... If I look at five years, much less 10 years, that relationship between GDP and room demand — I think they're going to find each other again, which means that we're going back into the world of talking about room demand that will be over 2% year over year. We're not there now, but I do think that the fundamentals that drive travel are going to drive growth that will bring us back to that historic relationship that we saw."

— Adam Sacks, president of Tourism Economics, at the end of his presentation about travel data for the year so far.

Editors' takeaways

It's a cliché we've pointed out and joked about for years that hoteliers are a continually hopeful bunch, and the general description of how they feel even during the bad times is "cautious optimism." That definitely continues to be true, and hoteliers continue to focus on finding ways to grow their businesses even in the current environment, but throughout the first half of this conference, I've seen a much more palpable sense of frustration than I can recall in my decade covering this industry.

I think part of that frustration stems from the fact that many people felt like 2025 was the year where the stars were finally going to align and growth would become much more robust and maybe even predictable. Instead, it's been more anemic than hoped and "uncertainty" might be the top buzzword of the week. In terms of what people expect in the second half of the year, it seems to be more of the same, as no one seems quite willing to predict anything but more unpredictability.

— Sean McCracken, news editor

Follow Sean on LinkedIn.

"Resilience" is the word of the day here in New York. U.S. hotel demand is low but slightly positive still, consumer confidence is holding steady and hotel investors don't mind waiting for a more optimal scenario to get buying and selling more up to speed. There are no earth-shattering headlines here at the conference, but rather a "steady as she goes, we've been here before, at least it's not the zero-demand pandemic environment" feeling. Yes, the industry approached 2025 expecting more interest rate cuts to spark hotel transactions, but that hasn't happened and it's OK. Investors on a main stage panel Monday agreed that underwriting hotel deals is so challenging today, that in many cases it really does make sense to wait and see.

— Stephanie Ricca, editorial director

Follow Stephanie on LinkedIn.

Coming into the conference, I really wanted to hear more than just about the "uncertainty" causing the industry to be in a "wait-and-see" holding pattern, and, for the most part, I got what I wished for. I've seen a difference — even if slight — since the last hotel investment conference I attended in March. Namely, day one started with a presentation from Matthew Luzzetti of Deutsche Bank who opened with asking if the tariff shock will break the consumer and send the country into a recession — and he said the he does not believe it will. While the new policies are bringing headwinds and travel does have the potential to be affected, aggregate data — about household income, savings rate, etc. — looks strong. He did add that should the labor market begin to break down, that would be a different story.

— Natalie Harms, reporter

Follow Natalie on LinkedIn.