U.S. monthly apartment rent growth declined last month in its deepest September drop in more than 15 years as excess supply affected all parts of the country.

The national average rent in the U.S. fell to $1,712, a 0.3% decrease from August’s revised figure of $1,717, and the decline marked the third consecutive month of no change or a decline in monthly rent, according to a report from CoStar's Apartments.com.

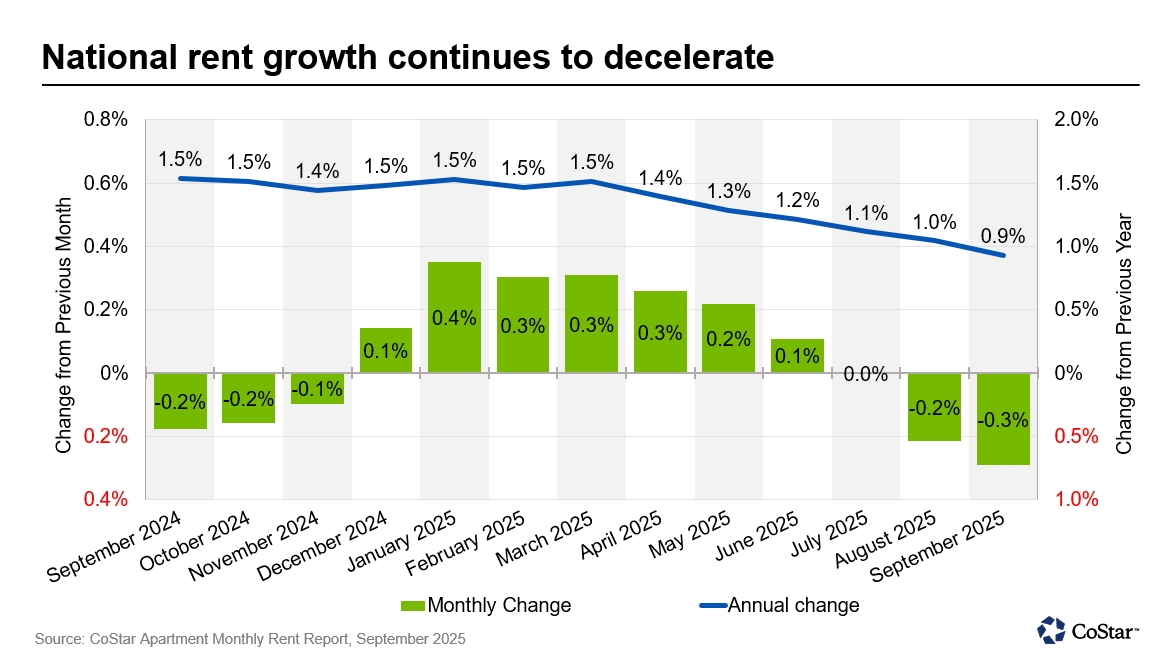

While multifamily rent growth usually follows a seasonal pattern of increases in the spring and a deceleration in late summer and fall, "the recent year-over-year slowdown — which adjusts for seasonality — signals a more pronounced softening in the market," Apartments.com said.

Moreover, the report said, annual rent growth slowed to 0.9% in September, down from 1% in August and 1.5% at the beginning of the year.

An abundance of available apartments is affecting the ability of landlords to push rents higher.

"Although many markets have moved beyond peak supply, a substantial inventory overhang continues to weigh on rent growth nationwide," the report said.

Nationwide rent declines

All U.S. regions posted declines in rent in September, with the West leading the country with a 0.5% month-over-month decrease, followed by a 0.4% slide in the South, a 0.2% drop in the Northeast, while rents in the Midwest fell 0.1%, Apartments.com said.

On an annual basis, the Midwest posted the strongest performance in the country with 2.4% growth, followed by the Northeast at 1.9%, according to Apartments.com.

The South also posted a slight increase, with rents rising 0.1% year-over-year, though they declined 1.3% in the West.

Markets with the highest levels of new construction had the weakest rent performance as more supply-constrained metropolitan areas, especially those in the Midwest and select coastal regions, continued to outperform, according to Apartments.com.

San Francisco led the nation with 6.1% annual rent growth, followed by San Jose, California, and Chicago at 3.8%, and Norfolk, Virginia, at 3.1%, the report said.

On the flipside, annual rents in Austin, Texas, declined 4.4% and fell 3.8% in Denver, while Phoenix and San Antonio posted drops of 2.9%, as supply outstripped demand.