NASHVILLE, Tennessee — It's long been accepted that the pandemic fundamentally shifted business travel demand downward, as the advent of remote work and video calls negated the need for some to conduct their business in person. While hotel demand remains below where it was in 2019, charting trends in office sublet availability could help inform the future of business travel.

There's growing evidence of a correlation between declining Class A office sublet availability and midweek occupancy — specifically Wednesday — among upper-upscale hotels, which are typically where business travelers stay. Class A offices are often occupied by Fortune 1000 companies.

Office vacancy numbers move too slow to relate to daily hotel occupancy numbers, but sublet availability is a more fluid key performance indicator, said Jan Freitag, national director of hospitality analytics at CoStar Group, during the "Return to Office: Return to Midweek Demand?" session at the 2025 Hotel Data Conference.

"The sublet availability we find is a much better real-time indicator of people coming back to the office and then hopefully that inducing demand for upper-upscale hotels around the trophy offices," he said.

It's not a perfect correlation, but there's enough of a relationship to give it credence, Freitag said.

"We're not here to say that this is one to one, but we think that there is something in the ecosystem of commercial real estate that connects the sublet availability space with upper-upscale Wednesday occupancy," he said.

Recovery story for midweek hotel demand, office performance

U.S. upper-upscale hotel occupancy on Wednesdays was at 76.9% pre-pandemic; that number is now at 70%, Freitag said.

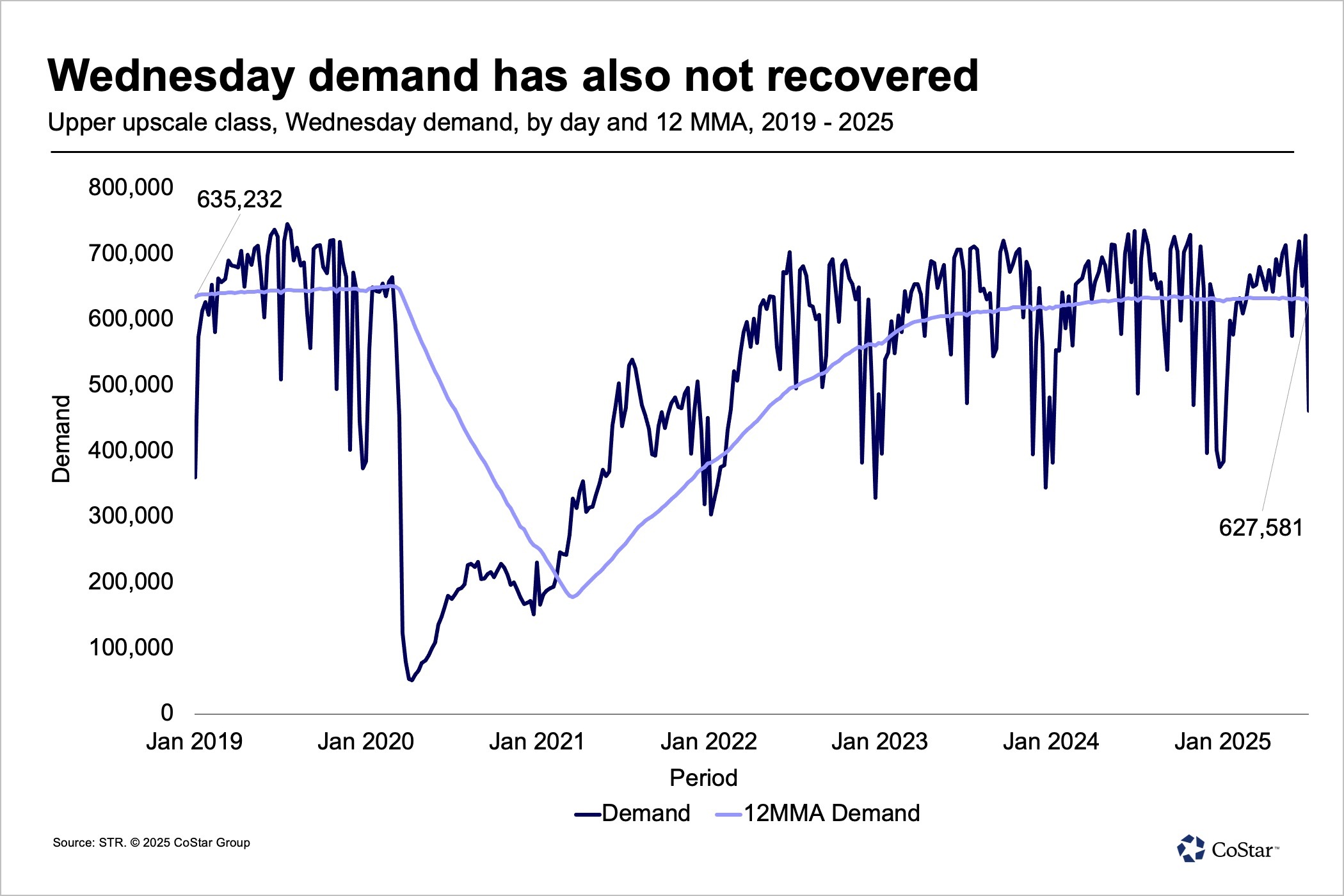

Growing supply is a factor in the gap between the two numbers, but that doesn't explain the gap in demand. Pre-pandemic, the 12-month moving average of Wednesday demand among upper-upscale hotels was 635,232; that number is now 627,581.

"Now we're not selling as many [rooms]," Freitag said. "So, the room demand has indeed deteriorated. Yes, part of the occupancy deterioration, of course, is supply increase, but there's also a portion of demand decline."

The recovery of office attendance to pre-pandemic levels is even further behind — it's currently at 72.6% of June 2019 levels, when about 60% to 65% of office seats were filled, on average. The current occupancy numbers indicate about 45% of seats are filled, on average.

"It's not that every office is half full — it's just some are really full and some are really empty," said Phil Mobley, national director of U.S. office analytics at CoStar Group.

In fact, the performance recovery for offices hasn't even started yet. Quarterly absorption numbers, which is the difference between move-ins and move-outs, have been in the negatives in 19 of the past 21 quarters, Mobley said.

About a third of office spaces were leased prior to 2020 and still haven't expired. There's some pockets where leasing activity is happening, but on the whole, there's a bit of a waiting game occurring, he said.

"As those leases expire, in the aggregate, companies are still reducing their footprint and the return to office is converging with that," Mobley said.

Another headwind and a main reason why offices haven't begun their recovery is because employment growth has slowed way down, he said. Knowledge-oriented industries that mainly use offices, such as finance, insurance, information and technology, and professional services, are about 200,000 people down from their peak in 2023.

But there has been a shift back toward return to office in the past year. About 1 million more workers are attending the office on at least a hybrid basis even as these sectors cut jobs, Mobley said.

Correlation between Wednesday occupancy, sublet availability

The glacial pace of leasing activity makes it a difficult metric to contextualize occupancy in the workplace. Most office leases are for about 10 years, which means there isn't a lot of movement in the numbers on even a quarter-to-quarter basis.

Sublet availability, on the other hand, moves much quicker and has proven to be a relevant data point when looking at Wednesday hotel occupancy. A sublease is when a company seeks out another company to take over some or all of its lease for a discounted price to then pay back to the landlord.

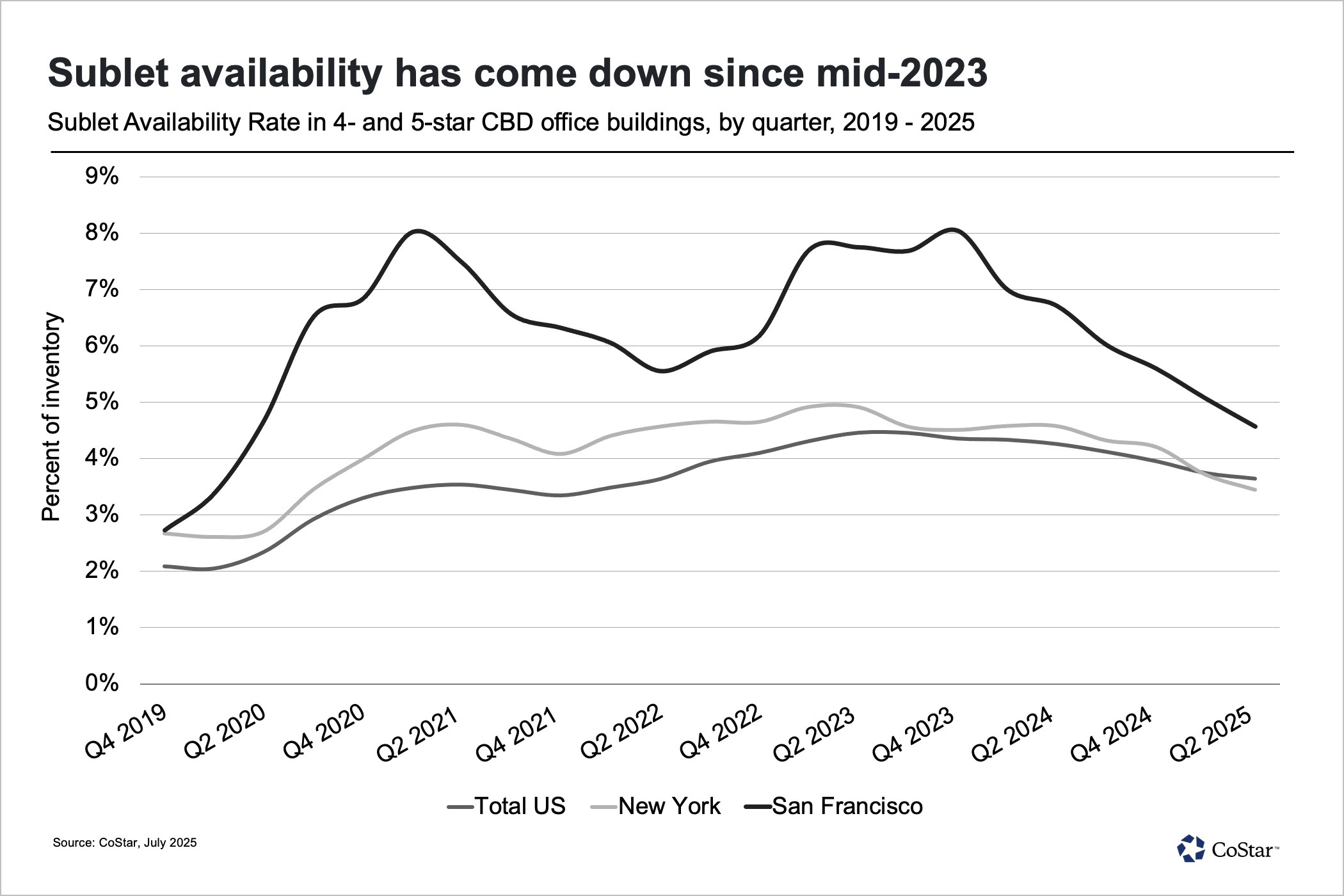

When the pandemic hit, markets such as San Francisco and Austin, Texas, put a lot of inventory on the sublet market, Mobley said. Those numbers are starting to come down, for a few reasons: the initial lease has expired; the initial leaser is deciding to bring its employees back to the office; or another company is coming in with interest in subleasing due to renewed interest in return to office.

"That means more bodies in the space. Our whole thesis here is more bodies in the space, better for hotel occupancy in the midweek," Mobley said.

The lower the sublet availability, the more workers are back in the office. And the more workers are back in the office, the greater the need for business travel.

"You could have occupancy in hotels recover because people who already have space in these and are using it, they start coming more frequently, and then they're generating visits," Mobley said.

When organized by market, the relationship between sublet availability and Wednesday occupancy becomes more clear, he said.

New York City, for example, is at more than 95% of upper-upscale midweek occupancy in 2025 year to date compared to 2019 and its office sublet inventory is near 2019 levels. Atlanta and Minneapolis, on the other hand, have five times more sublet availability than they did in 2019 and its weekday occupancy is suffering.