U.S. hotel room demand and revenue per available room made an about-face for the week of June 15-21 with both measures increasing following three weeks of decline.

In similar fashion, TSA screenings over the past week also posted a year-over-year increase following three weeks of declines.

Some of this turnabout stems from a later end date for U.S. schools reported by STR’s School Break Report. Demand increases were even more pronounced in the northern part of the country where summer breaks tend to start later. This further highlights the impact school calendars have on hotel performance trends.

Additionally, the movement of the Juneteenth holiday from Wednesday in 2024 to Thursday this year made for easy comps early in the week and for a stronger weekend. U.S. hotel RevPAR for the week advanced 3.3%, the result of average daily rate up 2% and occupancy rising 0.9 percentage points. This was the first weekly occupancy increase since early May.

Juneteenth lifted the top 25 markets early in the week

The Juneteenth federal holiday occurring on Thursday this year compared to Wednesday last year appeared to have an impact. The top 25 U.S. hotel markets received a boost early in the week, achieving strong RevPAR gains Sunday (+2.5%) through Tuesday (+12%) followed by a slowdown midweek and then a pickup on the weekend. Hotel markets outside the top 25 and other cities saw a boost starting Thursday on Juneteenth itself and extending through the weekend. The beginning of the week was slower outside the top 25.

Headwinds from Las Vegas and Houston

Houston and Las Vegas had an impact on U.S. hotel performance this week as well as over the past couple of weeks. This week, RevPAR in Las Vegas fell 17.4%. Given that Las Vegas is the largest market in the country with 3% of total U.S. hotel room supply, it weighed on total U.S. performance. Houston’s RevPAR dropped 3.4% due to difficult comparisons to gains last year due to several storms that led to widespread flooding and power outages throughout the area. Excluding both markets, U.S. hotel RevPAR increased to 4.2% with ADR up 2.3% and occupancy up 1.3 percentage points. Additionally, the performance declines seen in the U.S. over the previous two weeks are less pronounced when these two markets were excluded.

Bifurcation continues led by unstoppable luxury segment

RevPAR remained bifurcated across the hotel chain scales with RevPAR at U.S. luxury hotels advancing 9.6% lifted primarily by ADR – which rose 7% – while occupancy increased 1.7 percentage points. Upper-upscale and upscale hotels followed with RevPAR up 4.3% and 3.9%, respectively. Upper-midscale and midscale hovered around 2% while economy hotel RevPAR declined slightly. Bifurcation is even more extreme in the top 25 markets with RevPAR ranging from 10.9% in luxury hotels to down 5.2% in economy hotels.

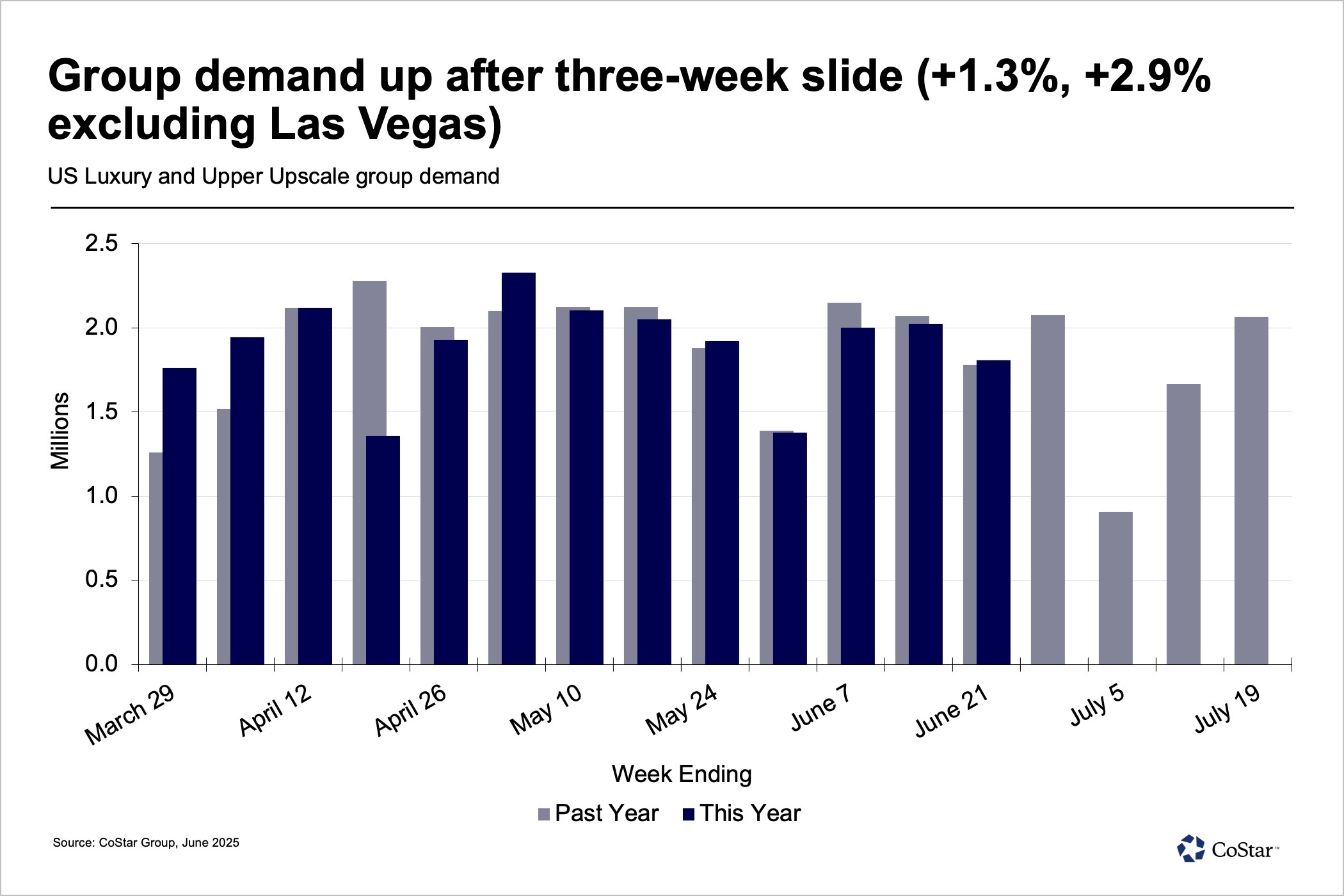

Group demand returned

After a three-week slide, group demand in luxury and upper-upscale hotels returned, advancing 1.3% with ADR up 4.1%. It was a slow group week in Las Vegas and when excluding Las Vegas, group demand increased 2.9%. Top 25 markets seeing the strongest group performance included New Orleans, San Diego, Boston and Chicago. Transient demand also increased 4% with ADR rising 2.5%.

Looking ahead

This week was a good week after several lackluster weeks. TSA passenger screenings hit an all-time on Sunday June 22, which we see as a sign that travel is alive and well in higher-income households. Can we say for certain that summer demand will be good? Probably not, but it was a welcome change from the previous three weeks. One week does not make a trend and the U.S. bombing in Iran and subsequent terror alerts could slow demand in some markets.

In the coming weeks, the impact of summer storms across the U.S. last year – starting with Hurricane Beryl in Texas – will be seen in declining hotel performance in those markets this year. July Fourth occurs on Friday this year compared to Thursday last year. This shift could create more weekend demand, allowing leisure travelers to kick off a three-day weekend. And while this week is generally a slow week for groups, having the holiday on Friday will give meeting planners the week to squeeze in conferences.

Modest Global RevPAR slowdown with some impact due to calendar comps

Outside the U.S., global hotel RevPAR retreated for the first time in four weeks. Occupancy (-1.9%) was the main driver of the modest decline as ADR was flat (-0.1%). And while overall global RevPAR was down, most major countries posted positive hotel performance driven primarily by ADR.

- Japan continued to hold the top spot (+31.2% RevPAR growth) with all markets seeing RevPAR gains.

- Canada followed with RevPAR up 8.1% with 17 of the 22 markets posting gains.

- In Italy (+8% RevPAR jump), 13 of its 15 markets reported RevPAR growth.

- Indonesia (+7.7% RevPAR increase) was lifted by a calendar shift of the Idul Adha public holiday.

Four major markets posted declines led by:

- Germany facing a tough comp to last year when hotel markets across the country hosted Euro 2024.

- China’s decline was seen across much of the country including the 10 largest markets.

- Hotels in the U.K. felt the loss of the Taylor Swift tour which took place last year in London and Cardiff.

- France saw hotel RevPAR slow across most of the country while RevPAR grew in Paris and Ile-de-France. This flip-flop is most likely affected by the slowdown Paris experienced last year ahead of the Olympics.

The impact of the rising tensions in the Middle East and this past week’s French rail disruption will be monitored as the northern hemisphere enters peak leisure travel season.

Isaac Collazo is senior director of analytics at STR. Chris Klauda is director of market insights at STR.

This article represents an interpretation of data collected by CoStar's hospitality analytics firm, STR. Please feel free to contact an editor with any questions or concerns. For more analysis of STR data, visit the data insights blog on STR.com.