July remained soft for the U.S. hotel industry with revenue per available room down 3.7% for the week of July 6-12 after a 1.1% drop in the prior week. Not surprisingly, weekdays Monday to Wednesday decreased the most with performance stabilizing by the weekend.

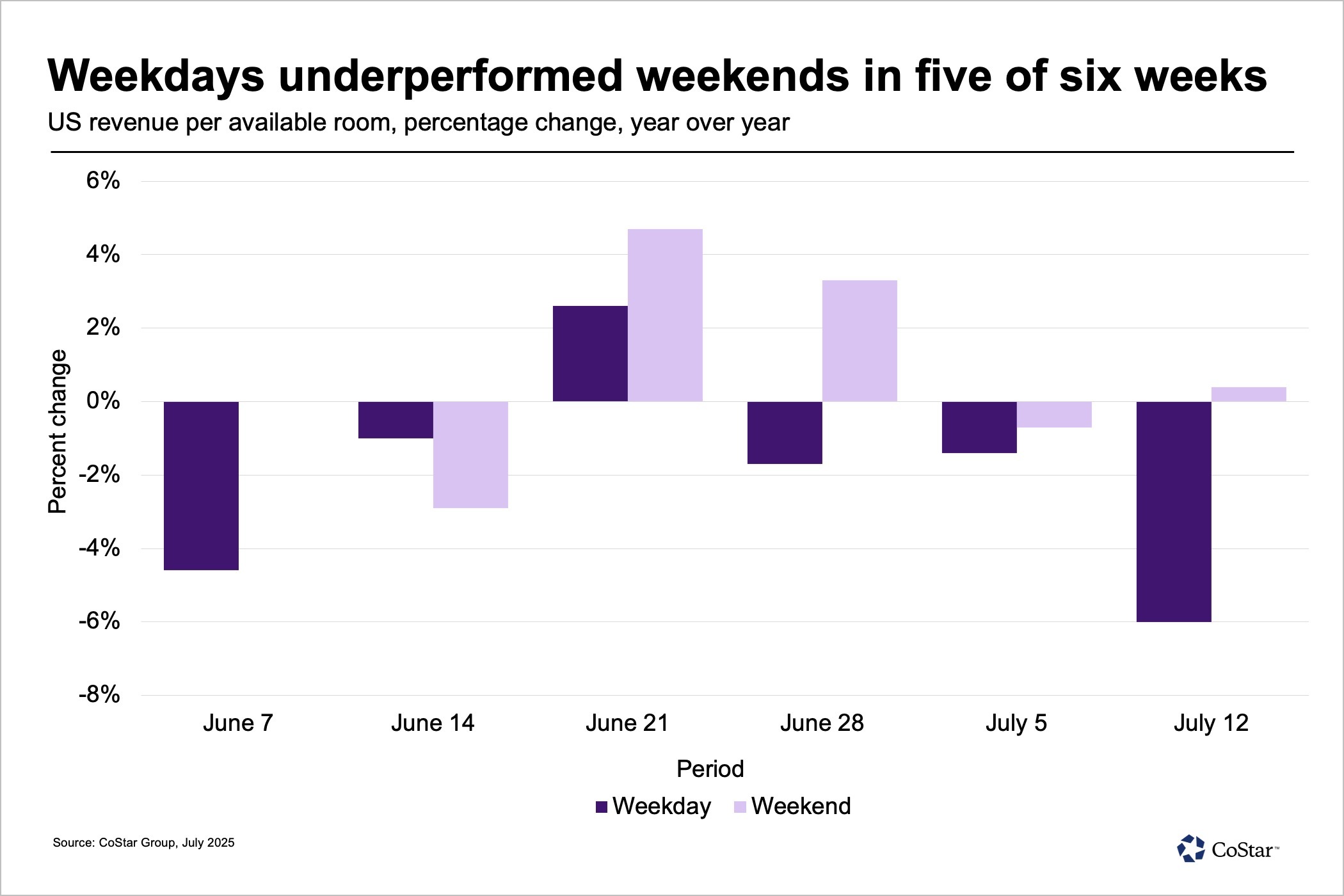

In simple terms, weekdays and the weekend serve as a proxy for hotel business and leisure travel trends, respectively. Since Memorial Day, with one exception, weekdays have consistently underperformed relative to weekends, indicating a continued weak business travel environment. Leisure travel, reflected in weekend performance, has been stronger than weekdays but still slowing as economic concerns and outbound international travel have created headwinds.

Additionally, TSA passenger screenings across the U.S. were up during the week when hotel demand was down, which indicates more travelers are choosing other forms of accommodations. Summer is the peak season for alternative accommodations such as short-term rentals, cruises and camping. We believe that these types of accommodation are becoming more popular and representing larger headwinds for the U.S. hotel industry. The imbalance in international inbound/outbound doesn’t help matters either.

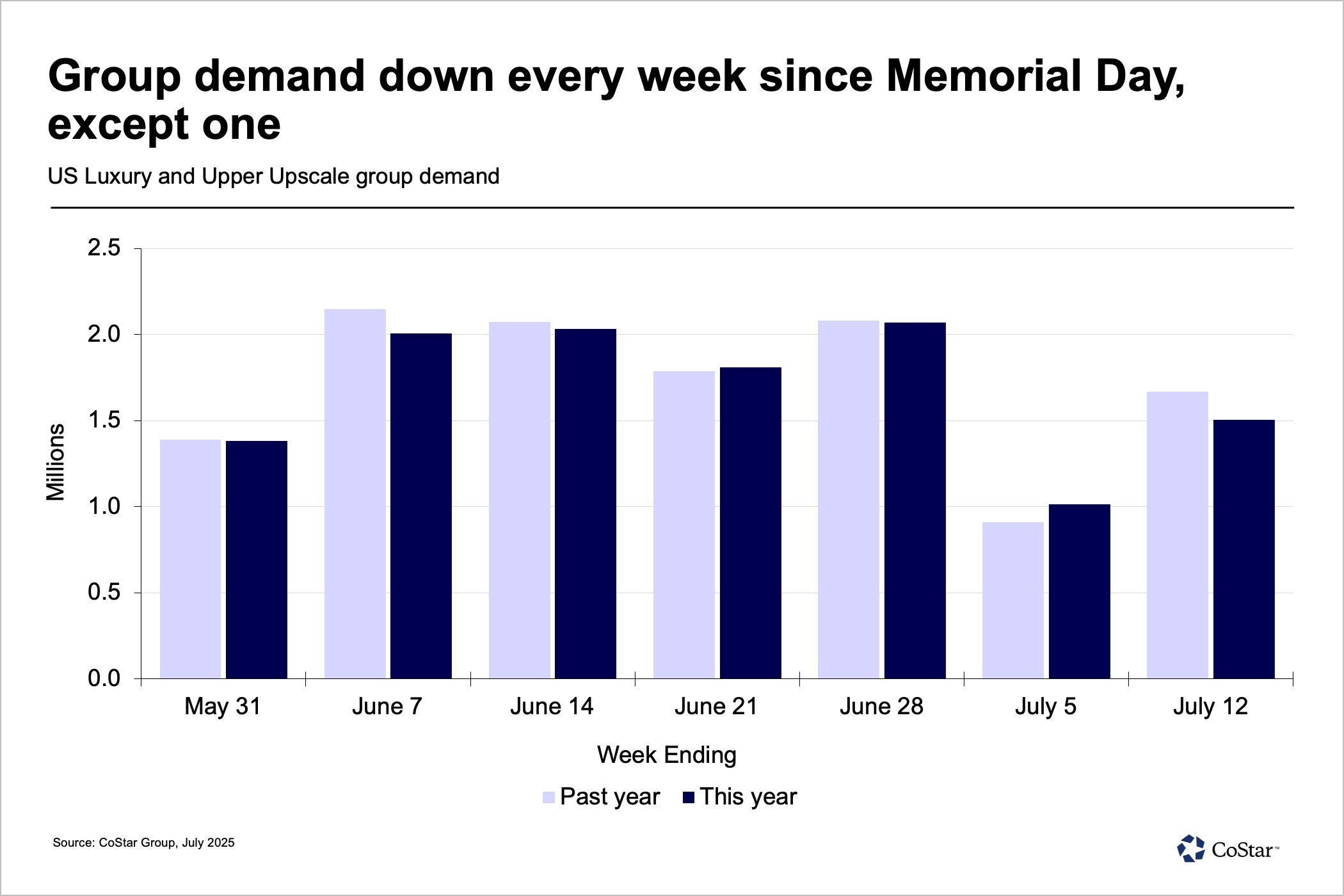

Group business demand retreated, ADR did not

Further evidence on the weak state of business travel was the lackluster group demand seen this week — and all weeks but one since Memorial Day. In the most recent period, group demand in luxury and upper-upscale hotels declined 9.8% year over year. Some of this was an offset from last week when group demand increased, which felt the impact of the Fourth of July calendar shift. Average daily rate for group business continued to be strong and increased 3.6%. Since Memorial Day, group ADR gains have held above the rate of inflation.

No chain scale immune

RevPAR slowed across all U.S. chain scales with the bifurcation trend holding. Luxury hotel RevPAR dropped 2%, while the next four chain scales were down around 4% and economy chains saw a 5% RevPAR decline. Falling occupancy was the primary reason for the decreases.

Weekday/weekend performance also highlighted the weak state of business travel. The more business-focused upper-upscale chain hotels saw the largest weekday RevPAR decline (-7.6%) followed by nearly equal declines (-6.1%) in luxury, upscale and upper midscale.

Midscale and economy hotels across the U.S. decreased at a slightly slower rate as RevPAR in those segments declined by 4.9% and 5.5%, respectively. On the weekend, luxury hotel RevPAR grew 6.5% and upper upscale RevPAR rose 2.6%. RevPAR for the next four chains scales decreased, ranging from 0% in upscale hotels to down 4.1% in economy hotels. This suggests that brands that cater to higher-income households are feeling less of an impact by the increased cost of living.

St. Louis continues to outperform while Houston faced tough hurricane comp

The majority of the top 25 U.S. hotel markets posted negative RevPAR comps due primarily to weekday declines. Nine markets saw positive RevPAR across both weekdays and weekends, led by St. Louis (+30.8%). St. Louis has ranked in the top three among top 25 markets in six of the last eight weeks. Over the past two weeks, St. Louis benefited from the 10-day General Conference of the Seventh-day Adventist held from July 3-10.

Here are some other notable market performance highlights:

- Atlanta hotel RevPAR grew 6%, thanks to a strong weekend due in part to Beyonce’s Cowboy Carter tour.

- Positive weekday and weekend RevPAR growth propelled Chicago hotel RevPAR up 4.2%, tying the Windy City with Orange County/Anaheim (+4.2%), which was lifted entirely by the weekend.

- San Francisco stood out with its weekend 35% RevPAR gain and the second largest weekday RevPAR loss (-26.5%) of the top 25 markets.

- In comparison with the timing of last year’s Hurricane Beryl, Houston sold 110,000 fewer hotel rooms this week (-20.5%) with a 34.2% reduction in RevPAR.

- Las Vegas continued its streak of weekly RevPAR declines but moved closer to the middle of the top 25 markets.

Are US hotels already at the summer peak?

Historically, U.S. hotel demand peaks in July. It’s safe to assume demand will again peak in the month, but given what we have seen in the past two weeks, demand is likely to be down from a year ago. So, what can hoteliers expect for the remainder of the year? Likely more of the same with a downward trend in demand and ADR.

Opinions and research about the immediate future range from the “sky is falling” to “business is booming.” Research companies Longwoods and Future Partners both report consumers still intend to travel while being more cautious about spending. However, the broader consumer confidence indicators are mixed with the Conference Board pointing negative while the University of Michigan turned positive. This reinforces that the future is uncertain at best.

Recent positive TSA passenger counts indicate that Americans are still traveling. However, alternative accommodations, international travel, and cruises are growing – and taking away hotel room nights.

Thus, we expect U.S. hotel demand, ADR and RevPAR will remain under pressure for the remainder of the year and into 2026.

Healthy performance across other parts of the globe

Excluding the U.S., global hotel RevPAR advanced 2.2% during the week, lifted by 3.2% ADR growth. Occupancy reached its highest level of the year so far (71.3%) but was down 0.6 percentage points from last year. Several of the largest countries saw ADR-driven RevPAR growth. Highlights among the largest countries include:

- Japan remained unstoppable with RevPAR gains every week this year except one. Demand slowed over the past two weeks while ADR continued to grow, resulting in a 22.1% RevPAR gain in the most recent week.

- The U.K. ranked second in RevPAR growth for the second consecutive week (+7.5%) as 90% of its 41 markets saw RevPAR gains. Markets advancing 20% or more included Cardiff, Birmingham, and Manchester.

- RevPAR in Canada rose 6.6% and was up for the sixth consecutive week. Widespread gains across 16 of 22 markets lifted RevPAR with Manitoba and Saskatchewan posting increases of more than 20%.

- Spain has seen strong performance over the past 10 weeks. In the most recent week, RevPAR increased 6.3% with all markets except Barcelona and Madrid posting growth.

- RevPAR gains in Indonesia were entirely due to ADR (+9.3%) while occupancy dipped 3.4 percentage points. The country’s two largest markets, Bali and Banten and West Java, helped drive the country’s RevPAR growth as Jakarta – Indonesia’s third-largest market and its capital – posted a decline.

- Mexico rounded out the list of RevPAR gainers. Mexico has seen positive RevPAR all year, however the pace is starting to slow; this is the result of slowing demand while ADR remains elevated.

Five of the 11 largest countries based on supply, posted RevPAR declines with India seeing the largest drop. Germany and France also saw declines due to sporting event calendar shifts. China continued to see falling RevPAR via falling demand.

Outside of the U.S., global hotel performance will be more normal with seasonal and event fluctuations.

Isaac Collazo is senior director of analytics at STR. Chris Klauda is director of market insights at STR.

This article represents an interpretation of data collected by CoStar's hospitality analytics firm, STR. Please feel free to contact an editor with any questions or concerns. For more analysis of STR data, visit the data insights blog on STR.com.