For the second consecutive week, U.S. hotel average daily rate rose at the rate of inflation, up 2.6% for the week of Oct. 5-11. As a result, U.S. hotel revenue per available room rose 0.6%, marking the industry’s first weekly RevPAR increase since the end of August. U.S. hotel occupancy, however, fell for a 16th straight week, with the most recent decline (-1.4 percentage points) half of what had been seen in the previous fortnight, when it was down about 2.5 percentage points.

The ADR gain was a surprise given the average increase of 0.2% in the previous 21 weeks ending Sept. 27. Also, unlike the previous week when rates rose 2.7% due to a large conference in Las Vegas, the result was widespread. ADR in the top 25 U.S. hotel markets the week of Oct. 5-11 increased 2.8%, despite a loss in Las Vegas, and the remainder of the country was up 2.4%.

Like the previous week, we could categorize the ADR gain as an outlier. The measure rose a mere 0.8% from Sunday to Tuesday. On Wednesday and Thursday, ADR was up 2.8% on a 4.1% increase in the top 25 markets. The weekend on Friday and Saturday nights saw ADR surge 4% due to a 4.1% gain in non-top 25 markets, while the top 25 saw ADR jump 3.8%.

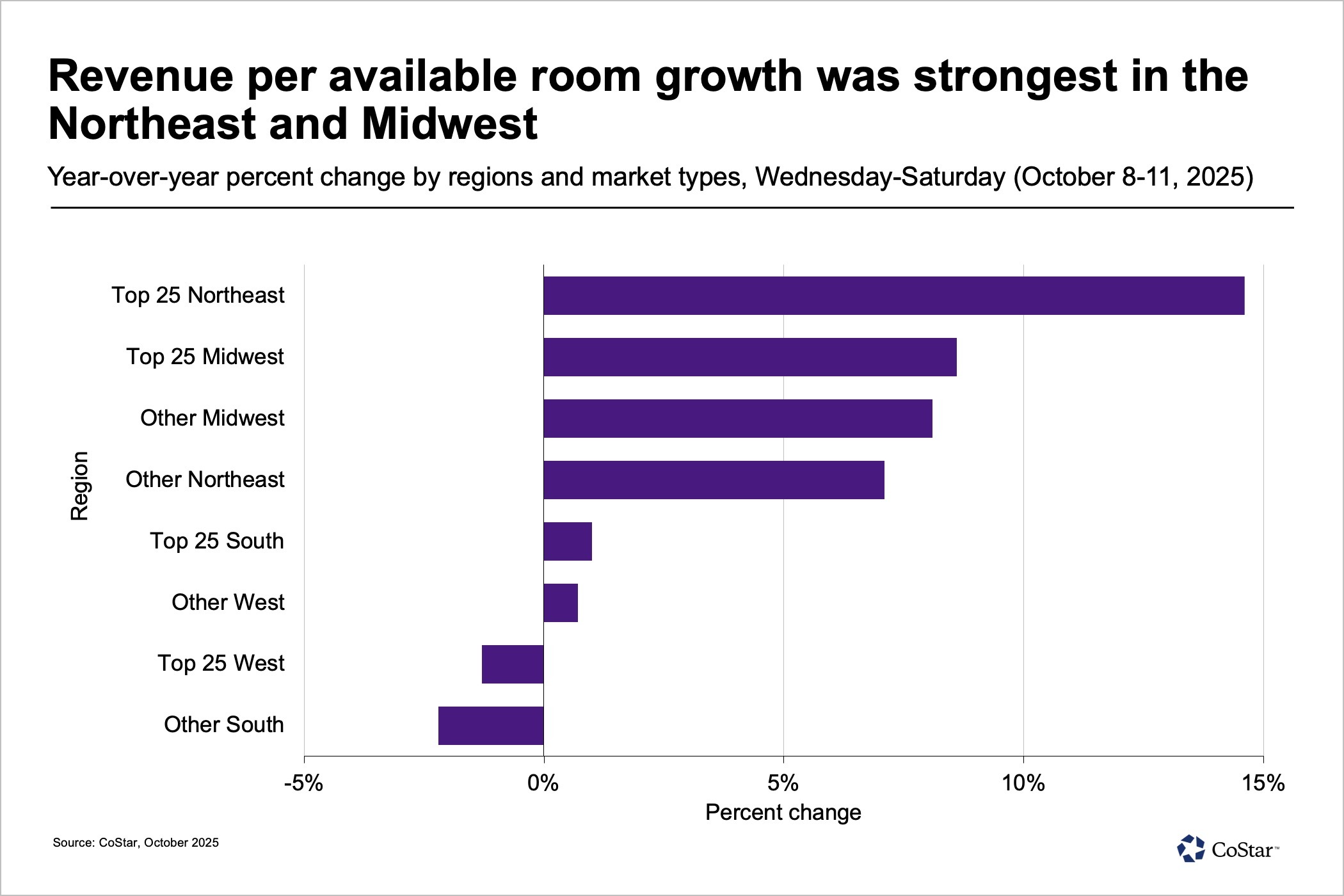

Weekend RevPAR up on strong ADR growth

Thirty-one U.S. hotel markets saw double-digit ADR gains over the weekend, the most since the end of March, led by Madison, Wisconsin, which posted an 81% weekend ADR gain due to the Wisconsin-Iowa football matchup. Like with Madison, most of the 31 markets were outside the top 25 and most hosted a college football game.

The weekend was also lifted by a somewhat easy comp to 2024’s Yom Kippur observance, which began on Friday, Oct. 11, and ended Saturday, Oct. 12. Another contributing fact was the start of the Columbus Day holiday weekend. The holiday did not shift from last year, but based on STR’s School Break Report, this past weekend was the start of the Fall Break for 16% of all K-12 students, which will be the largest percentage of students on holiday this fall.

A year ago, this matching Saturday was the end of the Fall Break peak. Overall, weekend hotel RevPAR increased 5% with the top 25 markets (+5.8%) outperforming the rest of the country by 130 basis points.

Group demand gains drive top 25 US hotel markets

The 4.2% ADR surge in the top 25 on Wednesday, Oct. 8, and Thursday, Oct. 9, was significant, but hotel RevPAR over those two days increased just 1.7% with a drag from Las Vegas. Excluding Las Vegas, RevPAR on those two days was up 5.5% on a 6.8% ADR gain.

Atlanta, Boston, New York, San Francisco and Tampa all saw double-digit growth in ADR with Orlando (+8.0%) and Chicago (+7.7%) also seeing solid rate growth. Tampa posted the largest RevPAR growth on those two days due to easy comps from last year’s Hurricane Milton, which came ashore south of the city on Wednesday, Oct. 9, 2024, as well as strong group demand this year. San Francisco also had a great week with RevPAR up 24% on those two days and about the same for the entire week (+24.7%) on nearly a 50% increase in group demand.

Group demand for the top 25 U.S. hotel markets on Wednesday and Thursday was up 13.7% excluding Las Vegas, which was down. Among upper-upscale class hotels, group demand on Wednesday and Thursday grew 12% among the top 25 markets, excluding Las Vegas.

Putting it all together, RevPAR from Wednesday onwards was up 7.5% in the top 25 markets — excluding Las Vegas — on 6.6% ADR growth. With Las Vegas, hotel RevPAR in the Top 25 was up 3.9% on a 4% ADR increase.

RevPAR at the start of the week for the major market group was down 3.2% on falling occupancy and flat ADR, and less so without Las Vegas. For the entire week, top 25 RevPAR grew 1.1%. Outside of the top 25 markets, weekly RevPAR was flat (+0.3%) due to weakness at the beginning of the week. From Wednesday to Saturday, RevPAR increased 1.8% outside the top 25 U.S. hotel markets.

With strong group demand across the top 25, it’s not surprising that luxury and upper-upscale class hotels saw the largest RevPAR gain in the week; luxury hotel RevPAR grew 6.3% and upper-upscale RevPAR rose 3.8%. Those gains were significantly higher on Wednesday through Saturday, especially in the top 25 markets. All other hotel classes saw RevPAR fall in the week with economy hotels dropping 9.1%.

Will US hoteliers see ADR drive RevPAR next week?

The last two weeks have been a nice ADR respite for the U.S. hotel industry, but is it sustainable? With occupancy still on the decline despite increases in other travel indicators, it seems unlikely that ADR will continue to grow at or above the rate of U.S. inflation. However, given a favorable calendar and the strength in group demand, especially in the top 25 markets, ADR might exceed expectations for the month.

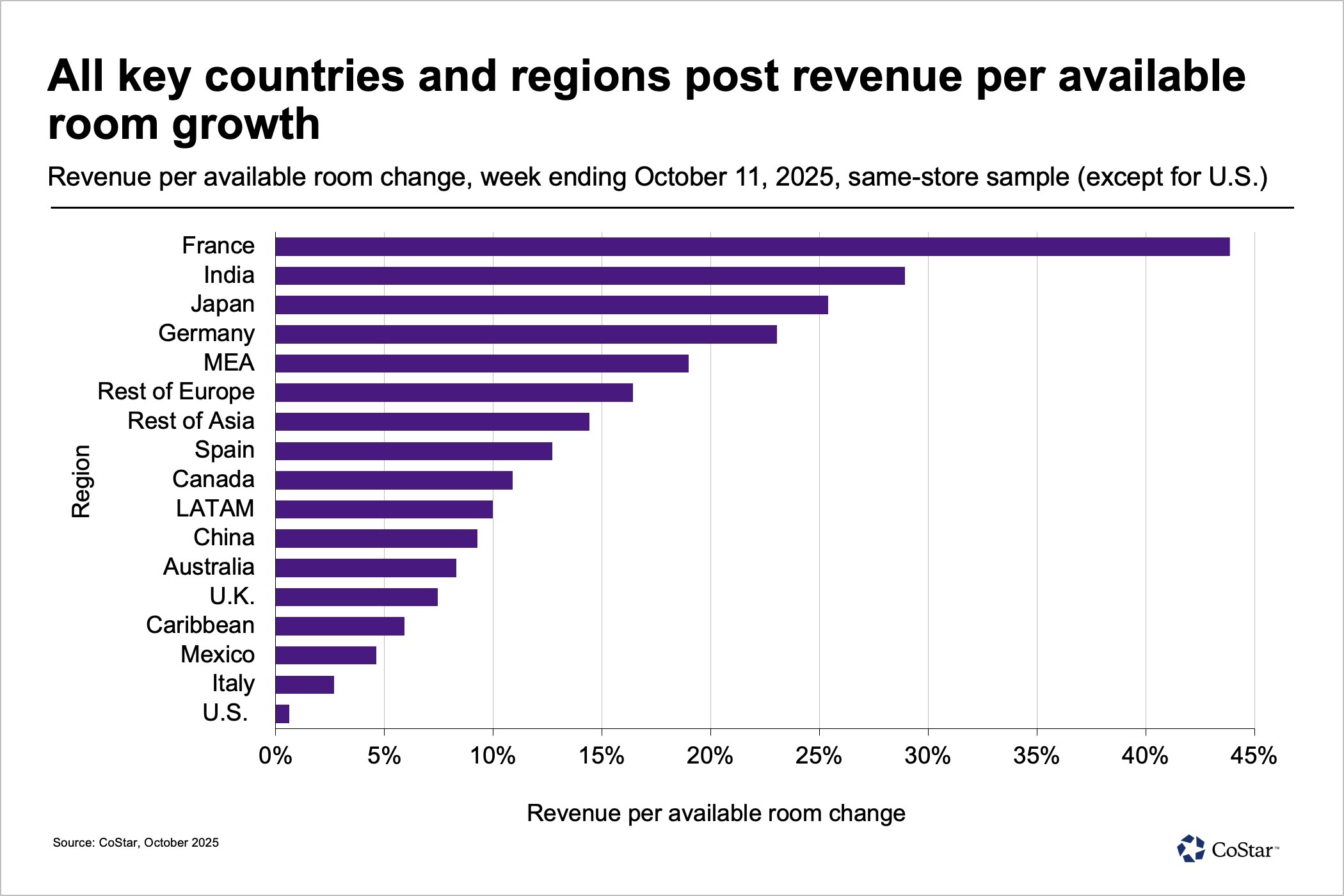

Global RevPAR rushes forward

Global hotel RevPAR on a same-store basis showed its largest growth since the end of the first quarter, rising 14.2% on ADR growth of 11.3%. All the key countries and remaining regions reported RevPAR gains led by France (+43.9%) via Spring/Summer Fashion Week finale in Paris.

Hotels in India, Japan, Germany, the Middle East and Africa region, Spain and Canada all saw double-digit RevPAR increases.

While France’s strong same-store RevPAR advancement was centered in Paris (+54.4%), all but one of the remaining markets saw RevPAR growth ranging from 5.3% in Hauts-de-France to 34.8% in Provence-Alpes-CDA. The only market in arrears was Bretagne (-4.0%), which saw a hotel occupancy decrease offset a 5% ADR increase. Not surprising, France’s luxury hotels saw the largest weekly RevPAR increase (+66.0%) with Paris luxury hotels increasing 73%.

All Japanese hotel markets were up this week with Tokyo RevPAR advancing 23.8%. However, Osaka continued to lead the country with same-store RevPAR up 58.3% on a 41.0% increase in ADR. As seen since April, Expo 2025 drove the gains, but they should slow as Expo concluded on Oct. 13.

Canadian same-store hotel RevPAR advanced by its largest amount of the past 10 weeks (+10.9%) with half of the growth coming from ADR. Toronto and Vancouver saw RevPAR growth of 15% or more with Quebec rising 20%. All three saw solid increases in both occupancy and ADR. Of the larger cities, Montreal’s RevPAR was on the weaker side, but still up (+3.6%) due to flat ADR. On a total industry basis, Canadian RevPAR grew 12.8%, mostly on ADR. Like in the U.S., luxury properties led the industry in growth (+23.4%), but unlike the U.S., RevPAR in all hotel types rose.

Isaac Collazo is senior director of analytics at STR.

This article represents an interpretation of data collected by CoStar's hospitality analytics firm, STR. Please feel free to contact an editor with any questions or concerns. For more analysis of STR data, visit the data insights blog on STR.com.