NASHVILLE, Tennessee — Over the past 12 months, U.S. hotels have been hampered by a triple whammy of negative consumer confidence, the effect of natural disasters and hesitancy from guests to book stays due to uncertainty.

All three of those considerations are linked, STR analyst William Anns said during a session at the 2025 Hotel Data Conference.

The rest of 2025 won't improve much for the U.S. hotel industry. CoStar and Tourism Economics released a revised forecast that anticipates a 0.1% full-year decline in revenue per available room.

“The goal is mitigating declines,” Anns said.

But certain segments of the hospitality business are still performing well, Anns said.

“Reflecting on 2024 performance, only the highest scales [of hotels] are seeing positive revenue per available room,” he said.

Luxury and upper-upscale hotels across the U.S. continue to outperform the lower segments.

“At the top end, recovery now is quicker than during the Great Financial Crisis, in which independent [hotels] took 27 months to recover, upper midscale, 35 months, and luxury, nine,” he said. “Demand again is aligned to consumer price index, but the ultra-wealthy are spending more on high-end hotels than on high-end retail.”

The American middle class has been most affected by inflation, tariffs and rising costs. This has led to slightly lowered or flat hotel performance in those mid-tier segments, Anns said.

Business travel is also down across U.S. hotels.

“Occupancy has fallen across all days of the week, not by a great amount, between 0% and low 1%. The Monday-to-Thursday conference has been shortened by a day, and there is a little less bleisure travel because of this,” he said.

In a reversal of what was seen post-pandemic, U.S. hoteliers have more pricing power on business nights instead of leisure nights, Anns said.

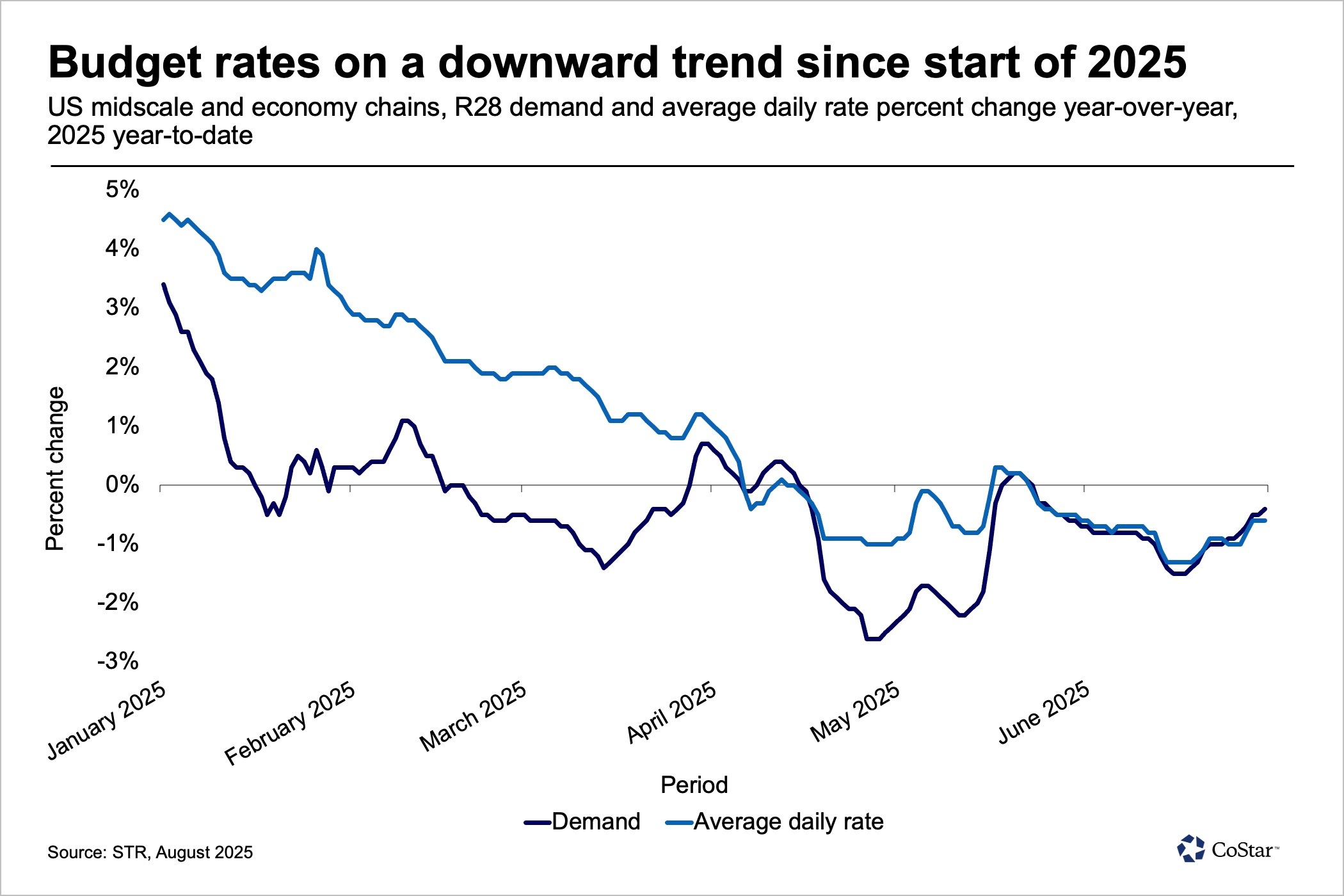

“Independent properties struggle with [average daily rate] as guests have less ability to burn loyalty points, while budget ADR has been on a downward trend since the start of this year,” Anns said.

Lower travel demand isn't surprising in a period of economic uncertainty as “travel is one of the first things to go” in a downturn, Anns said. But there are signs of U.S. growth as early as the second half of 2026.

Investor sentiment and group business

On the hotel ownership front, investor sentiment of the U.S. market has taken a serious hit over the last year.

“The U.S. has seen a big swing in outlook for investment. While it is currently at +2%, mostly there has been an erosion of its strong dominance,” Anns said.

However, the growth of average daily rate for group business has been “a real fillip at the moment among the other noise” for investor sentiment, Anns said. Of course, U.S. hoteliers would love to confirm more group business as well as add more meetings and events to their books.

“More plans lean towards delaying, rather than cancelling” into late 2026 or even early 2027, Anns said, “and fewer planners are actively sourcing new events.”

The data shows that 34% of planners were actively planning in May 2024, but a year later that number had dropped to 28%, while those rescheduling across the same period increased from 6% to 11%.

That uncertainty and delay has inevitably led to a rethinking around hotel supply, Anns said. Since STR’s last forecast, U.S. hotel supply growth has been downgraded, too.

“We’re seeing the lowest level of in-construction for some while. In 2019, approximately 35,000 rooms were in deferment or abandonment. Now it is 55,000,” he said.

International demand decline with hope for a 2026 rebound

U.S. domestic hotel demand declines and cautiousness across the board will not be rectified by a surge of travelers from overseas, which make up approximately 5% of U.S. room nights, Anns said.

If international inbound travel demand to the U.S. declined by 15%, U.S. hotels would see 10 million fewer room nights of business. Anns added overnight land travel from Canada is down by a third, mostly the result of U.S. tariff policy and political noise.

Could soccer come to the rescue next year?

Approximately 66.5 million international inbound travelers are expected to visit the U.S. in 2025. That estimate jumps to 68.8 million in 2026 due to the FIFA World Cup, which the U.S. is co-hosting with Canada and Mexico between June 11 and July 19.

All attention will be on the World Cup draw in December 2025 that will assign which nations play where in the group stage. The tournament also features 48 teams — up from 32 in 2022 — and a round-of-32 stage of the finals for the first time. Predicting which countries' national teams will advance past the group stage and beyond will be tricky for soccer fans and hoteliers alike.