NASHVILLE, Tennessee — In a world of uncertainty, one thing is clear: The U.S. hotel industry isn't performing at the level that was anticipated heading into this year.

Further proof of this came during the opening session at this year's Hotel Data Conference, when CoStar and Tourism Economics released the latest 2025 and 2026 U.S. hotel forecasts. Both years saw yet another downgrade in projected demand, average daily rate and revenue per available room. Hotel demand and RevPAR are now projected to be slightly in the negatives year over year in 2025.

"Things aren't great, and we're not expecting improvement in the near term," Kelsey Fenerty, manager of analytics at STR, said during the "Final Take" general session to close the conference. "The biggest, most No. 1 reason that we missed our [initial] forecast and continued to downgrade is really so abundant. It's that uncertainty that remains that makes this so challenging."

That uncertainty isn't an excuse to give up on trying to turn the trends around, though. While wrapping up the conference, Fenerty gave hoteliers some food for thought on how to look deeper into the numbers and find the context most important to their properties.

Providing context to the numbers

Hoteliers and industry analysts can look at a flurry of data to contextualize current headwinds. For example, U.S. corporate spending is expected to slow next year, which will have an adverse effect on ADR growth in upper-upscale, upscale and upper-midscale hotels, Fenerty said. This will in turn drive some softness in overall rate, which will lead to lower RevPAR.

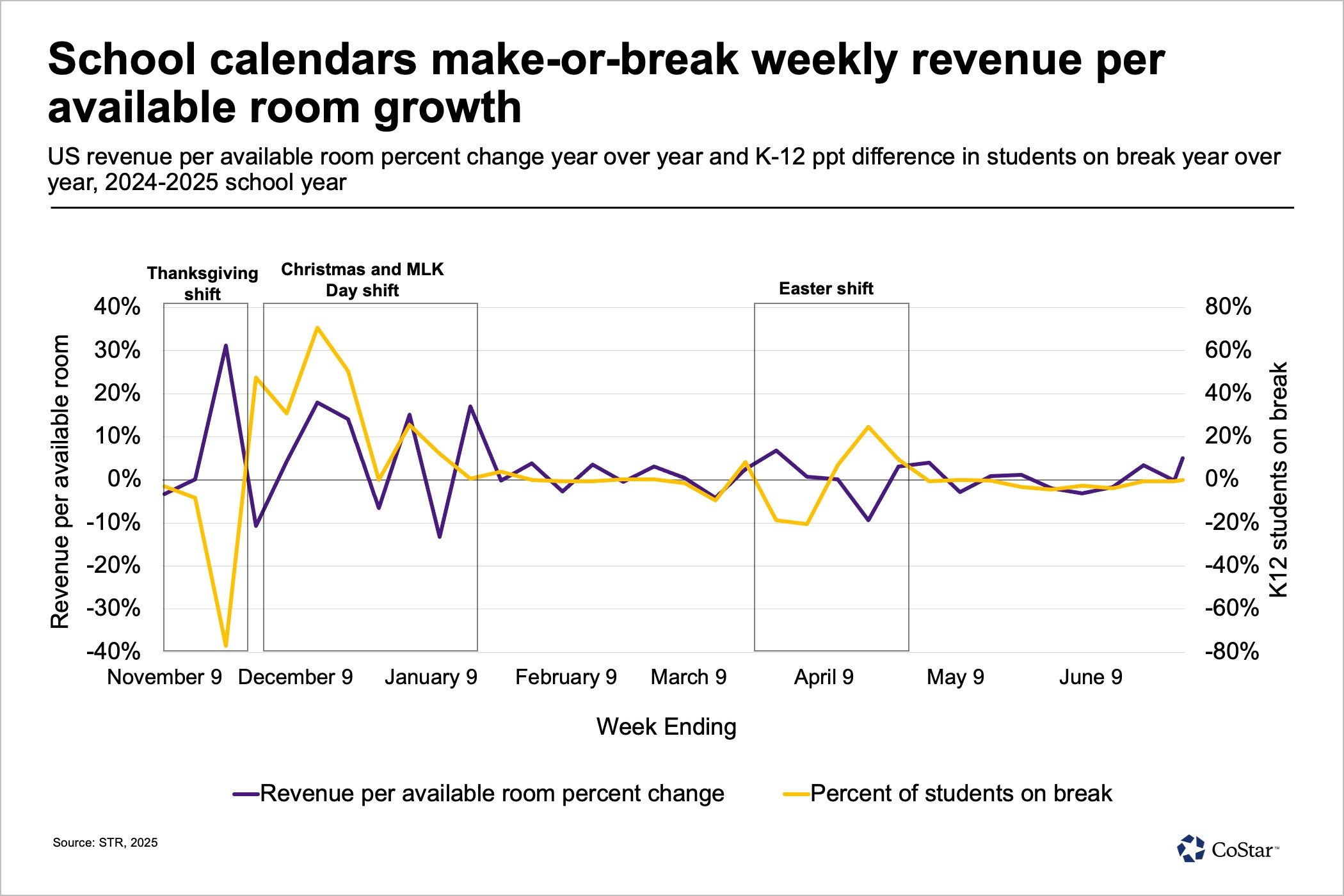

Another example is how calendar shifts can have an impact on monthly numbers. If a property is seeing success on a day-to-day or week-to-week basis but the monthly numbers come in weak, it could simply be due to trading an extra Friday for an extra Sunday, she said.

On the bright side, gross domestic product in the U.S. is generally consistent with hotel room demand, with the strongest correlation among high-end hotels. GDP is expected to continue growing in 2026, and if that's the case, the assumption is that so will high-end hotel demand, she said.

Among the key performance indicators, RevPAR and ADR change in 2026 follows a straight line down starting with luxury hotels and ending with economy hotels.

"The United States is not a monolith, and not all hotels are going to perform the same. It's why we have comp sets," she said. "That's why, no matter what the headlines, no matter what the news articles are saying, no matter what we say even, you have to run this all through the lens of your own property or portfolio."

One of the most pressing subplots of the downgraded U.S. hotel forecast is how much of a role international inbound and outbound demand numbers are playing. June year-to-date figures show international inbound arrivals are down 4% compared to last year and down 13% compared to 2019. During the same time frame, outbound departures are up 2% compared to last year and 23% compared to 2019.

This is clearly a factor when it comes to the industry at large, but it's more pressing for certain markets that usually receive that share of travel, Fenerty said. In 2024, Miami, Dallas, Honolulu, New York City and Los Angeles were the five cities with the highest international share of paid nights, according to Tourism Economics data.

"Are you in Pensacola, Florida, and you are very, very concerned about what college kids and families in the Deep South are doing? Or are you in Miami, Florida, and you're very worried because you're seeing less inbound travel out of the Americas?" she said. "Maybe you're based in the Dakotas, and you look at the price of crude oil more than you look at the euro exchange rate. Or maybe you're in New York City, and you are really worried that those Europeans are either going to go further north or not bother across the Atlantic at all."

Potential solutions

Even with the caveat that uncertainty moving forward will likely persist, hoteliers aren't completely helpless when it comes to looking for solutions that can mitigate the effects.

One of those solutions is events, Fenerty said. High-profile events such as the Kentucky Derby or the World Cup will have an obvious impact on luxury, upper-upscale and upscale chains in the host markets, but every market has some kind of event that rolls through each year that can provide a boost to room demand.

The 2026 FIFA World Cup will be a huge opportunity for hoteliers in the 16 host markets, and the event is expected to boost performance across the whole U.S. to a certain degree.

Group travel is expected to take a different shape in 2026 — not necessarily a decline in demand, but a different look compared to previous years. The expectation is a rise in smaller, more intentional gatherings and a growing desire for exclusivity in events, Fenerty said.

Event planners have taken notice: The trend over the past year has been event planners focusing more on rescheduling or rebooking groups from past years instead of trying to book new events.

Leisure travel trends are having more of an impact on demand due to business travel never fully recovering to pre-pandemic levels, she said. Holidays that relate to school calendars are having an outsize impact on hotel performance, and it is making bigger ripples without the buffer of a business base.

Return to office has flattened so far in 2025, but it's again dependent on market. As sublet availability in a market goes down, there is a correlation with Wednesday hotel occupancy — a prime business travel day — going up.

What's on the horizon

One tailwind for the hotel industry moving forward is the lack of incoming supply in both the near and medium term, Fenerty said. Over the past three years, significantly more rooms in the planning and final planning stages have been moved to deferred or abandoned compared to 2019 levels.

There's also been more room closures than in the past, further reducing the overall number of supply. Closures are starting to trend down, though, getting closer to long-term averages.

Another hopeful trend is hotel conversion activity, she said. While the number of hotel conversions is down, there are more conversions up the chain scale rather than down, a big change from the past.

"This change is a really hopeful signifier of investment and interest in our industry, despite a slow year," Fenerty said.