Healthy weekend performance for U.S. hotels in the last full week of June was offset by declines across weekdays, resulting in a flat week for U.S. hotels.

Revenue per available room nationwide was unchanged (-0.1%), the result of no movement in either average daily rate – which was flat at 0.0% growth – or occupancy, which was down slightly by 0.1 percentage points. There was movement in day-of-week performance as weekend RevPAR on Friday and Saturday advanced 3.2%, weekdays Monday to Wednesday retreated 2.2% and shoulder days Sunday and Thursday dipped slightly by 0.8%. Leisure demand is alive and well at hotels across the U.S. but it's no longer sustainable like it was when revenge travel was all the rage. Without business travel at 100% of the levels it was at prior to the pandemic, daily/weekly hotel demand will fluctuate up and down.

Chain-scale bifurcation continues at a much more muted level this week with luxury hotels posting the greatest RevPAR gain at 1.7% and economy seeing the greatest decline at 1.8%. Hotels across all chain scales followed the day-of-week patterns with the weekend producing the best and most positive hotel performance for all except economy hotels. Economy hotel RevPAR was the least negative on the weekend. Weekdays saw declining RevPAR across all chain scales. All chain scales except luxury posted a RevPAR decline during the shoulder period.

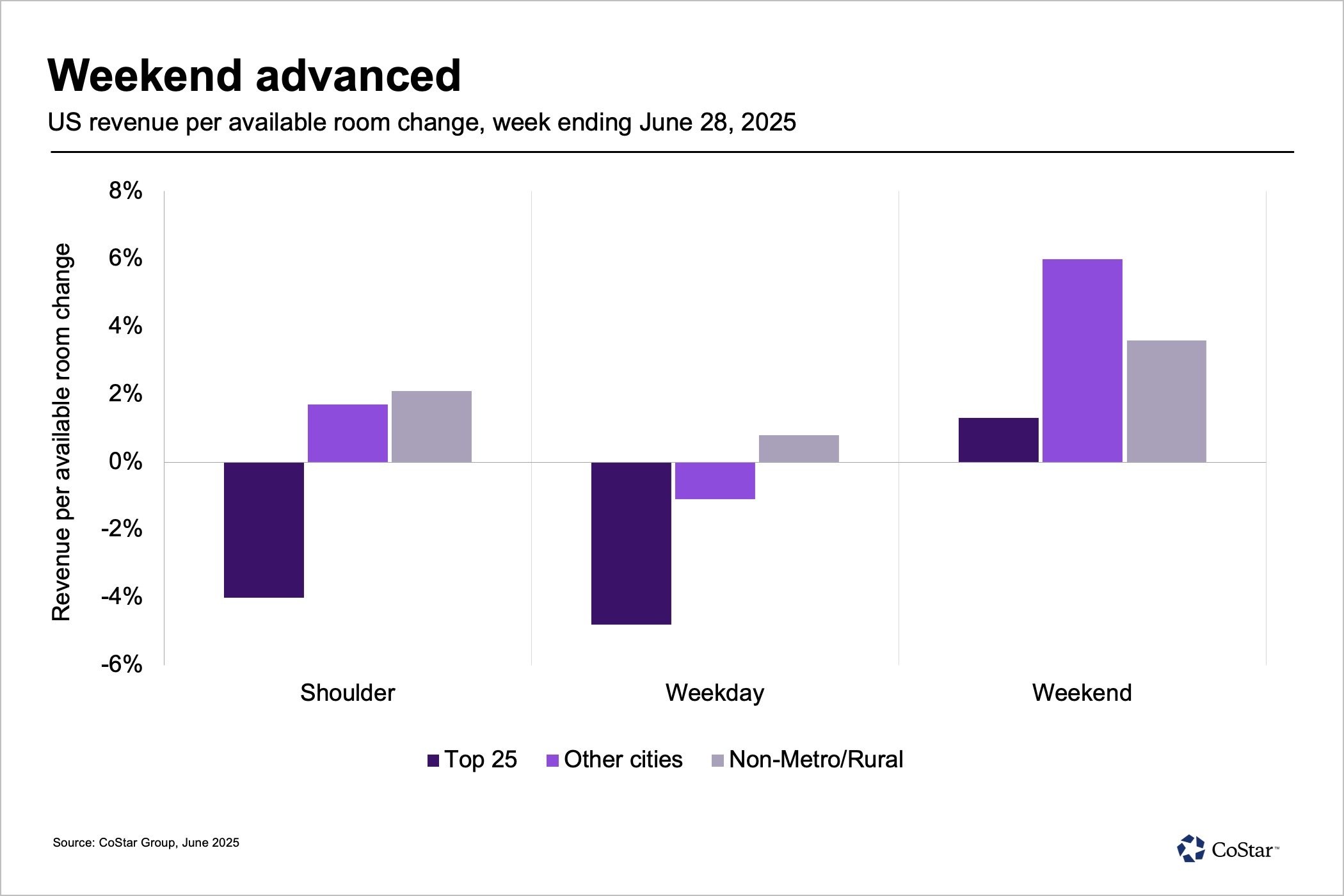

Non-metro/rural and other large markets outperformed the top 25

It was a lackluster week for the top 25 U.S. hotel markets while the rest of the country posted a respectable performance. Top 25 RevPAR dipped 2.8% driven by weekday (-4.8%) and shoulder day (-4%) declines. The weekend was positive with RevPAR up 1.3%. Only nine of the top 25 markets posted positive RevPAR. There were a few brights spots with Philadelphia, Dallas and Orlando increasing RevPAR by double digits.

In other large city markets, hotel RevPAR increased 1.9%, driven by the weekend up 6% followed by shoulder days up 1.7%. Weekday RevPAR declined 1.1%. Forty of the 70 identified large city markets produced positive hotel RevPAR with 17 seeing double-digit RevPAR. Top hotel markets included Chattanooga, Tennessee; Madison, Wisconsin; Pittsburgh and Cleveland, each reporting 25% or greater RevPAR gains.

RevPAR in non-metro/rural areas rose 2.1% lifted by the weekend (+3.6%). Shoulder days and weekdays also advanced 2.1% and 0.8%, respectively. RevPAR increased in over two-thirds of the 77 areas – 53 out of 77 regions – identified as non-metro/rural. Louisiana North, Wisconsin South and North and Missouri North topped the leaderboard in RevPAR gains.

Group demand held, lifted by markets outside the top 25

Group demand in luxury and upper-upscale hotels was flat, up just 0.1%, with an increase of 5.2% on the weekend offset by an average 1.7% decline over the other five days of the week. Some of the day-of-week shift was possibly due to the days on which Juneteenth and July Fourth fell last year – Wednesday and Thursday, respectively – compared to this year when the holidays fall on Thursday and Friday. The shift this year appears to have negatively affected weekdays and positively affected the weekend. Additionally, this shift may explain the 4.2% boost to hotel group demand provided by non-top 25 markets, while top 25 group demand declined 3.1%. Dallas, Miami and Philadelphia were top 25 bright spots posting healthy group demand increases.

Looking ahead

The week ahead includes the July Fourth holiday on a Friday – giving leisure travelers a three-day weekend – which is expected to create more weekend U.S. hotel demand. While the week is generally a slow week for groups, the Friday holiday will give meeting planners a few extra days to squeeze in conferences.

Summer months are filled with stadium concerts, fairs and festivals which have a significant impact on host markets, especially smaller markets where the impact of a large event is more significant. Evidence of this impact was apparent in the strong performance in markets outside the top 25 U.S. hotel markets. Impact from such events is expected to continue throughout the next couple of months.

Most major countries posted positive hotel performance

Excluding the U.S., global hotel RevPAR was flat (+0.2%) with a 1% ADR increase offset by an occupancy decline of 0.6 percentage points. Interestingly, the day-of-week pattern seen in U.S. performance was also evident on a global level. Weekend RevPAR advanced 3% while weekday and shoulder period RevPAR declined 1.0% and 0.9%, respectively.

And while it was a flat week from an overall global perspective, 9 of the 11 major countries posted positive hotel performance for the week with all but two also posting positive performance on average over the past four weeks. Japan continued to hold the top spot followed at a distance by Indonesia, Spain and India.

Chris Klauda is director of market insights at STR.

This article represents an interpretation of data collected by CoStar's hospitality analytics firm, STR. Please feel free to contact an editor with any questions or concerns. For more analysis of STR data, visit the data insights blog on STR.com.