There are two options for franchise-driven hotel brands to grow their stable of hotels. They can either put their flag on new hotels or reflag existing hotels in a so called "conversion." According to data from STR, CoStar's hotel analytics company, the number of new openings and conversion activity is clear: Conversions are winning out.

While the number of hotel conversions seems to stay remarkably steady no matter the economic cycle, new hotels tend to open with lower frequency a few years after a recession. This is likely the outcome of tougher financing standards after a downturn. After all, hotels mostly sign one-night leases and are therefore much more susceptible to sharp declines in demand when macroeconomic forces deteriorate, which also quickly changes the lending community’s appetite to underwrite hotels.

The trend is often short-lived, and in the inevitable upcycle, hotels can make up lost financial ground rapidly, which in turn makes them attractive to developers and lenders again.

Conversion Activity Is Mostly Brand to Brand

Looking at hotel conversion activity by year, three possible outcomes can be observed. A hotel either changes from one flag to another, it drops a flag to become independent or it becomes flagged by choosing to operate under a brand after being independent.

The data indicates that, in most years, the most common type of conversion is changing from one brand to another. Owners that have properties operating under a brand seem to prefer the access to loyalty programs and marketing power that come with the brand affiliation, so they typically stay with a franchise

Analyzing hotel conversions involving properties that either drop a brand affiliation completely and become independent or go the opposite route and select a brand after being independent, the trends are less pronounced.

In some years the conversion activity to and from brands is almost equal. But a few years after a recession, 2002 through 2004 and 2010 through 2012, the data seems to indicate that more brands get dropped. We will pay closer attention to the data after 2022 to see if this past pattern repeats itself.

Conversions More Often to a Lower Chain Scale

The decision to change brands results from a wide variety of factors. Often hotel owners face a property improvement plan, or PIP, to maintain brand standards as required under their franchise agreement. If the owner is not willing or able to invest in the property to meet the PIP requirements, the brand may have the right to terminate the agreement.

In such a situation, hotel owners may find that their hotel faces a smaller PIP by converting to a lower chain scale and can choose that route to maintain a franchise affiliation.

In other cases, owners may find that they can upgrade their current facility easily enough to qualify for a higher-rated chain scale. The data shows that, while changes to a higher scale happen, the majority of changes each year are to lower chain scales.

Even in 2011, when adjusting for the Best Western to Best Western Plus conversion activity, the number of hotel conversions to a lower scale outweighed the number of upgrades to a higher scale.

Fewer Conversions Include Economy or Independent Hotels

Tracking detailed conversion activity lends itself well to studying the overarching trend. Between 2000 and 2006, more than half of all hotel conversion activity involved economy brands and independent hotels. This ratio has now changed and, between 2015 and 2020, well over 50% of conversions took place in the other chain scales between luxury and midscale.

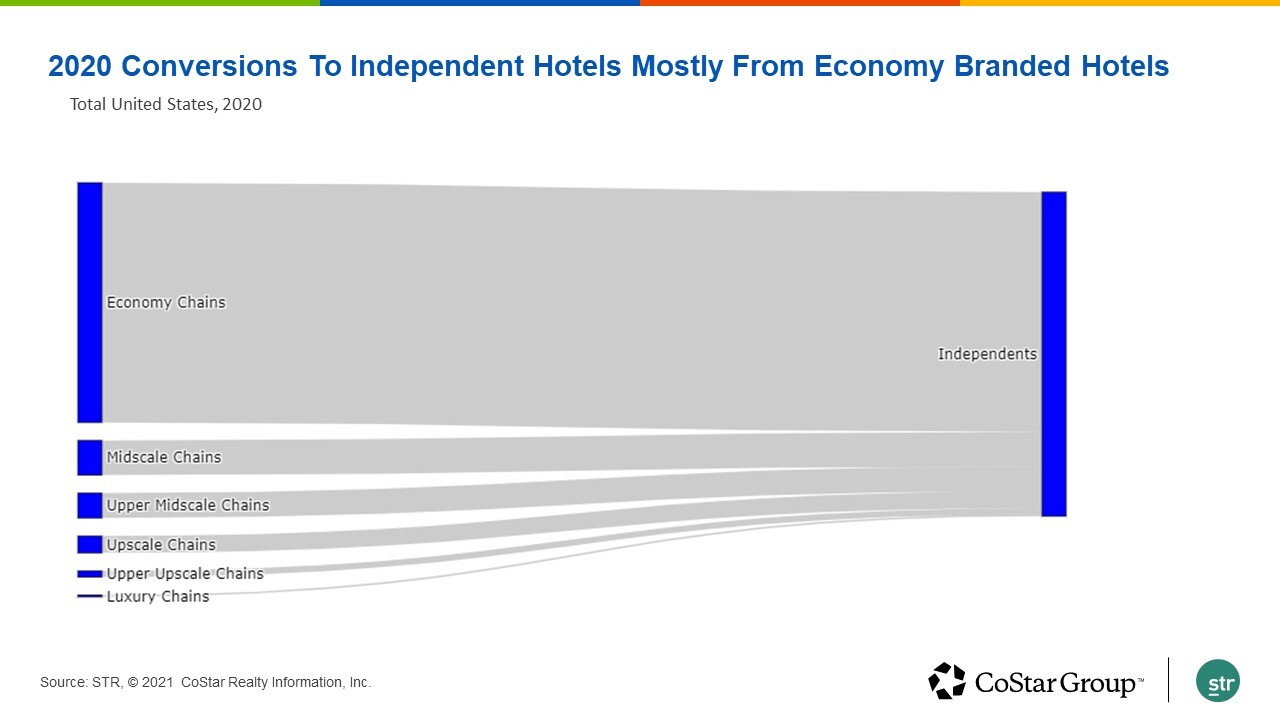

In 2020, conversion activity in and out of the independent chain scale showed a pattern that matches that of past years. Specifically, most brands that gave up their franchise and became independent were economy branded hotels. In all, 470 hotels converted to independent from various chain scales.

Likewise, most independent hotels that chose a brand affiliation converted to economy branded hotels. A total of 423 hotels affiliated with a brand after previously operating as an independent.

Even in the worst year of the U.S. hotel industry, conversion activity did not halt completely. We will continue to monitor the number of conversions to see if the tremendous disruption last year caused hotels owners to change their behavior. Taking past cycles as a guide seems to indicate that conversion activity may not be materially impacted.