NASHVILLE, Tennessee — Even as wealthy consumers continue to spend on travel, lower-income consumers are pulling back on their travel budgets, which in turn is affecting hotels in the lower-tier economy segment.

Speaking in a data-dive session titled “Tracking travel demand in a bifurcated economy” at the Hotel Data Conference, STR Senior Analyst Hannah Smith said U.S. luxury hotel demand is increasing, but lower down the chain scale toward the economy segment, demand keeps falling.

“For all classes, weekends are worse than weekdays, and all [hotel segments] but upper upscale and luxury show negative occupancy,” she said.

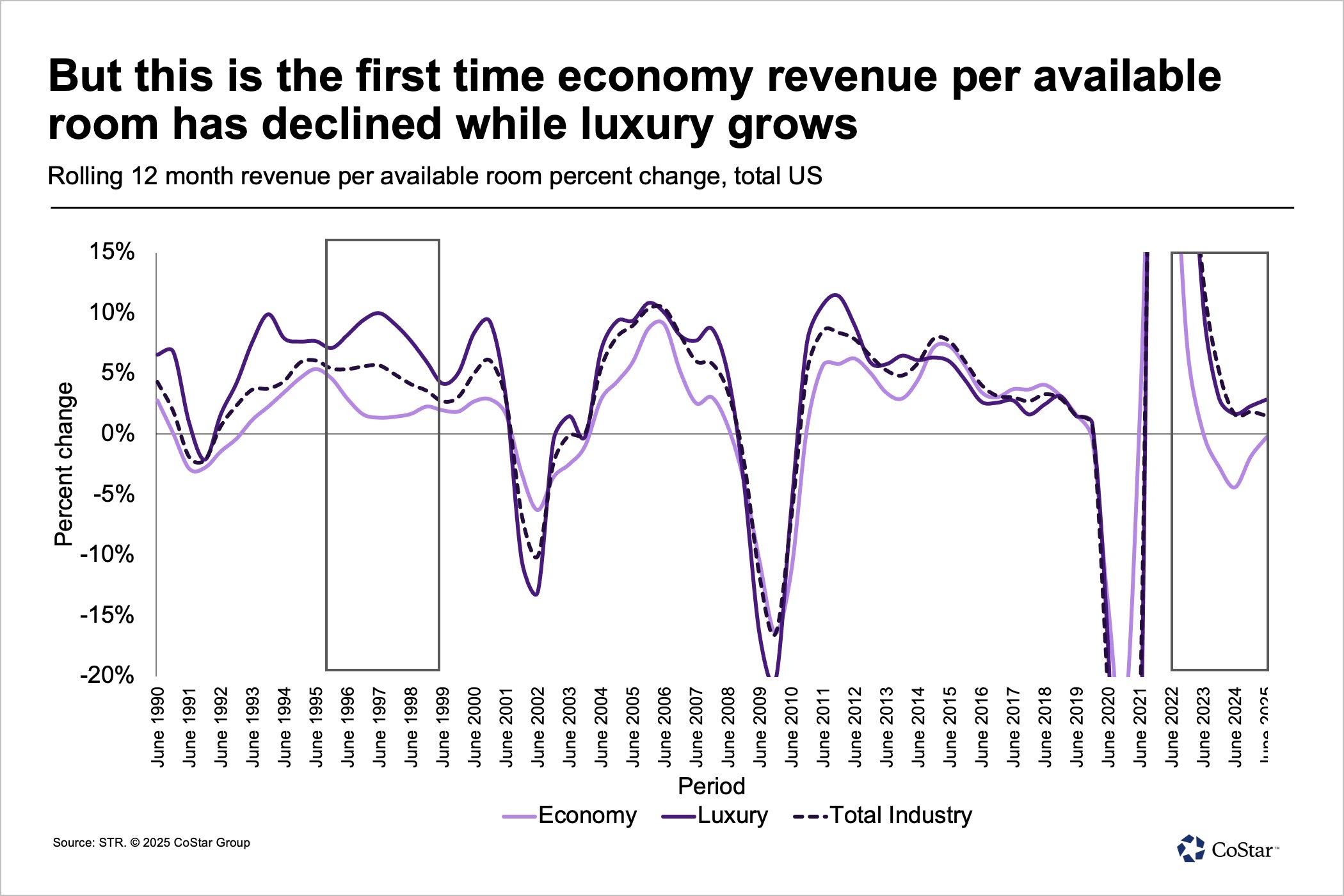

Most of the time, economy hotels operate below 55% occupancy, Smith said. The segment has shown 18 straight months of declines in revenue per available room in a rolling 12-month basis.

“We’re not seeing good average-daily-rate growth in that sector, although more low-end hotels are growing occupancy now versus the same time last year,” she added.

The good news is that 18-month decline is beginning to flatten, and a quarter of the U.S. hotel industry is finding growth. Approximately three-quarters of hotels still are declining in either occupancy, ADR or both.

Such performance patterns mirror the recessionary periods of the early 2000s and the 2008 Great Recession, but the significant difference now is bifurcation. In other words, RevPAR for economy hotels has declined while RevPAR for the luxury segment is growing.

“Twenty percent of hotels are in a good place. Luxury is growing occupancy and ADR, but we are seeing that even high earners, those earning more than $250,000 per year, are pulling back” their travel spend, Smith said.

Hotel occupancy around major high-end events is even beginning to see a slight decline, she added.

Diverging paths

For economy hotels, gross domestic product is not a perfect predictor of RevPAR growth for economy, Smith said.

For most segments, a rise in GDP correlates to a rise in hotel spend, but for economy hotels, "the increase in delinquent credit cards is a much more potent metric," she said. Credit card delinquency indicates budget tightening, which correlates to lower demand in the economy hotel class.

Declining supply in the economy hotel segment also has a notable effect on performance. Though the segment has seen a greater growth in construction than the rest of the U.S. since 2016, more hotels are leaving the economy class than are entering. Each year, economy hotels are either closing or converting to the midscale segment.

“Some even reopened as luxury properties, although they are very much outliers. Many economic hotels closed,” Smith said.

Heightened economic considerations will see more conversions, she added.

“Conversion is ruling still, and that is set to continue,” Smith said.

The luxury hotel segment is more aligned with GDP, but improvements in the stock market are not aligned to demand. Events business is translating to premium ADRs, although not to occupancy increases.

Smith said luxury hotel supply continues to outpace that of the overall U.S. market, and independent hotels are leading the charge. Such hotels require higher staff-to-guest ratios, and that comes with its own set of challenges in the current economic landscape.

Miami, Detroit and Los Angeles are leading that supply boost, Smith added, and three Texas cities — Dallas, Fort Worth and Houston — are in the top 10.

“A little more than one-third of U.S. hotels follow the bifurcation trend. High-end growth exceeds low end in most markets,” she added.

Of the budget-focused hotels that are opening, brands such as Oyo, Hilton’s Spark and IHG Hotels & Resorts’ Avid are leading the charge, Smith said.

Bifurcation also is playing out over segments that previously seemed to be resistant to the trend, such as extended stay.

Smith said she expects the hospitality industry to be talking about these trends for a number of years to come.

“Well, certainly we will be next year,” she said. “We do not expect the economy to bounce back until the end of 2027. Expect luxury to continue to outpace other segments over the next few years,” she added.

Clarification and correction, Sept. 19, 2025: This article was clarified to more accurately reflect the connection between credit card delinquency and economy hotel demand. It was corrected to report that economy segment supply is declining.