Following two weeks of year-over-year growth, U.S. hotel revenue per available room fell 2.7% in the week of May 4-10.

The decline was primarily on hotel occupancy, which was down 2.3 percentage points. Average daily rate dropped a modest 0.6%. The weekend days Friday and Saturday showed the largest decline with RevPAR down 4% as both occupancy (-1.6 percentage points) and ADR (-1.8%) retreated. Weekdays Monday to Wednesday were the least negative with RevPAR declining 2.3% totally on occupancy, while shoulder days Sunday and Thursday saw RevPAR decrease 2.9%.

Top 25 markets flipped from the previous week

An about-face occurred with the top 25 U.S. hotel markets suffering the largest losses after posting the highest gains in the prior week. RevPAR declined 4.3% on falling occupancy (-2.6 percentage points) as ADR was somewhat flat (-0.7%). RevPAR decreased by more than 3% all seven days.

Normally, a shift in top 25 performance is due to the outsized impact of Las Vegas. While RevPAR in the country’s largest hotel market was down for the week (-8.4%), the top 25 aggregate would have been down even if Vegas were excluded.

Among the top 25 U.S. hotel markets, San Francisco saw the largest decline due to the calendar shift of the RSA Conference. RevPAR dropped in the majority (17) of the top 25 with eight of the 10 largest markets experiencing declines ranging from down 33.9% in San Francisco to down 2.1% in Dallas. Overall, many markets were affected by event calendar shifts. Excluding both Las Vegas and San Francisco, 63% of the industry’s total demand decline was in the remaining top 25 markets.

On the other side of the spectrum, major markets seeing healthy RevPAR gains included Philadelphia (+18.5%), which benefited from strong group business over the past two weeks. Boston hotel RevPAR advanced 15.5% with all six submarkets posting double-digit gains on the heels of a prior negative week. Rounding out the list was Nashville (+9.3%) with strong performance Sunday through Tuesday, particularly in the central business district submarket, and Tampa (+7.5%).

Next 25 largest markets held RevPAR

Across the next 25 largest markets, the RevPAR comp was essentially flat, down -0.4%. Three of those markets saw strong RevPAR gains led by Pittsburgh (+34.5%), Columbus, (+29.8%) and Salt Lake City (+28.6%). Columbus reflected a shift in Ohio State’s graduation ceremony, which was held a week later than last year. RevPAR outside of the 50 largest markets dropped 2.2%.

Luxury chains unstoppable while other chains decline

Luxury hotel chains continued to post positive RevPAR comps, while the other five chain scales declined, due primarily to occupancy declines. Like with the total industry, weekends pushed the RevPAR decline with all chain scales down ranging from a 2.1% decrease for luxury to a 7.2% drop for economy. Luxury chain RevPAR was positive on the weekdays (+3%) and flat on the weekend. All other chains scales declined on weekdays and shoulder days.

Group business did not retreat

Group demand in luxury and upper-upscale hotels was almost flat (+0.5%), and contrary to the weekend softness reported across the industry, it was weekend group demand (+6.2%) that lifted the overall group segment.

Group demand on shoulder days was flat (+0.1%) while weekdays were down (-2.8%). Transient demand for the week was down 1.8%.

Taking a closer look and using comparable reporting hotels across all hotel classes, 90% of the week’s decrease in absolute room demand came from the transient segment. A week ago, both transient and group were up with group accounting for 63% of the growth. On a percentage basis, the decline in transient demand was nearly identical in the top 25 markets to that of the remaining markets (~-2%). In the previous week, transient demand was up. The two weeks combined saw transient demand flat (-0.1%) whereas group demand was up 4.3%.

Weekend transient demand among comparable hotels fell by 2.3% with group demand up 2%. The increase in weekend group demand was led by luxury and upper-upscale hotels, where it rose by more than 5%.

Looking ahead

The slowdown this week was a surprise — there have been many this year. While there were some calendar shifts, nothing obvious stood out. Could it be a reversal from the strong prior week or is this the beginning of the anticipated impact from the increased economic uncertainty due to policy changes?

TSA airport screenings were also down this week in the U.S., and the first reading of the upcoming week (Sunday through Wednesday) showed continued slowness. Recall that the school calendar for K-12 grades shifted due to the late Christmas holidays and a late Easter, which may also be playing a role.

Only time will tell, but forward-booking data in the top 25 U.S. hotel markets looks good for the rest of May and June.

U.S. outbound travel continued to rise while inbound travel moderated.

Continued healthy global RevPAR

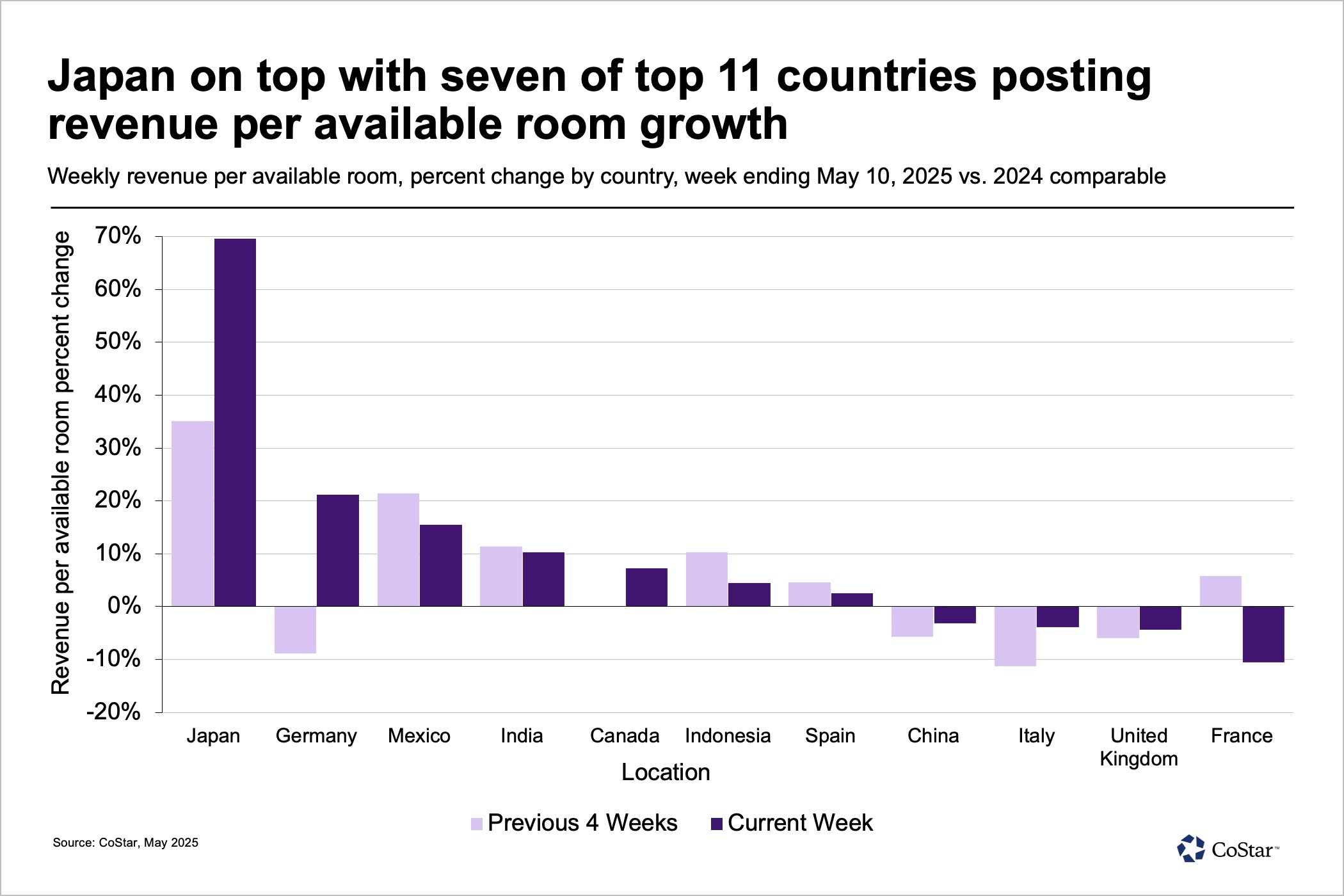

Global RevPAR advanced 7.8%, continuing its growth run, increasing by over 7% for five of the past six weeks.

Four of the top 10 largest countries saw double-digit RevPAR growth with Japan and Mexico in the top four as they have been for most of the year.

Germany saw strong performance with standout results in Frankfurt, Munich and Stuttgart. Nine of Germany’s 13 markets reported positive RevPAR changes.

India also posted RevPAR gains across almost all markets with the exception of India North, possibly the result of the recent miliary strikes.

RevPAR in Canada advanced across 14 of the country’s 22 submarkets with the three largest cities posting significant gains: Toronto (+18.6%), Montreal (16.2%) and Quebec City (8.1%).

France experienced a RevPAR decline partially due to the difficult comparison to last year when Taylor Swift performed in Paris.

China’s RevPAR (-3.2%) fell slightly more than in the previous week driven by upper-midscale, midscale and economy hotels.

Globally, hotel performance remains strong and doesn’t appear to be slowing.

Isaac Collazo is senior director of analytics at STR. Chris Klauda is director of market insights at STR.

This article represents an interpretation of data collected by CoStar's hospitality analytics firm, STR. Please feel free to contact an editor with any questions or concerns. For more analysis of STR data, visit the data insights blog on STR.com.