U.S. hotel revenue per available room rose for the first time in three weeks from Aug. 24-30, but the 0.2% RevPAR increase was nothing to celebrate. Average daily rate rose 1%, driving the slight gain, while occupancy (-0.5 percentage points) was down for the 10th week in a row.

Continued negative hotel performance in Houston and Las Vegas dragged down the national average once again. Excluding those two markets, U.S. hotel RevPAR increased 1%. Two other Top 25 Markets, Denver and Washington D.C., also posted notable, double-digit RevPAR declines for the week. Those markets have seen declines for four consecutive weeks.

Bright spots in New York, Orlando and Chicago

Three U.S. hotel markets posted RevPAR gains of more than 9%, lifted primarily by ADR growth.

- New York City’s hotel occupancy was the highest of all the markets as the market saw its second highest Labor Day demand ever, just 9,000 short of its record in 2019. Events benefitting the city included Lady Gaga’s Mayhem Ball Tour along as well as the annual U.S. Open Tennis tournament.

- A final blast of summer leisure travel lifted Orlando. Between Friday, Aug. 22, and Thursday, Aug. 28, Orlando hotels posted double-digit RevPAR growth.

- Chicago hotels had a great Labor Day with double-digit RevPAR gains Thursday through Saturday, ignited by a sold-out stadium performance by Oasis on Thursday.

An average Labor Day weekend

Weekday and weekend hotel performance, excluding Houston and Las Vegas, was mostly equal compared to last Labor Day week. The holiday weekend was slightly stronger in non-top 25 metro areas and non-metro/rural areas. The three-day Labor Day weekend, using preliminary data for Sunday, Aug. 31, was mediocre. Room demand was the fourth-highest ever but the best since 2022. Occupancy rose to 70.8% from 70.7% a year ago. ADR advanced 0.6%, leading to a RevPAR gain of 0.7%.

Lackluster summer

The unofficial yet appropriate definition of summer includes 101 days from the Friday before Memorial Day to the Sunday before Labor Day. Summer 2025 was sluggish at best, reflected by basically flat ADR (+0.2%) and lower room demand (-0.4%). All but the luxury hotel class felt the summer slump with economy and midscale hotels seeing the greatest declines. Mediocre RevPAR comps were seen in both the top 25 markets (-0.4%) and the rest of the country (0.0%).

Looking ahead

Next week’s U.S. hotel data is expected to reflect the soft performance seen all summer. The following two weeks should provide a much-needed lift as conference season picks up. These weeks will benefit from the Rosh Hashana holiday moving to the end of the month and Yom Kippur occurring into early October. Because of this shift, the last full week in September and the week into October are expected to be slow only to pick up after the holidays pass.

Markets hosting Taylor Swift’s Eras Tour in October 2024 – Miami, New Orleans, Indianapolis, Toronto and Vancouver – are expected to show a negative comp this year. And finally, the impact of Hurricanes Helene and Milton that swept through the southeast last September and October will create difficult comps for markets in North Carolina, Georgia and Florida this year. All in all, it’s going to remain challenging.

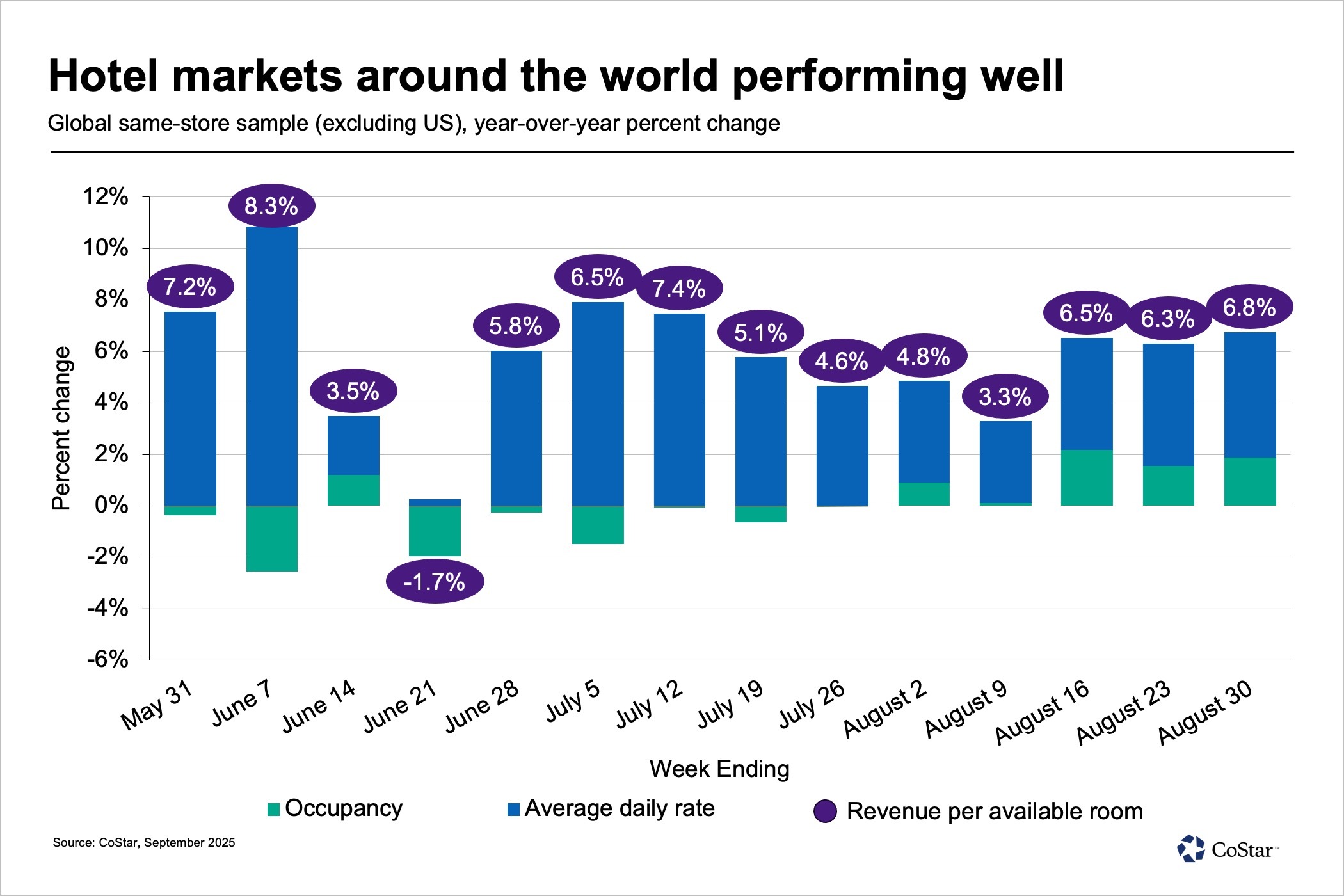

A strong summer globally for hotels outside the US

Hotels outside the U.S., using a same-store comparison, experienced a strong summer with RevPAR growth in every week but one. ADR was the almost exclusive driver of the strong performance. RevPAR in the most recent week rose 6.8% with ADR increasing 4.9%, while occupancy advanced 1.3 percentage points.

Over the past four weeks, the Middle East/Africa region saw the strongest RevPAR, rising 14.2%. Double-digit gains were also seen in Spain, Italy, Japan, and the rest of the Europe. Canada continued its growth streak, posting another week of RevPAR growth. France and Germany saw declines due to difficult comps to last year.

Isaac Collazo is senior director of analytics at STR. Chris Klauda is director of market insights at STR. This article represents an interpretation of data collected by CoStar's hospitality analytics firm, STR. Please feel free to contact an editor with any questions or concerns. For more analysis of STR data, visit the data insights blog on STR.com.