Through a combination of calendar headwinds and tailwinds, U.S. hotel revenue per available room (RevPAR) grew 3.2% during the week of April 20-26, 2025.

The headwind was the inclusion of Easter Sunday, providing a difficult comparison to last year when Easter Sunday was in March. It is notable that demand for the entire Easter week was the second highest since STR began weekly data tracking in 2000. As compared to Easter week last year, demand was 2.1% higher, suggesting that travelers are taking economic uncertainty in stride.

The tailwind was Passover, which ended on Sunday, April 20. A year ago, it began on Tuesday of the comparable week, making for easy comparisons. Because of these shifts, the beginning of the week saw declines in RevPAR from Sunday (-10.8%) through Tuesday (-1.3%) before turning positive on Wednesday onwards with weekend RevPAR up 10%.

While demand was up versus Easter week a year ago, the metric was down year over year due to the observance.

Significant ADR growth

What was even more significant and somewhat surprising was growth in average daily rate (ADR), which accounted for all of the week’s RevPAR increase. From Wednesday through Saturday, ADR increased 5.2% with occupancy rising 2.1 percentage points. The growth, however, is likely due to favorable calendar comp with Passover. ADR fell 0.6% week to week during Passover then rose 4.3% week over week after the observance. This year’s ADR increase still appears outsized and surprising.

Weekend occupancy surprise

While growth rates are benefiting from the easy Passover comps, absolute levels are immune.

U.S. weekend occupancy rose to 77.3%, which was the highest level in the country since the weekend of October 18-19, 2024 (78.3%). For added context, weekend occupancy did not surpass 77% last year until mid-June and was only above that level six times all year.

Comparing against the past 28 weeks, 25 markets posted their highest weekend occupancy this week including Chicago, Denver and Las Vegas. Another 37 markets saw their second highest with locations from San Diego to Dallas to Myrtle Beach to the New Jersey Shore benefiting from strong weekend demand after Easter.

Some of the growth could be from families on spring break, but according to STR’s School Break Report, only 14% of the K-12 student population was out last week versus 26% in the prior week.

Top 25 Markets post strong gains with an assist from Boston

The top 25 U.S. hotel markets experienced smaller declines at the start of the week (-6.5% to -0.2%) and larger gains at the end of the week (+5.0% to +13.7%). The timing of the Boston Marathon played a role in these smaller declines at the start of the week. The race is usually on the third Monday of April (Patriot’s Day), but due to a natural shift in the calendar, this year’s race was held a week later than last year.

Excluding Boston, RevPAR in the top 25 markets dropped at a similar rate to the rest of the country. Weekly RevPAR in Boston advanced 17.3% with Sunday’s RevPAR skyrocketing 169.1% followed by Monday’s 66.4% gain. The remainder of the week was much weaker with RevPAR from Tuesday to Thursday falling 13.8%. The weekend RevPAR was positive (+1.3%) all due to ADR growth (+4.4%).

Strong performance to end the week

Several other top 25 markets experienced double-digit RevPAR gains with the largest lift coming in the last half of the week. Chicago led the pack with RevPAR up 17.6%, benefiting from EXPO Chicago, which shifted from a week earlier last year. Las Vegas hosted LVL Up Expo, a gaming/Esports convention, which helped advance RevPAR 16.6%. Rounding out the list of top 25 markets with double-digit RevPAR gains were Los Angeles, New York City, Orlando and Tampa Bay with all but New York seeing most of the gain in the back half of the week. New York City saw double-digit RevPAR growth Tuesday through Saturday with Sunday and Monday over 5%.

Wisconsin North, host of the NFL Draft, earned top RevPAR honors

Outside the top 25, the Wisconsin North market took top honors hosting the NFL Draft over the weekend in Green Bay. RevPAR from Thursday through Saturday rose an average of 105.9% with ADR up 88.1%. Detroit, last year’s NFL Draft host, showed the largest decline across all markets as RevPAR retreated 28.8% due to the event shift.

Group demand decline felt calendar impact

Group demand in luxury and upper-upscale hotels declined 3.6% and followed the industry pattern at more magnified levels. Declines at the start of the week from Sunday to Wednesday averaged 21.6%, and gains Thursday through Saturday averaged 18.7%. Group ADR increased 5.2%. Transient demand in luxury and upper-upscale hotels did not follow the same pattern. Overall demand increased 2.1% at the start of the week and increased a bit more at its end. ADR increased 7.5% with no difference between the start and end of the week.

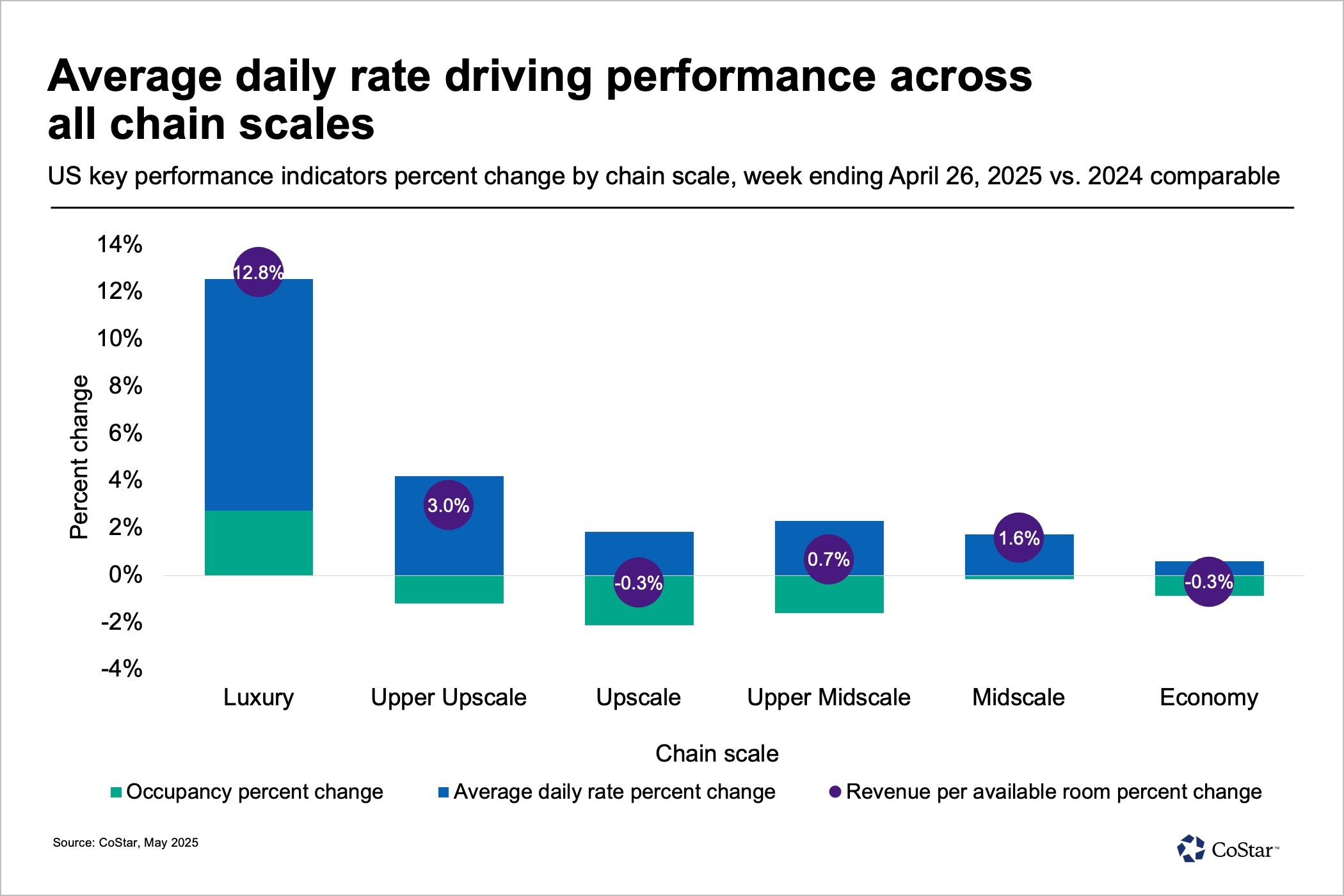

Healthy ADR gains across all chains with all but luxury decreasing occupancy

ADR advanced in all hotel chains, ranging from up 9.8% for luxury hotels to up 0.6% for economy hotels. Occupancy declined across all but the luxury segment, which rose 1.9 percentage points. Full-week occupancy decreases were greatest in upscale (-1.6 percentage points) and upper-upscale hotels (-1.1 percentage points). Occupancy losses in the other chain scales were less than one percentage point.

From Wednesday to Saturday, occupancy topped 80% in luxury, upper upscale and upscale with upper midscale above 76% and midscale at 68%. Economy lagged with occupancy at 59.4%, down from a year ago while all others saw strong growth. With the easy Passover comps, RevPAR growth was also equally impressive, ranging from up 15.6% in luxury during the four days to above 5% in the remaining chain scales except Economy, which was up 2%.

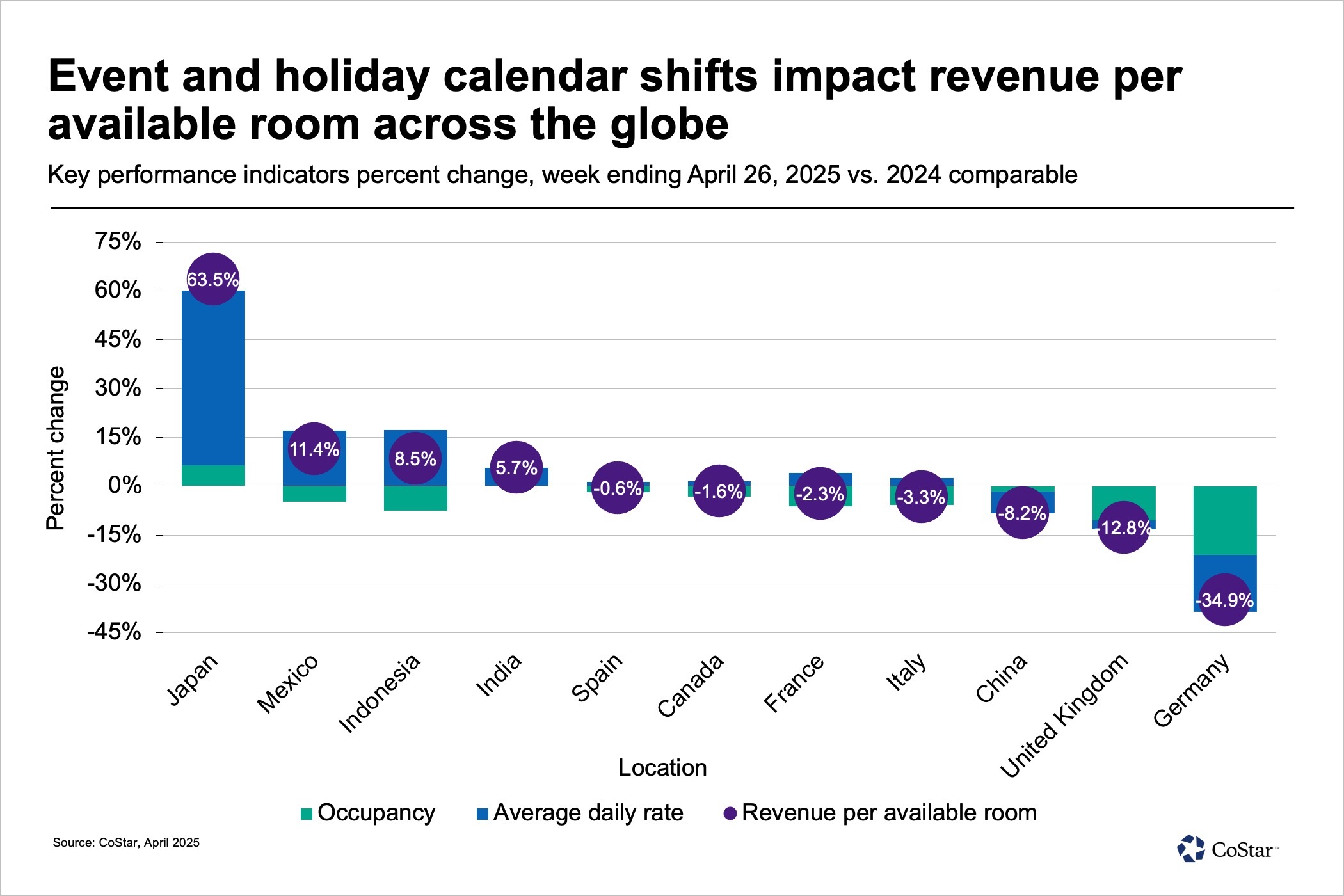

Global hotel performance slowed while Rome hotel demand rose during Pope Francis’ funeral

Hotel RevPAR across the globe slowed following three weeks of double-digit gains. Falling occupancy (-2.5 percentage points) was offset by an ADR gain of 5.1%. All of the larger European countries posted negative RevPAR comps due to occupancy declines.

Some highlights include:

- Japan continued its standout performance with huge RevPAR gains almost entirely driven by ADR.

- Mexico performance remained elevated but with its smallest increase of the year.

- Indonesia saw healthy RevPAR gains for the second week in a row.

- China posted an 8.2% RevPAR decline driven primarily by ADR.

- Germany suffered a significant drop impacted by trade fair calendar shifts.

Italy hotels saw RevPAR decline; however, Rome, the site of Saturday’s funeral for Pope Francis, saw a 6.5% RevPAR increase for the week. Friday night RevPAR rose 28.8% with occupancy and ADR reaching 88.8% and $365.08, respectively followed by healthy performance on Saturday with RevPAR up 20.4%. All Rome submarkets saw double-digit RevPAR gains on Friday with occupancy ranging from 85.3% to 95.4%.

Looking ahead

With most calendar shifts behind us, the next few weeks should provide a solid glimpse into what to expect this summer both for the U.S. hotel industry and globally. Advance bookings in the U.S. from STR’s Forward STAR points to a solid May and June across top markets followed by a flat July. Global performance is expected to remain positive while slowing.

Isaac Collazo is senior director of analytics at STR. Chris Klauda is director of market insights at STR.

This article represents an interpretation of data collected by CoStar's hospitality analytics firm, STR. Please feel free to contact an editor with any questions or concerns. For more analysis of STR data, visit the data insights blog on STR.com.